Week 219: Feeling more like a bear market

Portfolio Performance

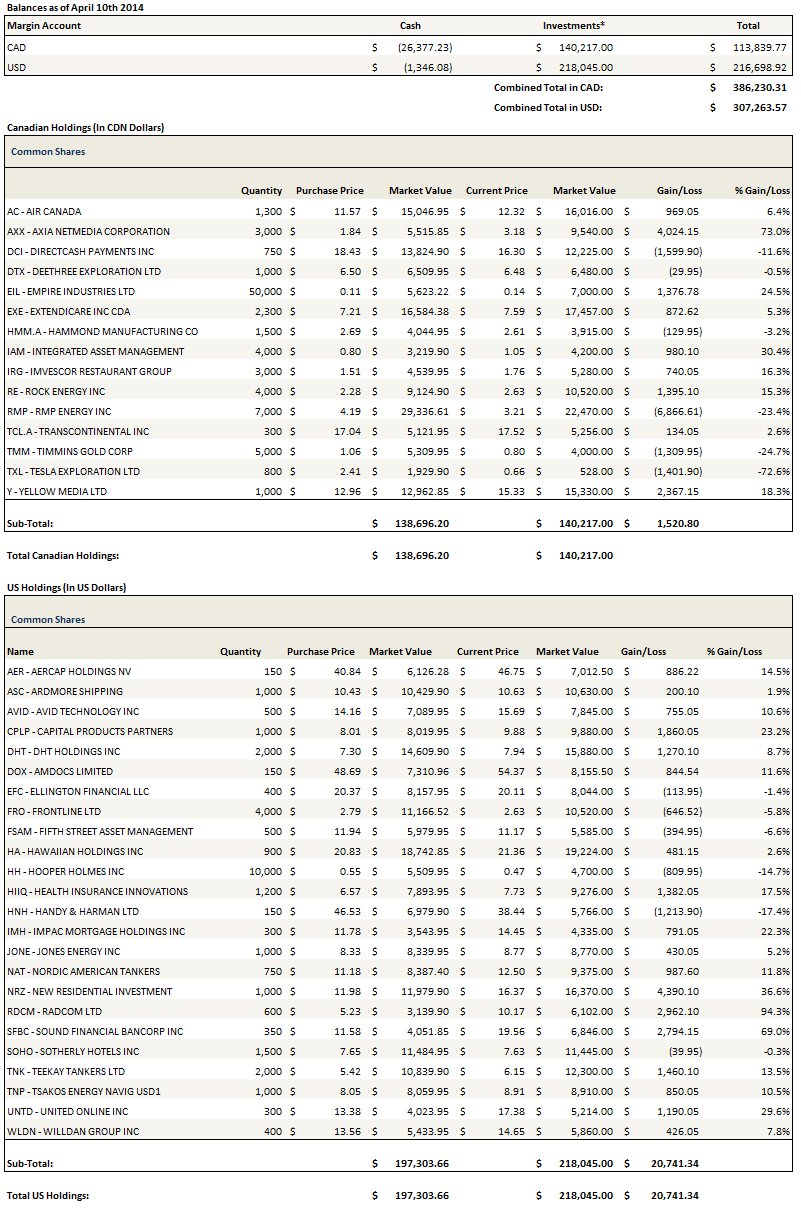

See the end of the post for the current make up of my portfolio and the last four weeks of trades

Monthly Review and Thoughts

In my update four weeks ago I wrote:

When I raise the question of whether we are in a bear market, it is because, even though the US averages hover a couple of percent below recent highs, the movement of individual stocks more closely resembles what I remember from the early stages of 2008 and the summer of 2011.

Since that time my concern that the averages had only been lagging the inevitable has born itself out. We have seen a 10-15% pull-back depending on the index you are referencing. It has become clear that we are indeed in a bear market, if not by definition then certainly in spirit.

The next obvious question is – when do you buy? Every other pullback over the last few years has been a buying opportunity. Is this pullback, being the deepest of the bunch, the best of the bunch?

I don’t think so. At least not yet. There are just too many headwinds right now.

First, returning to what I wrote last month:

When the Federal Reserve ended its quantitative easing program last year I was concerned that the market might revert back to the nature it had demonstrated after first two QE endeavors. But for a number of months that didn’t happen. Stocks kept moving; maybe not upwards at the speed they had previously but they also did not wilt into the night.

I am starting to think that was nothing more than the unwinding of the momentum created by such a long QE program. Slowly momentum is being drained from the market as the bear takes hold.

Nothing has changed here and stocks are still too expensive to say that we’ve passed through this process. If QE was a positive influence on stock valuations, certainly the lack thereof has to be a negative influence. While there are a few stocks that are cheap right now, many are not.

Second, when volatility is as high as it has been over the last few weeks it usually indicates the market is breaking down rather than breaking out. I’ve seen this pattern too many times; increasingly choppy and nomadic market moves tend to break down.

Third, we don’t really know what is going on in China. Nobody really knew how strong the boom was through the last decade; in fact I made a lot of money following the advice of metal prices over analyst comments. Similarly, I don’t think there are many that have a good grasp on the magnitude of the slowdown.

None of this means that it has to play out to the downside. Maybe China will be a blip, stocks will resolve themselves to the upside and I will be frantically trying to catch up. But betting against the odds is not profitable and these odds don’t feel like they are in my favor.

So what am I doing? Sitting with a lot of cash ( I have 55% cash in my investment account and 60% cash in my RRSP). Picking a couple of opportunities where I see them but keeping the size small enough that I won’t be hurt if the markets break down again. And where I can, holding some shorts to help hedge long exposure.

The last five years have been an incredible opportunity to compound capital. In 2012, when the Fed was clearly going to announce more QE and stocks were going up every day my strategy was simply to find the most levered longs I could to make the most of the upside. I remember how I was derided by many for doing that.

To give a particular example, I remember how some folks on twitter wrote snide remarks about my YRC Worldwide position. What a shitty company it was, how it was inevitable it would go bankrupt (one even wrote that the probability of a YRC banruptcy was 100%), and so on.

I just couldn’t figure it out. I kept thinking, who cares? The point of this game is to make money and in that particular environment, with the amount of stimulus we had and with a US economy on the mend, it was exactly the kind of stock that could run as a multi-bagger.

It seems as though some investors/pundits think that being right is a philosophical exercise. And in this game it’s not. My only measure of success in the market is how quickly and how far that chart at the top of each post trends from the lower left to the upper right. The rest is sophistry.

While 2012 was the time to buy the levered longs, today the reverse is in play. You have to be very careful about even buying good businesses that you believe are being mis-priced by the market. In a bear market just about everything goes down, so you better be sure about what you pick. Just because it is a good business with a moat doesn’t mean it won’t get sold off with the rest of the market.

I do think that in this environment growth is most likely to come back first. I am looking for stocks with catalysts and stocks with growth profiles maybe not recognized yet by the market. Especially if they are beaten down.

Selling Out

I did a lot of selling leading up to and on the bounces of the first decline. I wanted to get my cash positions up to at least 50%. I sold entirely out of Hawaiian Holdings, Impac Mortgage, Orchid Island Capital, Ardmore Shipping, DHT Holdings, Air Canada, New Residential and Yellow Pages. I also reduced just about every other position I had.

Since that time I have bought back into Ardmore Shipping and Air Canada to lesser degrees than the level that I had originally held them. I have added back my full position in DHT Holdings as I see strong fourth quarter shipping rates as a catalyst for some short term gains. The other stocks I might buy back if the prices become very attractive or if I see changes to the landscape that make me more constructive on the market.

New Positions

Most of my research in the last month focused on biotech firms. I have to say, its been a lot of fun. Its fascinating stuff. I even discovered a Vice documentary on how we are using viruses to battle cancer. The technology leaps are amazing!

I looked at Mylan, Mallinckrodt, Intrexon, Teva, and a whole pile of smaller Phase 2 candidates (including Flexion, which subsequently was clobbered after their FX006 Phase 2b trial had less than stellar results – note though there might be an opportunity with this one).

Most of these names I can’t bring myself to buy because of valuation. Even though the charts are bad and the stocks are way off their 52-week highs, most still look expensive to me. But I did take small positions in a couple of names: one large cap pharmaceutical stock (Gilead) and one small cap phase 3 drug developer (TG Therapeutics). Here is what I think of both of Gilead and TG Therapeutics and why I added them.

Gilead Pharmaceuticals

Gilead is a much bigger company than I typically invest in. With over 1.5 billion shares outstanding,currently trading at $105, they have a market capitalization of around $160 billion. The company has very little debt, with cash on hand of $7.4 billion and $12.2 billion in long term debt as of the end of the second quarter. They also just raised an additional $10 billion of debt this week, which many are speculating will be used for an acquisition.

Gilead produces leading hepatitis drugs (Harvoni and Solvaldi, with Harvoni being the next generation treatmen) and leading HIV drugs (Truvada, Atripla and Stribula). The two hepatitis drugs accounted for 65% of sales in the first half of the year. Harvoni, which is new to the market, accounting for almost 50%. They also make a cancer drug that I will discuss a little when I talk about TG Therapeutics.

In 2014 Gilead had cash flow from operations of $12.8 billion and capital expenditures of $500 million, so free cash flow was $12.3 billion. In the first half of 2015 cash flow was $11.4 billion and capex was $300 million. The increased profitability is coming from an increasing number of insurance payers approving coverage of the hepatitis drugs and from the recent introduction of Harvoni.

If you annualize first half cash flow Gilead has a free cash flow multiple of 7.4x, which is a lot cheaper than the other drug companies I have looked at. Why? The market is concerned about the concentration of revenues in one drug (Harvoni), potential competition for the hepatitis drugs, and the lack of a pipeline of new drugs.

While these concerns are valid, I think that the discount is over done. When I look at other large bio-techs Gilead trades at a 30-50% discount on free cash flow, and that seems too large. It just seems like the relative sentiment has gotten too extreme. There is also the potential of a catalyst in the form of an acquisition that the market approves of. Finally, as this excellent 3 part Seeking Alpha article series identifies, Gilead’s pipeline of homegrown drugs is not as barren as is often made out.

I’m keeping my position small. Much of this thesis is based on valuation and as I’ve already implied, I don’t believe that valuation in a bear market is a terribly strong leg to stand on. I think Gilead does well and outperforms if the market does well. But it will likely fall along with the market if things depress further.

TG Therapeutics

I owe this idea to a tweeter by the moniker of @Robostocks123, who has been tweeting about TG Therapuetics for some time.

Of all of the late stage biotechs that I looked at, this one made the most sense to me. TG Therapeutics is a $600 million market capitalization company with no debt and $60 million of cash. The company is in stage 3 development of a couple of different drugs targeting lymphomic malignancies.

The first drug, TG-1011, is in a phase 3 trial as a combination with another drug, Ibrutinib, which is owned by Abbvie. Ibrutinib has already been approved to treat b-cell lymphoma’s but there are a number of patients taking Ibrutinib that have had to discontinue treatment early because of adverse side-effects. Combining Ibrutinib with TG-1011 is expected to improve the effectiveness of the treatment and, most importantly, reduce adverse reactions and so far the results bear that out.

While we won’t know the phase 3 results for a few months, the Phase 2 results looked pretty promising. First with respect to adverse events, the combination of TG-1011 and Ibrutinib led to very few serious side effects:

And with respect to efficacy, the combination showed improved results over Ibrutinib alone.

And with respect to efficacy, the combination showed improved results over Ibrutinib alone.

The immediate opportunity is that after approval TG-1011 will be prescribed alongside Ibrutinib. Ibrutinib is relatively new but already is experiencing fairly significant revenue. Below is an excerpt from Abbvie’s last 10-Q (Abbvie calls it Imbruvica):

The immediate opportunity is that after approval TG-1011 will be prescribed alongside Ibrutinib. Ibrutinib is relatively new but already is experiencing fairly significant revenue. Below is an excerpt from Abbvie’s last 10-Q (Abbvie calls it Imbruvica):

I’m sure some will see the following as a promotional red flag but TG Therapeutics put their own quantification to the opportunity in this slide at their recent presentation at the Rodman & Renshaw Annual Global Investment Conference:

I’m sure some will see the following as a promotional red flag but TG Therapeutics put their own quantification to the opportunity in this slide at their recent presentation at the Rodman & Renshaw Annual Global Investment Conference:

TG Therapeutics second drug in Phase 3 is TG-1202. The 1202 drug is a PI3K-delta inhibitor, again targeting lymphomic malignancies. It is the same type of compound as another already on the market called Zydelig (from Gilead with $50mm of revenue in the first half of 2015). A third similar compound called Duvelisib from Infinity Pharmaceuticals is in phase 3 trials.

TG Therapeutics second drug in Phase 3 is TG-1202. The 1202 drug is a PI3K-delta inhibitor, again targeting lymphomic malignancies. It is the same type of compound as another already on the market called Zydelig (from Gilead with $50mm of revenue in the first half of 2015). A third similar compound called Duvelisib from Infinity Pharmaceuticals is in phase 3 trials.

Both drugs from the competition suffer from varying degrees of toxicity problems. Specifically with Zydelig patients can experience very bad diarrhea that can become life threatening. The consequence is that often patients don’t stay on the drug long enough to fully recover. Lymphomic malignancies are extremely difficult to fully wipe out and so you need a drug or combination of drugs with low toxicity so that treatments can run their full course.

TG-1202 appears to have a much improved toxicity profile versus the alternatives while having similar effectiveness.

While TG-1202 is showing promise as a single agent the ultimate game plan of TG Therapeutics is to combine TG-1202 with other drugs. The first combination that is being investigated is alongside the TG-1101 compound.

A phase 3 trial is just about to begin using the combination of 1202 and 1101. The trial includes the potential for accelerated approval of the drug combination if a significant overall recovery rate is observed among the first 200 patients. As I already mentioned earlier stage testing of TG-1202 on its own showed both good tolerance from patients and good efficacy. The hope is that together with TG-1101 TG Therapeutics will have a real winner, and one that does not depend upon a third party drug lie Ibrutinib. A further possibility that will be investigated down the road is that a 3-drug combination of TG-1101, TG-1202 and Ibrutinib may provide even more benefits.

TG Therapeutics is taking the attitude that no one drug is going to cure the blood cancers they are targeting. So their approach is to layer together drug combinations, first by adding TG-1101 to Ibrutinib, then by combining TG-1101 and TG-1202, and later by adding in combinations of earlier stage drugs in their pipeline like IRAK4 and Anti-PDL1.

Obviously I’m not an expert in this field, so maybe someone will be able to point out a fatal flaw in this idea. What I see is a company with upcoming catalysts and with a stock price that does not, in my opinion, reflect the potential success of those catalysts. So its a buy, but a small position because we know that when biotech’s go wrong, they go wrong badly.

Apigee

In addition to my two bio-tech buys, I added a small position in one tech name. I found Apigee while scouring the 52-week lows a few weeks ago. When I was first looking at the company it was trading at about a $180 million market cap with no debt and $90 million in cash.

I am going to do my best to describe what Apigee does without using the word platform. Because everywhere you read about anything tech you read about the platform, and I honestly believe that at least 50% of the time what that really means is the author doesn’t know exactly what it is the company does so using a term that implies a vague, black box it will be less likely to arouse suspicions.

So what Apigee does, as I understand it, is write code that allows companies to have their internal databases, servers and applications accessed by users (it could be a consumer of the data for personal or commercial use or another company leveraging the data or functions from an application to build upon their own application), but with restrictions in place that limit what data can be consumed and by whom, what app functionality is exposed and what modifications can be made, and that give the company the ability to track, monitor and extract information about what the API clients are doing and how their data and applications are being consumed.

So they sell an API platform.

I think its a pretty decent business idea. There are plenty of non-tech companies that are getting dragged into the mobile world and to think they are going to hire programming staff that will create mobile interfaces that function and perform effortlessly, be secure, be expandable over time and serve the needs of clients seems like a tough gig to me. I’ve worked in a dedicated software firm for seven years and its tough to have good code even when this is what you do. Having a third party provider of the necessary middle man interfaces makes sense.

Of course the question is whether Apigee has the best solution out there. While I can’t speak directly to that I can fall back on the results.

Apigee is growing revenue, growing gross bookings and adding clients. Note that I added the 2015 data to the company slide below.

But I am still not completely sold on the stock, and I have kept my position quite small. My problem is that Apigee is far from being cash flow positive. And I really have a problem holding stocks will lose money as far as I can model out.

Below is my model. The 2016 numbers are based on their own midpoint guidance while 2017 is based on my estimate of 25% revenue growth, some improvement in margins as subscription and licensing takes a bigger piece of the pie, and modest operating cost increases.

The company says they expect to be cash flow positive in the second half of 2017 so maybe my expectations are too conservative. And really, that’s kind of the bet here. The story is an IPO gone bust, but the results so far suggest the business is on solid ground. If the company puts together a couple more quarters of beats that profitability number is going to start to come in and I bet the stock gets back to its IPO price.

Where I am at with Oil

If I were a promoter I might say that I nailed the bottom in oil stocks. A more honest appraisal would point out that it took me three tries.

Those that follow the blog will recall that I had tried and failed to pick a bottom in July. I was in the process of my second try when I wrote my mid-August update but that one didn’t stick either, as I sold out of RMP Energy and Jones Energy soon after my August 16th post (I kept Granite Oil which has turned out to be a big winner even as other oil stocks have suffered). My third attempt came on the heels of this release from the EIA, where they revised production downward for the first six months of the year and that one proved to be the winner.

The changes to the EIA data, which clearly show US production has been declining since early in the year, seems like a game changer to me. Maybe it is not a reason for oil to go straight up, but it might be a reason for it to no longer go down. Just like the stock market, it’s not when the data begins to get better that matters, but when the data stops getting worse at an accelerating rate. Its all about the second derivative.

So we will see. After the EIA release at the end of August I bought Crescent Point, Surge Energy and Baytex, and added back Jones Energy and RMP Energy. However I knew I would not have the nerve to hold onto these positions if they moved and sure enough I quickly panicked down my positions in each on that first, rather dramatic, correction from $49 (and no I did not catch the top in any of the positions).

I’ve since sold completely out of a number of the positions (I currently hold Granite, a little Crescent Point and a little RMP) as we seem tenuously on the brink of a re-test. While I want to believe that an oil turn is upon us, I’m just not sure. I am really torn about whether to believe the Goldman Sachs of the world or side with the tiny minority that think that all the data doesn’t quite make sense.

Because the reality is that to be an oil bull you have to believe the data is wrong and the forecasts are wrong.

One opinion I will note is this interview from BNN ith Mike Rothman of Cornerstone Analytics. Rothman believes, if you can believe it, that we will see $85 Brent at year end. Check out the date – he called this on August 25th, when oil was carving out its bottom in the $30’s.

Rothman’s thesis is basically that the IEA numbers aren’t right and everyone, all the experts and so on, are at their root basing their opinions on this one set of numbers.

And they have an unfortunate problem that I think is well known where they are chronically underestimating demand. Typically the problem is in the emerging markets… we’re seeing a major episode of that… a lot of the assertions I’m sure you have heard, I’m sure the people listening to this program have heard is that the oil market is oversupplied by 2-3mmbbls and that demand is weak. Demand is at record levels. Its not an opinion its an assessment of the actual data. The problem is the underestimation of the non-OECD.

I am somewhat sympathetic with this view. I remember back to pre-2008 when the IEA continually underestimated demand. Meanwhile we know that world production declines by 4-5% and that decline is, if anything, accelerating. Wells have to be drilled to stem that decline and it still requires capital to drill wells. I have to ask – is that capital really getting the return to justify its expenditures? Because if it takes 2-3 years to get back your capex then its not worth doing even if you are a national oil company. You’ll end up deeper in debt. I don’t know, maybe everything I read is gospel but it just doesn’t sit right with me. I would love to see well level analysis and economics of new developments in Iraq, Iran, Russia, all these countries where it is supposedly so profitable to ramp production and where all those production ramps are sustainable.

But with all that said, I remain neutral in my actions. I’m not going to pound my fist and say the market is wrong. I’m just going to quietly write that I don’t think things are as certain as all the oil pundits write and continue to be ready to pounce when the skies clear enough to show that an alternate thesis is playing out.

Portfolio Composition

Click here for the last four weeks of trades.