I went through all my bank earnings reports and conference calls on the weekend. When I say all, it isn’t really a big universe. It consists of: BSVN, BCBP, CADE, CUBI, MLVF, OCFC, PKBK SBFC, SFBG, SI, UBSI.

Nothing super exciting. Still hard to get excited about most of them unless I decide I just want to buy them cheap, close my eyes and wait it out. But I did buy CUBI back, and of course I bought Silvergate (more on that shortly). If there was any theme to all these earnings reports it would be that deposits remain up big and that the deferred loans are coming down fast, in large part because they better come down fast since the bank GAAP holiday is going to end Dec 31st and if these banks haven’t figured out how to make these loans current they are going to have to reserve for them (extend and pretend has been fun while it lasted but its now coming to an end).

The other thing that I think I underestimated was just how beneficial these PPP loans can be. In all honesty, between the extend and pretend CARES act and these PPP loans, it feel like a bit of a free-money wealth transfer to banks if you ask me. But anyway, the loans are pretty much no risk to the banks because the government stands behind them, the banks collect the interest, which are usually in the 2% range it seems and the best part (for the banks) is that they rake in fees for originating the loans and I didn’t realize how significant those fees can be.

Here is where CUBI comes in. They had a SBA lending program heading into the pandemic so they were well-placed to ramp up the PPP lending program once it was announced. They have originated $5 billion of PPP loans. That works out to 30% of the loan book as of the end of Q3. That’s a lot. Most other banks I’m looking at are 5% or less.

Anyway Customers expects to generate $100 million in pre-tax origination fees from these loans. They must be getting a 20 bps origination from the government to originate.

They recognize the fees when the loan is either forgiven or paid back. Given that we are in a ‘free for everyone’ world now, these loans are going to be forgiven and relatively soon. Customers figures 90% of loans will be forgiven by the end of the first half of next year.

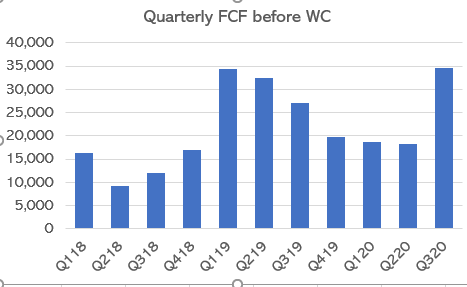

~$100 million over the next 3 quarters is some decent juice to earnings. Consider that Customers net income was about $60 million last quarter and that was with $12 million of fees from PPP.

Meanwhile Customers is bringing down their deferred loans like a good little bank – from 7.3% in Q2 to 2.6% in Q3, and they operate in New York and New Jersey, where the virus pig is further through the python than most places.

Everyone hates Jay Sidhu it seems and maybe there is good reason but he is making some decent decisions here. He was quite adamant on the call that he is not going to stand by while the stock continues to trade at the rather shockingly low multiple of 0.45x tangible book. If they have to, he said they will take the nuclear option:

We are working on scenarios to shrink the balance sheet and have massive stock buybacks so that the appropriate valuation of the company is being reflected by — into the value of the organization.

Anyway, may not be the best run bank in the world, but does it really deserve to be priced as one of the worst?

Here are my notes on the quarter:

- so first: Bank will earn approximately $100 million in pre-tax origination fees from PPP loans, significantly adding to its common tangible equity in 2021 – that’s a crazy amount of fees for a company with a market cap of $400mm

- they recognized $12mm of fees in Q320 – will recognize the rest over life of PPP loans, expect 90% to be forgiven in H12021

- total PPP loans are $5b – of total loans of $16.4b so about 30%

- additional PPP loans in Q3 contributed $10mm of Net Interest Income

- PPP loans have 1.97% yield on avg

- expecting 95% of their PPP loans to be forgiven – half of their loan balances are below $150k

- Core EPS of $38mm or $1.20 per share

- their NIM declined to 2.86% – seems similar to other banks

- are projecting NIM in 2.9% to 3% range for FY 2020

- deferments are down quite a bit – from 7.3% to 2.6% – now $302mm loans

- for reference here is the relevant section of CARES on loan deferments:

Temporary Relief from Troubled Debt Restructurings. A financial institution may elect to suspend requirements under U.S. GAAP for loan modifications related to the COVID-19 pandemic that would otherwise be categorized as a troubled debt restructuring and to suspend any determination of a loan modified as being a troubled debt restructuring, including impairment for accounting purposes, as a result of the effects of COVID-19. Any such suspension (1) is applicable for the term of the loan modification, but solely with respect to any modification, repayment plan or other similar arrangement that defers or delays the payment of principal or interest that occurs during the applicable period for a loan that was not more than 30 days past due as of December 31, 2019; and (2) will not apply to any adverse impact on the credit of a borrower that is not related to the COVID-19 pandemic. The election may begin effective March 1, 2020, and end at the earlier of December 31, 2020, or the date that is 60 days after the date on which the national emergency declaration related to COVID-19 is terminated. Financial institutions are directed to maintain records of the volume of loans involved so federal banking agencies may collect data about such loans for supervisory purposes. (Section 4013)

- key point is that the deferments end Dec 31 2020 right now

- hospitality is $404mm (3.5% of total loans) and 31% in deferment – so about $120mm or 40% of their deferments are hospitality

- avg loan to value in hospitalty is 65% – seems pretty low, if these loans do get called they’d get back their money on sale you’d think

- their multi-family portfolio has vacancy rate fof 3.4%, is 60% LTV, 4% of it is in deferment

- consumer loan deferments down to $25mm from $60mm

- NPAs are still very low, at 0.34% but this is of course because of the deferment

- their reserves are way higher, at over 2%, or $155.6mm

- guiding to $3/share core earnings for 2021

- also to mid-high single digit loan growth (excluding PPP)

- deposits were up 21% to $10.8b yoy

- expect funding tailwind from $466mm of CDs that mature at YE and will reprice down significantly – that is close to 5% of interest bearing deposits

- saw loan growth of $6b, to $16.6b – of that $5b were PPP loans, so about $1.6b of loan growth outside of PPP

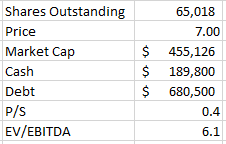

- this just seems too low to me: we are trading at about 43% of September 30 book value and only at about 4x 2020 and 2021 earnings.

- on stock buyback:

are working on scenarios to shrink the balance sheet and have massive stock buybacks so that the appropriate valuation of the company is being reflected by — into the value of the organization.

- I’m not exactly sure what this is but it’s a little concerning:

our specialty lending, lender finance business is the largest component of that. It’s an approximately $1 billion business for us today, and that will be driving majority of the growth. That’s a business that is predominantly at approximately 65% advance rates on a pool of collateral with collateral swaps in the event that there’s ever an issue. And as we’ve modeled it out, you’d have to be at a reception multiple times as big as a great recession to ever experience $1 of loss. So that’s the biggest component of our specialty niche businesses.

BankMobile

- expected to close by YE

- have “no intention of owning equity” in BM in long run