Letter 23: Thinking it Through

Let’s Start with Europe (again)

The unfortunate reality of investing at the moment is that you cannot make a decision without first appraising the situation in Europe. Correlations of most stocks, most asset classes, have gone to one. The ability of the ECB to buy Italian debt, or the liquidity position of Societe Generale weighs as much on the price of Coastal Energy or Arcan Resources as does the success of their next well.

Its a bizarre new world.

This week Europe had their latest summit installment. The response of the market to what transpired was confusing. The market crashed mightily on Thursday, only to rally just as mightily on Friday. Italian and Spanish bond yields spiked on Thursday but then dropped modestly on Friday.

Given the confusing signal sent by the market, I want to take a few minutes to step through what was agreed to at the ECB and among the EU members. Hopefully we will be able to draw some useful conclusions as to what it means to the stocks we invest in.

The Fiddling of the ECB

A tweak here, a tweak there and pretty soon you have… well not a whole lot to be honest. Let’s take a look at what the ECB did:

- They lowered the rate for banks to borrow money from the ECB

- They increased the types of collateral that banks can use to get liquidity from the ECB

- They extended the period for banks to do long term borrowing from the ECB to 3 years and suggested they would facilitate such loans in unlimited amounts.

While these actions are somewhat helpful, what the ECB failed to do (at least directly) was to agree to buy significant quantities of government bonds. This failure was likely responsible for the collapse in the market on Thursday.

Some have argued that the change in long term borrowing requirements will effectively let banks buy sovereign bonds on behalf of the ECB, effectively skirting the rules. From the horse’s mouth:

There is no need to be a great specialist to understand that tomorrow, thanks to the central bank’s decision, the Italian state can ask Italian banks to finance part of its debt at rates which are undeniably lower than today’s market rates,” Sarkozy told reporters at a European Union summit on Dec. 9. “I take Italy but I could take the example of Spain. This means that each state can turn to its banks, which will have liquidity at their disposal.”

What Sarkozy is talking about is theoretically possible, however I am skeptical that it is going to be very meaningful in practice. For one, the EU banks are already in the process of deleveraging. By all accounts they are already too leveraged. The process described by Sarkozy just adds more leverage. For two, you have to think that the last kind of assets that the EU banks want more of are questionable sovereign bonds. Finally for three, if the banks decided to leverage up with even more sovereign debt all you’ve really done is doubled down on eventualy bailout that will be required when that sovereign debt goes bust. You haven’t actually solved anything.

One of the last gasps of a Ponzi scheme is to use one investment vehicle to start purchasing the assets of another at an inflated price. In other words, once you run out of outside suckers, you try your best to shuffle around the funds to appear solvent. Needless to say this typically doesn’t last very long.

In all I don’t think that what the ECB did amounts to much more than a temporary blip of increased demand. The problem of too much debt remains, liquidity to banks only helps solve the banks liquidity crisis, and the ECB still refuses to get its hands dirty by buying that debt in bulk. However, if you want another opinion on this, on the bullish side, I think there was an excellent summary written by Savannahboy on Investors Village.

What did the EU do?

Describing what the EU did is trickier. It is easy to get caught up in the market move upwards on Friday and assume that something significant must have happened at the meetings. Well, I did a lot of reading and if something significant did happen, nobody told the journalists. I suppose that the existing “plan of a plan” got tweaked and even pushed forward a couple of steps. Yet it still remains a long way off from being a clear path to solvency.

A good Globe and Mail article by Eric Reguly reported the following summary of what was accomplished:

At least 23 of the 27 countries in the European Union – soon to be 28 with Croatia’s apparently suicidal desire to climb aboard the listing ship – agreed to a new, long-term fiscal pact designed to ensure that the euro never again gets hit with an existential crisis. (Britain isolated itself by refusing to join the deal, for fear that it would have to sacrifice the safeguards on its banking industry.)… On top of that agreement, the EU is strengthening its roster of financial stabilization tools. The EU will lend about €200-billion ($272-billion) to the International Monetary Fund, co-sponsor of the bailouts of Greece, Portugal and Ireland, to boost its firefighting capabilities. The European Stability Mechanism, the permanent bailout fund, is to launch next summer, a year earlier than originally planned, and its lending capacity is to be increased.

Reguly goes on to make what I think is the very valid point that all of these moves will do nothing to deal with the fact that the peripheral countries are not growing.

Look at Greece. Two years of austerity demanded by the EU and the ECB – read: Germany – with the IMF at their side have pushed the country to the verge of failed state status as economic activity vaporizes. The rest of the EU is slipping into recession.

With no growth, budget deficits everywhere refuse to disappear. Debt is going up. Perversely, the German-inspired response to the persistent deficits is demand for even deeper austerity. This is self-defeating, vicious-circle economics. At its worst, the lack of growth will erode the ability of the weakest countries to service their debts. Once investors figure that out, their sovereign bond yields will soar again, to the point their funding costs become unsustainable. Italy is getting close to that point.

This is key. Markets are almost exclusively focused on what bandaid can be created to keep the banks from going belly-up next week. Perhaps the summit made some strides in this regard. We should be able to make it through Christmas without anything catastrophic occuring. But nothing that is being done about growth.

Jane Jacobs and the Feedback Nature of Currencies

The reality is that the fundamental problem in Europe is what brings it together in the first place: the existence of a single currency. Italy, Greece, Spain, etc, cannot compete with Germany on a level playing field. These countries need to have a way of leveling that reality out. The primary (perhaps the only market based) mechanism for doing so is the relative value of the currency of each region. If there is only one currency, there is no way to rebalance between the Eurozone countries.

This was the salient point made by Jane Jacobs years ago in her great book “Cities and the Wealth of Nations”. In that book Jacobs begins with the basic premise that a currency is a feedback mechanism. She goes on to argue that the problem with a country based currency is that it doesn’t allow for proper feedback of the individual cities that make up that country. Cities within a country have a wide range of productive capacities. What needs to occur in order to correct imbalances between cities is a readjustment of each city’s currency.

Jacobs provides a number of examples of how national or imperial currency regions usually results in one or two economically powerful cities, and a number of other dependent cities, usually requiring transfer payments of some sort to survive.

Speaking particularly of Europe she says (remember this was written in the early 1980’s):

In Italy, as time has passed since the unification of the country a century ago, the economics dominance of Milan has grown only more marked, not less so. Even Rome itself has only a meager cioty region, vanishing a few miles south and east of the city where, immediately, the poor south of Italy begins. In Germany before its postwar partition, Berlin had become ascendent…In France, only Paris has a significant city region now, unlike the country’s so-called eight great peripheral cities: Marseilles, Lyons, Strasbourg, Lilli, Rouen, Brest, Nantes, Bordeaux.

Outside of Europe she points to the example of Canada (Toronto and central Canada has typically grown briskly and propped up the weaker maritimes provinces), the US (cities of the northeastern corridor typically being much stronger then those of the south), and Britian (where “the passage of time simply widened the economic gulf between [the rest of Britian] and London”) to name a few.

What Europe has embarked on with the Euro is the exact opposite of what is needed. Currency regimes need to evolve to produce better feedback, not worse. The Euro currency feedback mechanism is skewed by the strength of the German economy (actually more exactly the economy of its one or two prime export replacing cities, Berlin and Frankfurt). Peripheral countries like Italy, Greece, Spain and Portugal are doomed to receive faulty feedback rather than the natural “export subsidy” that would occur if those countries had (lower value) currencies of their own.

US Housing Market

Getting away from Europe, I spent some time this weekend listening to an interesting debate at the AmeriCatalyst Housing conference. I was introduced to this conference when I discovered some of the videos of Kyle Bass being interviewed at it. As it turns out there is a lot of interesting stuff at the conference, not the least of which is the discussion below about the state of US housing. This is a debate / information session put on by experts in the mortgage and housing industry.

Probably the most interesting aspect of the debate was with regard to shadow inventory. I’ve never been totally clear on just what shadow inventory was, and it seemed to be a number that varied significantly depending on the conclusion the purveyor was trying to draw, so it was interesting to hear the comments of these experts on the concept.

The truth is that the magnitude of shadow inventory depends as much on the definition as anything. A couple of different estimates of shadow inventory are made by different analysts. Laurie Goodman (who I first learned of from ftAlphaville fame) pegged shadow inventory at 11M (which is an amazing 20% of housing mortgages outstanding). Mark Fleming pegs it at 2M. Both analyts are using the same data.

How is this possible? Its all in the assumptions. Shadow inventory is really just houses that are expected to go into default at some point. There is nothing particularly nefarious about the concept, even though the name suggests it is some sort of inevitable flood of housing supply. It may be, but it may not. It depends on what happens. Laurie, to come up with her 11M number, assumes a fairly large number of prime mortgage defaults, including some that are currently with LTV (loan to value) of less than 100%. Laurie also looks at 60 day past due as her “bucket” from which to extrapolate current nonperforming loans. Mark on the other hand, uses 90 day past due, and does not include currently performing prime mortgage defaults.

As Mark Fleming puts it, the true shadow inventory is “behaviorly perception driven”. In other words, if the housing market begins to be viewed as bottoming, if the economy is perceived as improving, the impetus to default will be less and the shadow inventory will be on the lower end. If the view is another lengthy recession, then expect a lot more inventory to come out of the shadows.

What it Means to the Portfolio: Lightening up on Gold

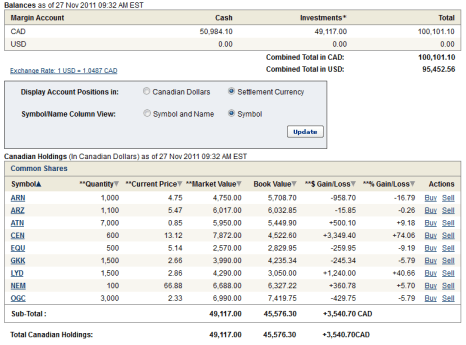

I sold out of Newmont Mining earlier this week, and I lightened up on my position in Aurizon Mining. I remain bullish of gold stocks, just not as bullish as I was.

I have been expecting that the European problems would precipitate ECB money printing. I still believe this is going to happen, At some point that is; as I pointed out the structural flaw in the Euro currency union means that there simply is no way that Italy, Greece, Spain and Portugal (maybe even France) are going to grow themselves out of their debt.

Nevertheless Draghi’s comments this week suggested that money printing may be a little further off into the future than I had hoped. Without that, gold remains vulnerable to the headwind of its own price appreciation, and the damage that has done to jewelry sales.

The WSJ had a good article on this:

India’s wedding-season gold demand has nearly disappeared as the yellow metal’s local prices have climbed to near-record levels because of a fall in the rupee’s value, sparking a rush to sell scrap during the usually peak buying period.

“There is virtually no demand for gold,” said Prithviraj Kothari, president of the Bombay Bullion Association.

I feel reasonably comfortable holding story stocks like Atna Resources and Lydian International (I also started a position in Esperenza Resources this week, though not in my online portfolio). I feel less comfortable with Newmont, which is basically a play on the price of gold. The same case can be made to a lessor extent with Aurizon Mines (though the reason to hold onto Aurizon is an eventual consolidation of the gold sector).

Buying the Banks

While I am reducing gold, I am buying back some of the regional bank holdings I sold off after beginning to be concerned about Europe. The truth is, the regional banks have faired better than I would have expected during the past 6 months. The recent bottoming of the ECRI weekly leading index, along with decent jobless claims data, suggests to me that the US economy does not have its bottom falling out. I suspect that a muddle through for the US should be good enough to see decent price appreciation in some of these beaten up regionals.

Bank of Commerce Holdings

A bit of a punt here.

I was listening to BNN last week and I caught Contra The Herd’s Benj Gallander’s top picks. One of them was Bank of Commerce Holding (BOCH on the Nasdaq). I did some work this week on the company and it looked cheap (less than 10x earnings, trading at about 50% of tangible book), it had a reasonable level of nonperforming loans (3.3%), and it has the potential for better earnings in the future once it works its way through its loan loss write-downs. So I bought some.

The worry about this regional bank is its region.

The Company conducts general commercial banking business in the counties of El Dorado, Placer, Shasta, Tehama and Sacramento, California.

This is not-exactly-but-close-enough-to the inland empire that didn’t fare so well during the housing bust:

Given the circumstances, the company has done an admirable job of keeping their loan book clean thus far:

- Nonperforming loans to total loans 3.33 %

- Nonperforming assets to total assets 2.30%

As well ROE has been decent, particularly if you consider that the number includes the provisions to losses the company has taken:

Return on average assets (ROA) and return on average equity (ROE) for the three months ended September 30, 2011, was 0.91% and 7.45%, respectively, compared with 0.67% and 5.95%, respectively, for the three months ended September 30, 2010. ROA and ROE for the nine months ended September 30, 2011, was 0.75% and 6.45%, respectively, compared with 0.70% and 6.61%, respectively, for the nine months ended September 30, 2010.

I estimate that if you looked at ROE ex-provisions, the number would be very close to 10%.

Bids in for Oneida Financial (ONFC) and Community Bankers Trust (BTC)

While I managed to pick up a position in BOCH quite quickly, I have bids in for, but so far haven’t been able to purchase, too many shares of ONFC and BTC. Rest assured I will wait patiently until I do. Both of these banks represent good value, and unlike BOCH they are both in areas with stable economies and housing (Virginia for BTC, Central NY for ONFC).

In the case of Community Bankers Trust, the 3rd quarter brought the first profitable quarter in quite a while. It also showed a continuation of the trend towards less charge-offs.

BTC trades at less than a third of tangible book value ($3.67) at this point. Meanwhile, insiders continue to buy shares.

Oneida Financial is a NY based bank with stellar loan performance (well under 1% nonperforming assets to total assets), strong earnings performance (should earn in the neighbourhood of $0.80 this year), and is trading slightly under tangible book value of $9.10.

Oneida Financial is a NY based bank with stellar loan performance (well under 1% nonperforming assets to total assets), strong earnings performance (should earn in the neighbourhood of $0.80 this year), and is trading slightly under tangible book value of $9.10.

I am particularly impressed with Oneida’s consistency of earnings throughout this tumultuous period.

Oneida also pays a dividend of 5%.