Research: Luby’s

- announced this today:

has approved and adopted a plan of liquidation and dissolution (the “Plan of Liquidation” or the “Plan”) that provides for the sale of the Company’s assets and distribution of the net proceeds to the Company’s stockholders

the Company currently estimates, assuming the sale of its assets pursuant to its monetization strategy, that it could make aggregate liquidating distributions to stockholders of between approximately $92 million and $123 million (approximately $3.00 and $4.00 per share of common stock, respectively, based on 30,752,470 shares of common stock outstanding as of September 2, 2020).

- this doesn’t sound like a new press release – they had this in the 10-Q:

On June 3, 2020, we announced that our Board of Directors approved a course of action whereby we will immediately pursue the sale of our operating divisions and assets, including our real estate assets, or the sale of the Company in its entirety, and distribute the net proceeds to our stockholders after payment of debt and other obligations. During the sale process, many of our restaurants will remain open.

- I guess the new thing is putting numbers to it

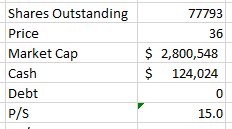

- have 30.7mm shares outstanding $31mm market cap at $1.05

- another $63.7mm of debt

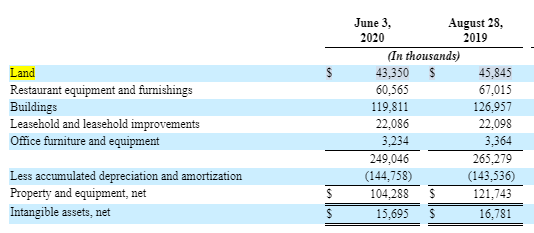

- book value is $65mm – also intangible assets of $15.7mm

- got a $10mm PPP loan but that is in those numbers

- presumably the RE must be worth quite a bit? Or maybe the brands?

- this is the RE on the balance sheet, certainly if its closer to undepreciated value it is worth a lot:

- this SA post seems to have it about right:

Bottom line: Luby’s owns the structures and land on over 90 of its locations. This property is on its books at cost, and many have been owned for decades. As an obvious consequence, there has been plenty of appreciation that is not reflected on the balance sheet.

- they had appraised the properties previously: Luby’s, which on Friday had a market value of $39.4 million, said its remaining 74 properties were appraised at $211 million last year, according to its annual report filed with the Securities and Exchange Commission.

- if the RE is really worth $200mm it seems like a pretty straightforward play

What they do

- they own hamburger restaurants – Fuddruckers, Lubys Cafeteria and Cheeseburger in Paradise

- own 31 Lubys and 8 Fuddruckers at end of Q220

- are another 59 Fuddruckers franchises

- In 2010, bought Fuddruckers for $61 million and three years later acquired Cheeseburger in Paradise for $11 million.

- they also operate Lubys Culinary Service

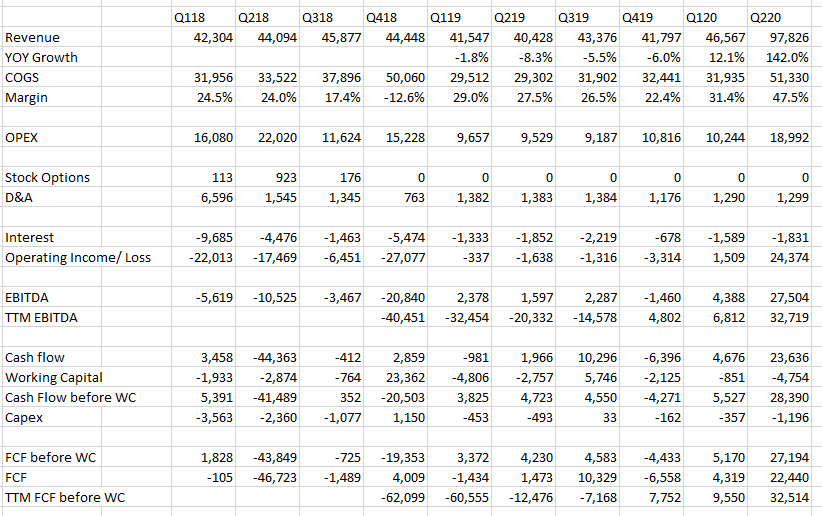

- their results haven’t been improving much – revenue has been declining

- costs have come down some so they are fairly close to breakeven

- in quarter before COVID sales were down 7% yoy, they had a slight cash flow loss

- had 13 store closings and 7 transfers to franchisees

- they closed 22 stores yoy in Sept quarter last year

- total of 39 restaurants closed in year up till Nov 2019

- the fourth quarter results were really not that good, the stock dipped that day to the $1.80s but then popped back up

- though SSS were stabilizing – they were up a little over 1% at the cafeterias and flat at Fuddruckers – nothing to write home about but better than the past

- before liquidation they were restructuring – transitioning accounting, payroll, reporting and backoffice to leading multi-unit residential outsourcing firm, blah, blah, blah

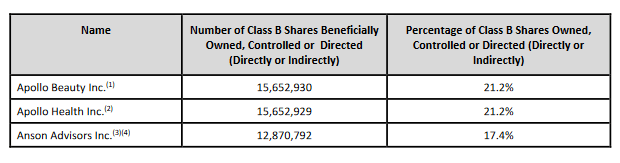

- they have a special committee doing the strategic review

- they are transitioning some company-owned Fuddruckers to franchises – have done 14 since Apr 2019 not sure what that means for RE?

- I bought some at the open – seems like it is likely worth more than $1.80, not sure if I have enough info to say for sure its worth the $3-$4 the company is saying though