Progress being made on the Hovnanian Preferreds

I wrote up my position in Hovnanian preferreds (HOVNP) in April 2013, so a little over 9 months ago. During that time the preferreds have went on a round trip to nowhere, peaking out at $18 in the summer before falling back to $14 in the last few weeks of the year.

I waited patiently through most of the year, not adding to my position but not reducing it either. When the preferred shares touched the $14’s though, I decided to add with the rationale that we are another year closer to the housing recovery.

I didn’t, however, put in any new work before my purchase. I took the lazy way out, falling back on the thesis of choppy but improving fundamentals of the housing market and my work from nine months earlier that suggested that by 2014 Hovnanian should cross the fixed interest coverage restriction that has kept them from paying interest on their preferreds.

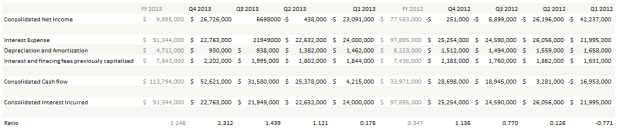

This week I filled the void and did some work on the progress made by Hovnanian. In the table below I have calculated the interest coverage ratio that restricts dividends on the preferreds. If you want the language of the preferred document you can go back and read my original comment but in simple terms it is a ratio of consolidated cash flow from operations (so cash flows that do not include cash from unconsolidated subsidiarie) to the interest paid during the period. That ratio has to be above 2.0 for the previous 12 months before Hovnanian can reinstate payments on the preferreds.

So progress is indeed being made. The fourth quarter was the first quarter where the ratio exceeded the 2x threshold.

My original assumption was that Hovnanian would exceed the threshold in 2014, and this was based on 16% top-line growth in both 2013 and 2014 and costs that were in-line with historical margins. In 2013 the company exceeded my estimate on the top line, posting revenue of $1.85 billion, versus $1.48 billion in 2012, which works out to about 25%. The company should easily hit my $2 billion revenue target this year. Meanwhile, interest costs have declined from around $100 million annually to something less than $90 million. Admittedly the recent $150 million note offering of 7% senior notes is going to bump that up somewhat, but hopefully that money will be quickly put to work at higher rates of returns.

So I still expect the company to exceed the interest coverage ratio within a year. When they do, I expect interest to once again be paid on the preferreds, and thus for the price of the preferreds to move close to their $25 par value. Even today at $15, that represents a 50% return in a year (to get 50% I am assuming the preferreds continue to trade at a discount to par even after the dividend is reinstated, reflecting remaining uncertainty about the dividends sustainability).

While the preferreds are not in the portfolio I track on-line because of the limitation of the practice portfolio I use for those purposes (it doesn’t let you buy preferreds), they represent a 4.5% position in my portfolio. So its not huge, in part because the stock is not terribly liquid and in part because it remains a risky bet; keep in mind that these preferreds traded down to as little as $2 during the crisis and it was only in 2012 that they returned to above $10.

Nevertheless, the upside is there and the company is on-track to follow the ever slowly recovering economy back toward normalcy. I think there is a good chance that I will selling these in the $20’s around this time next year.

Interesting idea. I’ve looked at quite a few busted cumulative preferreds, but not non cumulative. Have they (HOV) discussed a desire to be a stock that pays dividends, or do you see a motivation for that?

Hi Clint – I think I answered your question to some degree in my response to Matt but no I don’t think HOV has ever been a dividend payer on the common. The expectation that they will start paying dividends on the preferreds again once the covenants have been reached depends more on the company’s credibility. Preferred share owners do get to elect 2 Advisory Directors to attend BoD meetings though. The prospectus is here:

http://www.sec.gov/Archives/edgar/data/357294/000104746905018621/a2159949z424b2.htm

I’m going to repeat the question I asked in April that went unanswered: I understand that HOV may be allowed to pay dividends soon, but what incentive do they have to do so? It is a non-cumulative issue, after all.

Sorry if I didn’t reply earlier, if that happens just send me an email. The comments process isn’t great and I have missed replying on occasion.

I’ve had the question asked before so I’m going to give you that same response, though you may find it unfulfilling: Its a fair concern and I worry about it too. But I think the company would lose a lot of credibility if they just let the preferred sit there without any dividend even after all covenants are met and the company is on sound footing. What would that project to future debtors and shareholders? I’m also not sure that the board of directors could allow it? I can see them dragging their feet though.

Maybe I am being to optimistic though? I’d appreciate any insights, particularly if you have examples of $1B+ public companies that have followed that path. Because I admit I might be wrong.

Matt’s question is an excellent one… most preferreds–even non-cum preferreds–have some kind of consequence if the dividends remain unpaid. A common one that I’ve seen: 3 board seats for preferred holders after 9 (or some random number) consecutive quarters of unpaid dividends. I haven’t read this prospectus, so I don’t personally know what is or isn’t there. But otherwise, it seems that Matt’s question has some serious teeth.

Hello! Q1 2014 results were not very good as they reported a loss. The ratio you note above is now below 2 again. Does this start the clock all over again? Meaning does the ratio need to be above 2 for 4 consecutive quarters or is it for an entire FY? I am interested in these preferreds but it looks like the payoff may be even longer than 12 months away at this point.

Thanks in advance

Keep in mind that Q1 is always the worst Q. You really need to look at the ratio on a 12 month basis. But yeah, the quarter was a bit weak and that likely delays things. But the homebuilders are very volatile and the industry cyclical, so lets wait for a few more Qs of data before jumping to a conclusion on it.

Thanks for the response. So does the ratio need to be above 2 for 4 consecutive quarters, essentially 4 snapshots in time? Or for any TTM time period? So for a year the ratio can be 2, .5, 4,5 and average out over 2 for the 12 month period?

Hi, do you have any update thoughts on the HOVNP preferred?

Sorry but I haven’t really followed HOV closely enough to say. If I were going to look at it again I would just run the calcs on how close they are to exceeding their covenants so they can reinstate the dividend payments.