Low Tolerance

My tolerance for draw-downs has declined with age.

Ten years ago I used to say, irreverently: “you have to lose money to make money”. More often than not, I still do. It is far more common for a stock I buy to go down 20% before ever going up than for it to go straight up after I purchase it.

On individual names I have not changed – I still give lots of leeway. But when it comes to my portfolio as a whole, I do not have the patience for it.

What I deem to be an “acceptable” draw down has shrunk dramatically. 10 years ago I had no problem with a 10%+ move down. 5 years ago that had shrunk to around 5%. Now, at 2% I start getting worried.

2% is not a lot of leeway. It assuredly means that many times I am selling stocks that are simply in a lull. That I am not giving the ideas time to work out.

But investing in stocks is not the same as investing in real estate or a business. I can always buy back tomorrow.

I firmly believe that one of the biggest edges I have as a small retail investor is my ability to sell at will.

There aren’t many things a retail investor has an edge in. Research – no. Team – well (looks around the empty room) uh, no. Access to management – certainly not.

But the one thing I can do is sell. Free myself up and start over again.

Take this week for example. After mostly avoiding what has been a sort of crummy market for the last month or two – even as the indexes have gone up many (most) stocks have not – I was hit by the malaise of everything non-FANG, non-EV (of which my portfolio has neither group at the moment).

Energy got hit and while I don’t have big energy positions, I have enough. Commodities in general got hit, and Olin Corp, Westlake Chemical Corp and Chemtrade are all commodity plays. The biotech rally turned sour (again!). And then on Friday gold did what gold does and failed to hold its breakout.

Of all these names I only kept my chemical company positions and a few gold stocks. I sold all my energy positions, many of my biotech positions and some of my gold stocks.

I can always buy them back if I am wrong.

Consider Vertex , Ionis, Bristol-Myers and PTC Therapeutics. The idea was that these stocks had lagged and with drug price pressure off the table the stocks could run. And they did run – for about two weeks. Then they topped and started falling again.

I could stick with these names under the hope that this is just a retest of the lows and they are still in the early stages of a new bull market. I remain hopeful that is case.

But honestly, I have no idea. Sentiment in biotech is awful. We are in tax-loss selling season. There is no immediate catalyst for either of these stocks. And my original thesis – a run off of the drug-price news, it simply has not played out. Pivoting to anything else is thesis creep.

And with all of these stocks, I can buy them back any day I want. They are not illiquid microcaps. When biotech does have another leg of its bull market Ionis is probably going back to $60 or higher. Whether my cost basis is $31 or $35 is not a big concern.

This is the perspective I used on all these sales. I can always buy them back. I may buy them back Monday if conditions change. But let’s see how the biotechs act the next few days. While the charts of the bigger one’s like Bristol-Myers, Vertex, Ionis, PTC Therapeutics and Incyte Corp look roughed up, but some of the smaller one’s look downright awful.

With that in mind, let’s look at some charts.

I have a chart deck of about 50 biotechs I step through at least every weekend. And quite honestly, it looks like a disaster right now. Many of these charts have broken down to new lows or on the verge.

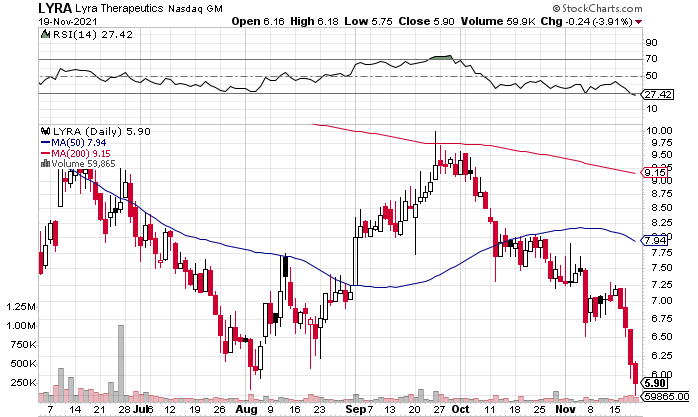

Consider Lyra, a name I have owned and written about before. I was kicking myself for selling the stock on its first pop to $7.50, after which it promptly went all the way up to $9.

Well since that move to $9 Lyra has been a steady road down to $5.75 now. No news. Where does it end?

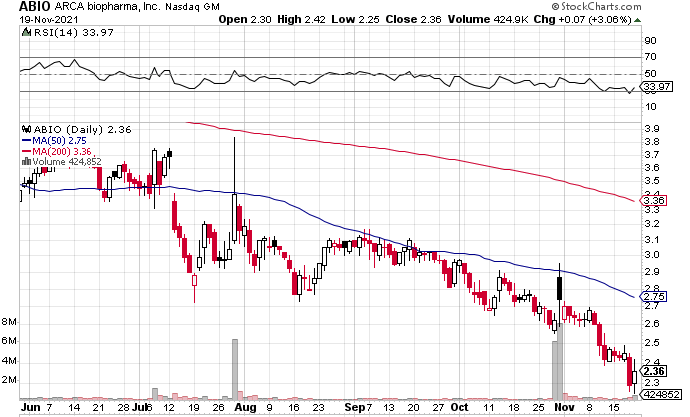

Or Arca Biopharma. This is a name I mentioned early this year. It is, admittedly, a shitco. But it is a shitco that is now trading at a -$25 million EV. That is negative twenty five. How negative can it go?

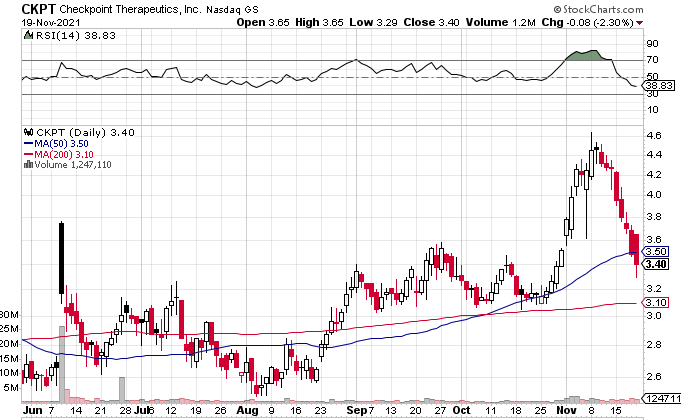

Checkpoint Therapeutics was one of the immunology stocks I bought in August. I was lucky enough to not believe the rally and sell a bunch of it above $4. The company has readouts in the next month or two that could be game-changers. But it takes a lot of courage to buy this chart.

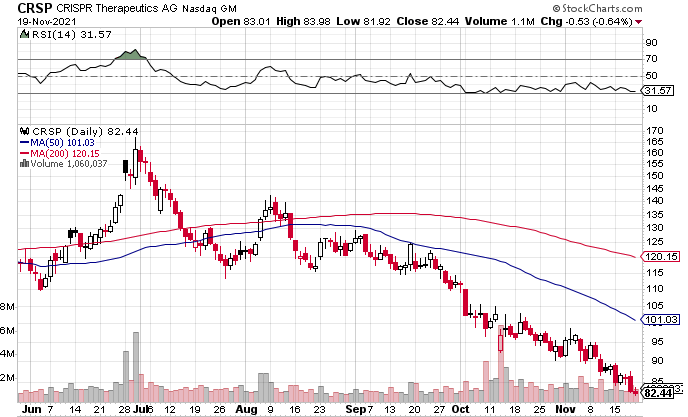

I thought genomics was the future. That might be the case but in the short-term, I was just wrong.

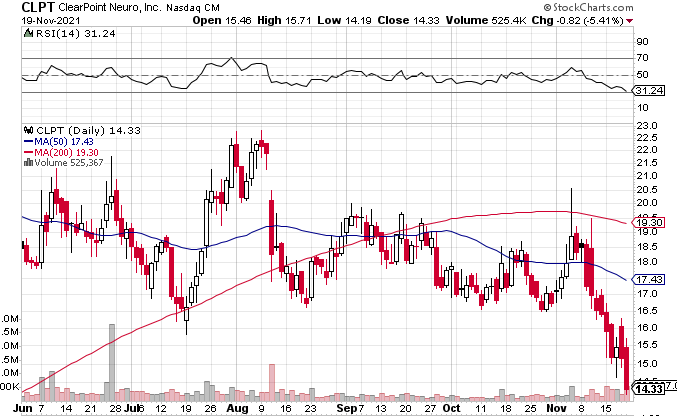

Clearpoint catches a whole lot of hell on twitter but honestly? This chart is no different than 90% of the other biotechs out there.

I could go on and on and on.

I know the biotech stocks are setting up for an incredible run at some point. But I’m not sure that comes before a good, old fashioned panic. A day where they open way down and everyone is freaking out. I want to be on the right side of that – with cash ready to buy.

So that’s where I’m at. I”ll end with the one biotech I have kept a piece of. Eiger Pharmaceuticals. I have sold some of my position, but I’ve held a good chunk of it.

Eiger is the one risk I am willing to take in biotechland right now. Eiger’s Interferon Lambda molecule is in a large COVID trial in South America, called the Together trial.

There are many signs that this drug works. It is not perfect – its not the pill that Merck and Pfizer have, but it is a single injection as opposed to a daily regime. Stocktwits actually has a very good Eiger board, complete with posters that provide the journal data on Lambda and their other molecule, lonafarnib, both of which are in trials for HDV – which is really the main story with Eiger.

Having read through all of the literature I can get my hands on, I come away thinking there is a fair chance Lambda will have good results. I don’t believe that is priced in the stock. We’ll see.