Portfolio Performance:

Portfolio Composition:

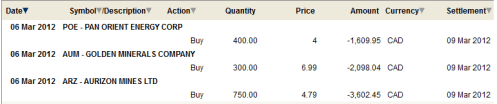

Trades:

Europe to the sidelines (for the moment)

Eric Reguly had a worthwhile article in the Globe and Mail this weekend. He outlined the reasons why Greece and Europe are still as badly off as they were a couple of months ago. Apart from the markets perception, nothing has changed.

The basic problems in Greece, and in the rest of the periphery, he says, remain.

The country’s economy and its social fabric are unravelling at an alarming pace and the second bailout, combined with a sovereign bond haircut, will do next to nothing to stop the horror show.

So why is the market rallying when these problems have not gone away?

I think that there are a lot of similarities between the markets reaction to Europe today and the reaction of the market in 2007 and 2008. During the housing crisis, what drove the market down was not so much the fear of falling housing values, as it was the fear that falling housing values would cause banking problems.

At times, when it appeared that the housing problems were going to create only housing problems, the market rallied. When the spillover to the banking system was evident, the market fell.

There are different types of bear markets. There are bear markets that are economic and those that are financial. When an economic bear market hits, some sectors get hit hard, some get hit, and there are always some that actually don’t do too badly at all; the idea being that there is always a bull market some where.

When a financial bear market hits, everything goes down. Because in this case what drives the bear market is a lack of liquidity to buy stock. So all stocks fall. To be sure, this eventually hits the economy and causes a financial bear market, which happened in late 2008-2009 and compounded the problem. But there is a fundamental difference here in that during an economically driven bear market, though it may be more difficult a stock picker can still pick stocks. In a financial bear market you can’t pick anything and you just have to get the heck out.

How this relates to today is seen in how the market does not seem to care whether Greece goes into a severe recession. This is because Greece is an insignificant spec in the world economy. The market only cares if the problems in Greece spill over into the banking sector and cause banks to fail, not lend, seize up, and other worrying verbs, thus precipitating another financial bear market.

I wrote a long piece on the LTRO a month ago. As it turns out this has been the most popular blog post that I have ever written. This is somewhat unfortunate because this isn’t intended to be a blog about Europe, I am not an expert on macro economics or on banking, and the post is only tangentially related to the purpose of this blog; the stocks I own. At any rate, in the post I argued that the LTRO may have a short term psychological impact, but over the long run it wasn’t going to do much for the Greek, Portugese, Italian and Spanish economies because none of the problems those economies are having have been dealt with.

I still think this will be the case. Reguly highlighted the reasons why (referring specifically to Greece) in his article:

Labour costs remain too high. The economy is sinfully undiversified and laden with low-value industries, like stuffing tourists onto cruise ships. Corruption is rife. The tax-collection systems are primitive. The professional protection rackets – from truck drivers to doctors – remain intact. The country lacks a working land registry. The bureaucratic red tape leaves entrepreneurs and land owners in despair.

This is all really bad stuff. And its stuff that applies in large part to Italy, to Spain, and to Portugal. However, what is forgotten, and what I think I neglected in my post about the LTRO, was that while all this is true, it was also true a year ago, two years ago, long before Greece came to be a headline and before it began to cause markets to collapse.

The LTRO has accomplished an extremely important objective and that is that is has (temporarily) removed the mechanism for a banking collapse. The banks in Europe were on the precipice because they were overlevered (see my analysis of Deutsche Bank which remains levered at an insane 60:1) and they faced problems funding that leverage. Now, with the help of the LTRO, the banks are still overlevered but can get all the funding they want from the ECB.

Juggling Dynamite

I was listening to the Canadian money program Money Talks yesterday. The had Danielle Park, who writes the blog Juggling Dynamite, on as a guest. You can listen to the interview here by selecting the 10:00 am segment for February 25th. Parks basic argument is that this rally is a sham. Its built on liquidity, will die by liquidity, and there is no evidence that the economies of the world are getting better.

The main theme is the incoming recession… its already underway in Europe, Japan and the UK, what has been going the last several months is all about liquidity injections again, but the reality is it doesn’t fix things, we don’t have any solutions, debt has to be written off…

She argues that individual investors have to be very careful right now. They have to be careful about chasing the market up here, careful about jumping into dividend stocks to try to get a bit extra yield, and to be extra careful about fixed income because the yield you are getting there are miniscule. She has some very good comments about how dangerous the current environment is to the individual and moreover, how criminal it is that central bankers continue to punish savers and try to force risk averse individuals into risky assets.

Now, if you look at what I have done over the last few weeks, I have moved from almost 50% cash to basically no cash. So I must be completely at odds with her assessment right?

Wrong.

I think she’s dead on.

This is a false rally. This is a liquidity driven rally. This remains “the banks in Europe are not going to implode tomorrow so they must be worth more today” rally, which is not a positive pronouncement about anything other than that the end of the world is postponed.

CNBC had Lakshman Achuthan on this week to talk about his recession call from a few months ago. Last week I talked about how one of the indicators I follow, the ECRI’s WLI, was perking up, and that this perhaps portended to a strengthening US economy.

Maybe I have been too quick to look for confirmation. The counterpoint is that it is indeed simply a liquidity driven event. Achuthan also argues, much like Park, that it is. Central bankers are printing money and that money has to go somewhere. Real economic activity is weak and so the money goes into speculative investments instead. Achuthan said that given the amount of money being pumped into the system, he is surprised that the WLI has not risen more than it has.

Here’s the entire clip:

But what can you do?

So rally is on weak legs. Nevertheless, its a rally. If you recognize it as a liquidity driven rally then really, what you want to invest in (temporarily) is liquidity driven stocks. If you look at the stocks I am buying lately, they are exactly that. I am doing the right thing, even if perhaps I have not fully understood the reasons.

I like to call the junior gold explorers, companies like Geologix, Golden Minerals, Canaco, little liquidity eaters. The stock price of these sorts of companies have much more to do with the availability of liquidity then they do with the price of gold. That is plain to see by looking at a chart of any stock in the sector. Every stock suffered through 2011 even as the price of gold rallied hard. Every stock soared beginning in 2012 once the LTRO was announced and it became clear that liquidity would be in abundance again.

But these are trades. I do not expect to be holding any of these stocks 2 years from now. Absent some sort of paradigm shift like a move to the gold standard, these are stocks to hold for the run up and then cut loose when it looks like they are turning the taps off again.

But in the mean time, in the words of Jesse Livermore, from whom I stole my blog title and my avatar:

“But I can tell you that after the market began to go my way, I felt for the first time in my life that I had allies- the strongest and truest in the world: underlying conditions”

The underlying condition right now is one of liquidity. It is not the intent of this blog to philosophize (too much) on the eventual consequences of such liquidity. There are plenty of folks, like the wonderful Ms. Park, who are already describing those consequences eloquently. The intent here is to try to evaluate those conditions clearly, and to describe how I am acting to capitalize on those conditions.

For the moment anyways, that means that I own stocks.

Of course next week could be a different story.