Research: DLH Holdings

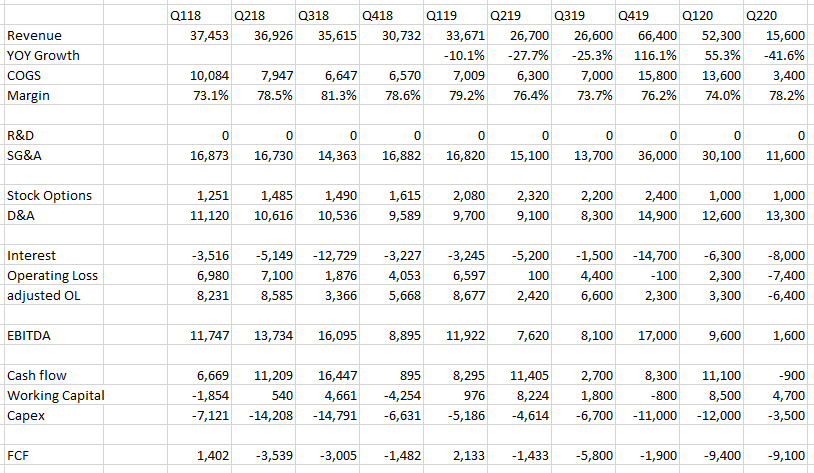

DLHC is a stock I bought in April and sold later in June or July and now I bought it again on Monday.

They have some debt that they took when they made a big acquisition last year, and they aren’t in a great business or anything – this is basically staffing and project deployment. And they have some customer retention issues – as you’ll read there is a small business set aside that could bump them with the VA, but from what I read they would still end up as a sub-contractor anyway so its not as big of a deal as it sounds.

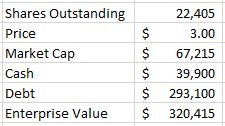

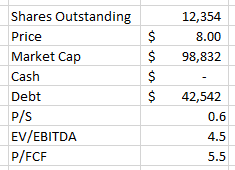

Its a cheap stock, and really that’s the thesis. It trades at 5.5x FCF. The larger staffing companies trade at 8x to 10x EBITDA. It is not going to the moon but I think it should be worth more than this.

- market cap of $98mm at $8

- trades at 4.5x EV/EBITDA, 7.1x P/E, 5.5x FCF

- revenue is expected to grow if analyst estimates can be believed – 34% growth yoy in 2020

- they provide professional healthcare and social services

- geared at: large-scale federal health and human service initiatives

- over 1,000 employees

- 100% of revenue is from Federal gov’t

- agencies they service include: VA, HHS and DoD from their legacy business

- also NIH and CMS from the SSS business they acquired last year

- revenue last year can be divided between 3 markets within the Federal govt:

- Defense and Veteran Health Services – 45% of revenue

- Human Services and Solutions – 20%

- Public Health and Life Sciences – 35%

- before they acquired SSS the VA was 65% of revenue

- it isn’t just contract labor, they do provide labor but also are responsible for delivering some processes,services on behalf of the gov’t

- these services are to gov’t – to Veteran Affairs, Health and Human Services, DoD

- there is definitely contract risk though – before renewing they had 9 contracts with the VA that were coming due in Oct 2019 – so a loss of these would have been devastasting

- there were some contracts that they were precluded on bidding on at renewal because they were supposed to go to small business

- but the RFP for the renewal is off the table, at least for now, this is what they said on Q3 10Q:

As previously reported, a single renewal request for proposal (“RFP”) had been issued for the nine (9) pharmacy contracts that required the prime contractor be a service-disabled veteran owned small business (“SDVOSB”), which would have precluded us from bidding on the RFP as a prime contractor. We had joined a SDVOSB team as a subcontractor to respond to this RFP. However, the government has canceled the previously issued RFP for these contracts. The government has neither indicated nor announced its future procurement strategy. Due to the time required to conduct a procurement process, we expect these contracts to be further extended

- They aren’t impacted much by COVID. In March 25th presentation they said:

- – since then have actually won business due to COVID in Q220

- – they do have net debt of $42mm – this is down from $55mm at beginning of year – and from over $63mm at time of acquisition

- – they took on debt in the large SSS acquisition last year

Q120 Results

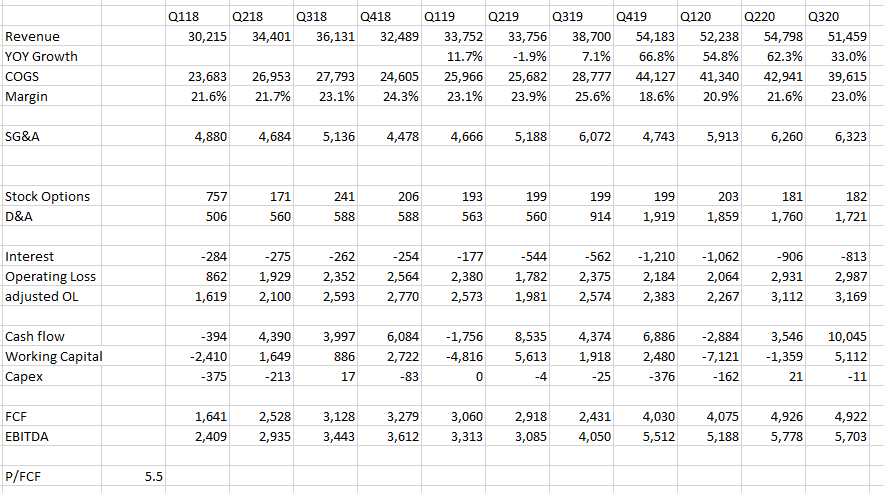

- they had $5mm EBITDA in Q12020

- reduced debt by $4.8mm in January

- said past 6m are good benchmark for going forward – had $106mm of revenue, $6.5mm OI, and $10mm EBITDA in last 6m

- not surprisingly operating margins are tight – 6% in Q12020

- Q12020 results were EPS of 13c, cash flow from ops before WC of $4.2mm, capex is minimal

- if I go back to F2019 – EPS was 44c, $13mm of cash flow before WC, $0.4mm capex – so trading at 4x FCF

- debt was only $7.2mm in FY2018 – so it was all debt for acquisition

Q220 Results

- Q2 was a little weaker

- revenue was down a little because of COVID – the revenue they get includes “accommodation” so travel of employees, expenses

- saw some organic yoy growth but they didn’t qualify how much

- they didn’t get this in Q220 b/c of COVID

- but almost all the rest of revenue is directly related to their contract workers:

numbers of workdays and slight things like that, that represents about 93% to 95% of our revenue quarter-in, quarter-out. The remaining 5% to 7% is comprised of what we would call accommodation revenue, so things that you would not independently seek to bid on

- still had EPS of 16c per share, $5.5mm of EBITDA

- also generated $10mm of cash

- debt down to $44.5mm – expect reduction to $40mm by YE

- received contracts to assist the National Institutes of Health in their fight against infectious diseases – in this case, COVID-19. With recent awards expected to generate approximately $15 million in calendar 2020

- this is related to COVID trial – so I think they are administering the trials, so the amt and timing depends on the progress of those trials

- could be additional revenue from other yet to be announced COVID programs – its changing all the time

Social & Scientific Systems Acquisition

- provide healthcare staffing

- to: Department of Health & Human Services – including the National Institutes of Health (NIH) and the Centers for Medicare and Medicaid Services (CMS) – along with other healthcare-related institutions

- 400 employees

- paid $70mm for acquisition of Social & Scientific Systems, Inc – $63mm net of cash that they would receive from tax rebate

- expected that they would contribute $65mm of revenue annually

- had a backlog of $346mm at time of acquisition

Acquisition of Irving Burton Associates

- acquired for $32mm

- provides government healthcare research and IT services to clients including the US Army Medical Research and Development Command, the Telemedicine and Advanced Technology Research Center (TATRC), and the Defense Health Agency.

- increases DLH’s overall portfolio of services

- likely improves the company’s contract bid prospects relative to competitors in the government healthcare services space.

- company’s current revenue run-rate is ~$25M annually with a $143M outstanding backlog.