Turning the Corner? Jaguar Mining Q2

I just finished reviewing Jaguar’s conference call and results for Q2. There is a chance, and I do say a chance, that they are turning the corner.

Turmalina

It appears that the worst is over for Turmalina. Costs in Brazilian Real were constant with Q1. Feed grade was reasonable at 3.3g/t. Below are Turmalina’s operating results.

Caete

Caete had the already disclosed problem with the mill break down. $hit happens. Mines inevitably run into operating blips. This affected costs in the short term. But that is a lot different from a grade problem, or a sequencing problem. Those are long term issues. A dysfunctional gear box is not something to worry about.

I think its important to note that while the mill had problems, Caete mining costs remained stable compared to Q1. The company is also moving forward with the expansion of Caete from a 700,000t/y operation to a 900,000t/y operation. Management said that this would raise gold production to a 100,000oz/y level, though I have to say I don’t understand the math on that one.

The company said that they expect significant improvements to Caete in Q4. That means that you shouldn’t expect too much from Q3, apart from a reversal of the one time issues. I think Q3 will look more like Q1, meaning $850/oz costs and 13,000 oz. That would be ok.

The company said that they expect significant improvements to Caete in Q4. That means that you shouldn’t expect too much from Q3, apart from a reversal of the one time issues. I think Q3 will look more like Q1, meaning $850/oz costs and 13,000 oz. That would be ok.

Guidance

The company wouldn’t give a mine by mine breakdown of production so far in Q3. However they did provide an aggregate estimate. They said production in July was similar to June, which was 15,000 oz. August was expected to be better than July. Extrapolating to September and adding it all up, one might expect Q3 production to be in the 46,000-49,000 range. That would be a solid quarter and would generate some serious cash flow.

Gurupi and CAPEX Worries

The company gave some details about what to expect for Gurupi. They are investigating other sources of funding. I got the impression that there was a JV of some sorts in the works. I think this would be positive. First of all, Gurupi sounds like its growing, which is great but it also means higher CAPEX. Second, I think that one dead weight on the share price is that when you work out the company’s CAPEX requirements versus cash flow for the next 5 years, there isn’t a lot of wiggle room.

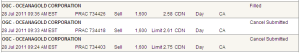

Below is a snipit from Jaguars own press release on February 10th. The tables show how Jaguar expects to fund its capital expenditures over the next 5 years. The most important row to look at is that “Beginning Cash Balance” row. In the first couple of years the cushion is only about $100M. I don’t think the market is comfortable with that cushion given Jaguar’s problematic production past. A cash inflow for Gurupi would allieve these concerns.

Short Sellers

The last thing that was talked about on the CC was the short interest. As I’ve pointed out before, Jaguar has an enourmous short interest. Management believe that most of it is linked to the convertible, where hedge funds short the stock against the convertible to hedge the downside risk. I don’t really know what management can do about this, but they seem to think they can do something. A divided seems unlikely given the CAPEX requirements described above. I don’t think a share buy back would do much. They expect to announce measures to counter the short selling in the next few months. We’ll just have to see what they come up with.