Research: Ribbon Communications

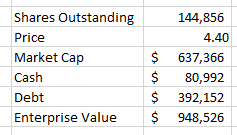

- 110mm shares at $4 for $440mm market cap

- $81mm of cash

- $391mm of debt

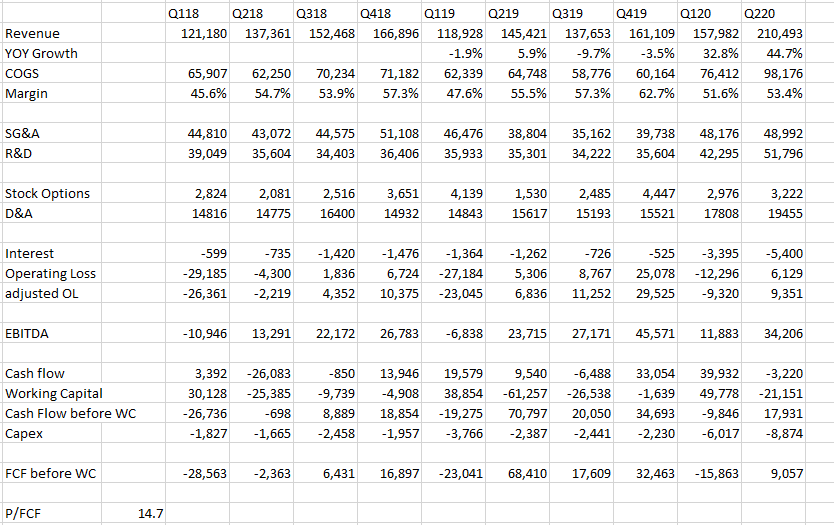

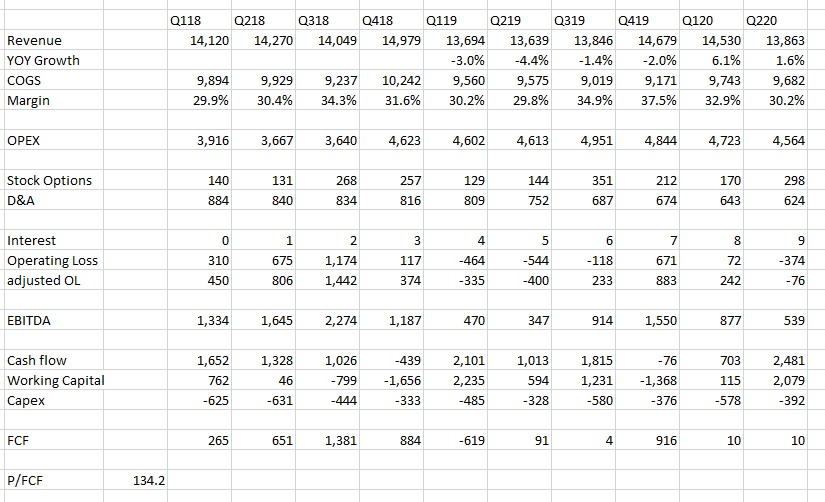

- cash flow was okay though $37mm in H120 $22mm fcf in H120

- company seems to generate a fair bit of FCF – see table at the end

- this is one of those companies where their business description is all jargon which is a flag of sorts

- software solutions provide a secure way for our customers to connect and leverage multivendor, multiprotocol communications systems and applications across their networks and the cloud

- here it is in a nutshell: their products help CSPs and to lessor extent enterprises upgrade legacy infrastructure to cloud, IP-based networks

- 70/30 split with CSPs/enterprise

- software is about 50% of product revenue

Their business is focused on:

- providing software to modernize network to IP

- providing IP network security

- providing edge solutions

- providing NFV solutions

here is how they break down what they are providing in the 10-K:

- sell mainly to service providers – both fixed and wireless, MSOs, ISPs

- I’m not sure if I have ever made money on a company selling to CSPs 😛

- secure cloud-based delivery of UC solutions

- use direct and indirect sales channels

- These guys are a merger and acquisitions machine, making it even more complicated to look at

Competition:

- Network transformation: AudioCodes Ltd., Mavenir Systems, Inc., Metaswitch Networks Corporation, Oracle Corporation (Session Border Controller) and ADTRAN, Inc (also MSFT recently bought Metaswitch)

- Security and Analytics: SecureLogix Corporation, RedShift Networks Corporation, Empirix Inc. and Oracle Corporation.

- A concern I see in transcripts is they are competing against much bigger companies, I guess referring to Oracle and Microsoft

Acquisition of Anova Data

- Feb 2019

- provides advanced analytics solutions (wtf is that?)

- acquired Feb 2019

- has something to do with big data analytics and machine learning

Edgewater Networks

- Network Edge Orchestration for the distributed enterprise and UC market – well at least I can understand what that one is

- software leader in session border controlers

- allows RBBN to get into SD-WAN market

GENBAND

- not really clear what product these guys sell but improves RBBN position in move to IP networks and cloud-based networks

ECI Telecom Group

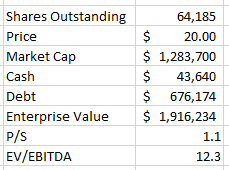

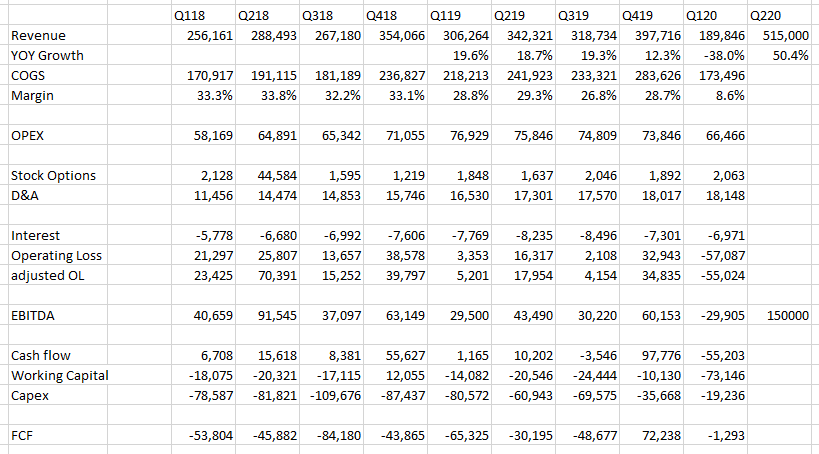

- merger in Nov 2019

- issued 32.5mm shares to ECI and $324mm of cash

- leading packet optical solution provider

- address markets like NFV and SDN

- had $25mm EBITDA in 2018, $27mm EBITDA in 9m 2019

- 50% of ECI revenue comes from India and Russia

- There’s some sort of adjusted revenue accounting problem in India right now with major CSPs and that is impacting the India business

- the Cowen guys don’t think a lot of ECI

- According to RBBN merger presentation ECI does have a big TAM – not sure if its growing much though

Kandy

- this one was a divestiture

- received 13mm shares of ACVtechnologies for Kandy

- Kandy was a provider of deployments of UCaaS, CPaaS, and CCaaS for mid-market and enterprise

- so these Kandy guys are competition to RingCentral, 8×8, Vonage

- they had a slight loss in Q220 – revenue was significantly higher yoy though

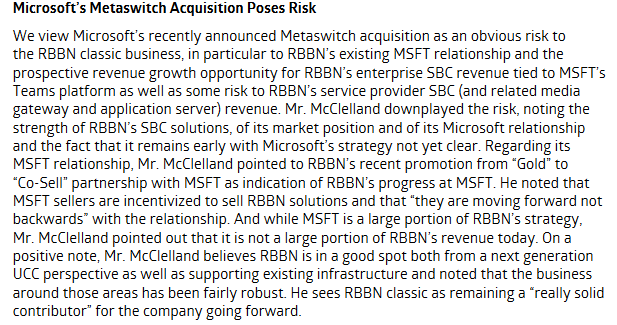

This is from Cowen about the risk of competition now from MSFT:

- Metaswitch portfolio is similar to RBBN both have session border controllers (SBCs), media gateways, voice applicationservers, and software under the Unified Communications

- There is also an interesting point alluded to on last CC – asking whether UCaaS is going to be against headwinds

- It seems like a lot of elements of their business are under headwinds

- Makes you wonder what real reason was for acquisition of ECI

Cash flow

- working capital was about -$30mm though so that would be something to look into more

Conclusion

- while the stock is pretty cheap, I’m not sure its worth buying

- The Cowen guys note on a number of pieces that they are going up against larger, better capitalized competitors

- Would probably want to see that they can succeed first, esp with ECI acquisition

- doesn’t really seem like they are in a good place, competing against very large competition, MSFT just bought up a smaller player to add to that competition, so I don’t know… seems like a pass for now