Lojack (LOJN) – Speculating on a step-change from Fleet

I’ve been watching Lojack (LOJN) for a while, almost bought into it a couple of times but I’ve never been able to get comfortable until a few weeks ago.

The irony is that if I had waited a bit longer, I could have gotten in at about 15% less. Oh well. I always dislike writing up a stock that has already moved to the upside (I am in the process of doing just that with Air Canada right now). So here I get to do the opposite; tell you why I liked the stock at $6.20, and must really like it here at $5.40.

Why I bought Lojack in the $6’s

I decided to take a position after I reviewed the fourth quarter results. My reasons were:

- The existing stolen vehicle recovery business appears to have reached an inflection where further increases in revenues should make a larger contribution to the bottom line

- The outlook the company provided on Fleet was very positive

- The stock price (around $6 at the time) priced in a modest improvement in the stolen vehicle recovery business but none of the upside of Fleet.

The Lojack Business

I think what held me back from buying the stock for so long was that you have to be willing to make a bet that things have changed. Lojack and their stolen vehicle recovery business haven’t had a very good track record of making money. They’ve only recently started to show growth. So there’s the worry that the next quarter may be the end of the short-lived trend. That’s the risk here, and I am waiting with some trepidation for the first quarter results.

Now for a little bit about the company. Lojack has been in business for over 30 years producing this one one product; stolen vehicle recovery systems. Its been a good business over that time, but its cyclical and has seen increased competition from GPS solution providers.

So Lojack struggled for a number of years with competition and with the downturn in vehicle sales that came along with the recession. But lately they’ve been turning it around, in large part because they changed their sales strategy for the devices. They now do over half their sales as pre-installs. This is when the dealer installs the Lojack devices before the vehicle sale and then pitches the sale of the car with the device already attached. It aligns the interests of the salesperson and Lojack, because with the devices already installed all they need is a customer signature to make a little extra commission. It also takes the sales pitch out of the office; the Lojack product is no longer just one of a list of add-ons that the dealer tries to up-sell once they have the customer reeled in. And with the device already in the car, the customer is more likely to ask why not then they are to ask why. There is a very good article discussing the pre-install strategy here.

So the pre-install strategy has been working well and what were previously lackluster sales have reversed; the company has been outpacing the growth of the North American automotive industry for over a year now. Below is Lojack dealer sales growth versus overall auto sales growth in the US (this is taken from comments on the third and fourth quarter conference calls):

The result is that they finally turned the corner on EBITDA in 2013. In particular, in the fourth quarter they generated $6.3 million of EBITDA, which is quite good for a company with an enterprise value of about $80 million.

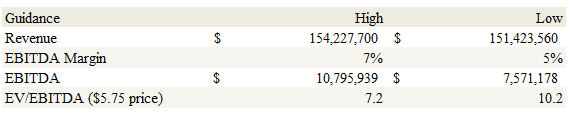

After the fourth quarter Lojack guided for 2014 revenue and EBITDA for the stolen vehicle recovery business. Below I have reproduced that guidance and extrapolated a multiple from it (note that this multiple was done with the share price around $6).

I’m suspicious (hopeful?) that the guidance is conservative. In the fourth quarter they had 15.5% EBITDA margin. While the fourth quarter is seasonally strong, when pressed on the conference call, management admitted that the strong EBITDA was in large part due to the scalability of the business and the simple fact that revenues are increasing. We’ll have to wait until the first quarter report to know whether the fourth quarter was an anomaly or whether they really are sandbagging their guidance.

Also interesting is that on the last couple of conference calls management has been clear that they have “only scratched the surface” on the potential of the dealer channel and pre-install strategy. They’ve had the pre-install strategy going since mid 2012, and while its well entrenched with a few dealers, it still has a long ways to go with others. As long as the company can keep managing the business well, and as long as the US auto market continues to grow, there should be room to grow further.

So there you have what is kind of the foundation of the thesis. A company trading at what is probably a fair value if they hit their guidance, with upside if they continue to outgrow the industry.

But that wouldn’t be nearly enough to convince me to buy the stock. Here’s the real reason. Beginning in 2013, Lojack began to ramp up towards the sale of a fleet product powered and designed by TomTom. The partnership with TomTom gives them exclusive rights to sell the device within North America.

What Lojack brings to the table in the partnership is their dealer network. They operate in 28 states (as well as 30 other countries). 80% of the stolen vehicle recovery systems are sold via their dealer network. Like I said they have been in business for 30 years. They have long-term relationships with their dealers, and these relationships have only strengthened of late with the pre-install strategy. They also have strong relationships with law-enforcement agencies in those states, because in order for the anti-theft devices to work the transmissions need to be integrated into the local law enforcement systems.

Think of it this way. Lojack has had this massive intangible asset sitting off-balance sheet. The asset was its dealer and law enforcement relationships and the sales and marketing network. For the longest time that asset was underutilized; they used it to sell some devices but that’s about it. But it could have been worth more, as it wouldn’t be easily replicated by a competitor. With this move into fleet they’ve figured out how they can extract more value from that asset. They can leverage the relationships and provide another value-add product that should be a win-win for Lojack and the dealers. They’ve already started hinting that once fleet begins to chug along, we should expect other initiatives, aimed at aligning Lojack as a company providing the “connected car” solution. I think its a smart strategy.

What can we expect from Fleet?

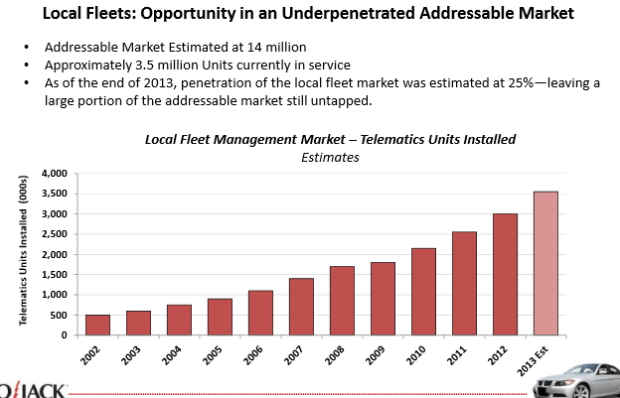

Lojack and their competitors have thrown out some general numbers about the Fleet business.

According to C.J. Driscoll & Associates is approximately 14 million fleet vehicles. Only 25% of those vehicles are currently equipped with the GPS Fleet Management System. The expectation is that the market can grow at a 15%-20% clip going forward.

Putting some numbers to the overall market size, from a Motley Fool article: “research firm MarketsandMarkets estimates that the entire fleet management industry is currently worth $11 billion and will be worth around $30 billion by 2018, growing at a compounded annual growth rate of 23%.”

Fleet for Small and Medium Business

Lojack is focusing their fleet product on local fleets, so on the small and medium sized business (SMB) market. This market is fragmented. Most of the larger competitors in Fleet, like Trimble, are focused on addressing the needs of larger businesses. According to Lojack, no one competitor in the SMB segment has more than 3% of the addressable market.

One of their biggest competitors in the market will be Fleetmatics. Fleetmatics is also one of the only fleet management company that is public (the others are MiX Telematics and Calamp, of which Calamp provides almost no details about their business metrics so I’ve had to leave them out of the discussion). Here are some brief metrics on Fleetmatics as well as MiX Telematics.

Of the two, Fleetmatics is the closer comparison because they operate mostly in North America, whereas MiX Telematics only generates about 10% of their revenue from North America, with 50% coming from Africa. Fleetmatics is, however, quite highly valued, and some would argue overvalued. Something to keep in mind.

I spent some time reading through the Fleetmatics 10-K, and one nugget that I thought was interesting was that Fleetmatics doesn’t appear to have nearly the salesforce or dealer relationships that Lojack has. In fact Fleetmatics seems to primarily utilize web channels for its sales. From its 10-K:

Our inbound leads are largely generated through Web-based marketing efforts. This involves extensive search engine marketing, search engine optimization, digital advertising, email marketing, direct Web traffic and programs with digital media companies… our outbound lead generation involves a variety of traditional marketing activities, including direct mail, email marketing, cold calling, advertising, trade shows and in-person events, and telemarketing.

I find it somewhat reassuring that what would be their largest competitor in the space doesn’t seem to have nearly the sales and marketing pipeline that Lojack has.

Trying to extrapolate something for Fleet

On the fourth quarter conference call Lojack said they already had about 19,000 leads for fleet. Leads are defined as vehicles of potential customers they are currently in discussion with. If I were to stick my finger in the air, I would guess that they can generate 100,000 subscriptions by the middle of 2015.

When I speculate at 100,000, what I am really saying is that I think Lojack can capture 20% of the growth of the local fleet market by the end of 2015. Given the dealer network, the alliance with a recognizable brand in TomTom, and the lack of a really strong competitor, I think that’s a reasonable bet.

Below I have tried to calculate what that would mean to Lojack. Be forewarned, this is going to entail some hand waving, because Lojack has not given a lot of detail with respect to the price of the subscription.

Lojack did give some guidance on margins, said they expect similar margins to what they get from stolen vehicle recovery. So about 50%. This seems to jive with what I see from Fleetmatics; they have about 75% margins but they make their own devices, so if TomTom was marking up the devices by half Lojack would be left with about 50% margins.

Based on their year end subscription base (445,000) and their fourth quarter subscription revenue ($50 million) Fleetmatics subscriptions go for about $37.50 per month. I’m going to assume Lojack sells their subs for $35 per month. Its worth noting that Lojack has suggested that they won’t be charging up front for the device or installation, so it will be a pure subscription fee model.

When I use the above assumptions, I get the following estimates for subscription revenue and, applying an EV/subscriber of about half of Fleetmatics (because I am also of the mind that Fleetmatics is overvalued), I’ve come up with what you might expect the enterprise value of the fleet segment to be valued at. I’ve included the Fleetmatics comparison for easy reference.

This isn’t intended to be a forecast. While I am hopeful that they will ramp up subscribers quickly and get to 100,000 in the next year or two, I really have no idea. We’ll have to wait and see.

The bigger point I am trying to illustrate is the upside potential to a positive outcome. Right now the companies enterprise value is $80 million. If you value 100,000 subscribers at less than half of what the market is giving Fleetmatics, you would more than double that enterprise value. You would also add 25% growth to the top line. So you can see how the stock is leveraged to things playing out the right way.

Conclusions

The hope here is that Fleet takes off at the same time that we see steady growth from the anti-theft device business. If that all comes together then the stock will be significantly higher than $6 and I’ll stop kicking myself for not waiting until $5.25.

On the other hand, the worry is that Fleet takes time to ramp up sales and we see a bad quarter from anti-theft. If that happens the stock probably drops back to the $4’s and this becomes a wait and see story.

So its not for the faint-hearted. Nevertheless, given where we are in the economic cycle, given the updates provided by the company over the last couple of quarters, and given the age of the vehicle fleet in the US, in my opinion all the signs point to further improvement in the quarters ahead.

One other point is that its an illiquid stock though and I have to admit I don’t like that. As I increase the size of my portfolio I am beginning to get tired of these low volume small-cap names because I find it more difficult to take a sizable position, or if I do take a sizable position I know I’m going to fret about how I am going to get out of it if something goes wrong.

So I’ve tried my best to keep my position reasonably small, though its been difficult with the stock falling down to the low $5’s, and (sigh) I have been compelled to add further down here and make it larger then I would probably like it to be. In order to keep it from getting too large I don’t expect to follow my usual strategy and add much even as the stock rises. Instead I’ll just sit tight and hopefully watch it go up.

Hello L,

I enjoyed your LoJack post. I think fleet management is in an investing “sweet spot” of being high growth, valuable to the customers, but also extremely boring to the investing community. However, I worry about LoJack’s ability to be a player in this space, given how it has struggled over the years in its core business…do they have a winning team in place? In contrast, Ituran (ITRN) has been very successful in the auto theft recovery business.

However, I am intrigued by one of your comparables that I had not seen before: MIXT. Have you dug into this any further? I imagine that the value of fleet management is higher in subsaharan Africa than it is in North America.

Thanks,

-S

TomTom’s view on the NA fleetmanagement market. Comments are from last CC.

Hans Slob – Rabobank – Analyst

And we should not expect, let’s say, a deal in North America, because I’m thinking of a partnership in North America? How is that working?

Marina Wyatt – TomTom NV – CFO

We have a two-pronged approach in North America. We have an organic team, so our own team, and then we also have a partnership with a company called LoJack, which we started last year. I think what we’ve learnt about the North American market is that it takes some time to get established. I think in terms of our own team, it’s really found its feet over the last year and is starting to grow quite well, but it’s very small in a large market. The LoJack partnership started during 2013 and needs more time to really start to take hold, and we’ll watch the progress on that as we go through 2014.

Click to access TOM2_AS-Transcript-2014-02-11T13_00.pdf

thanks for the info.

Since it fell more than 10% today, are you buying more? Or stated differently, do you think it’s a good idea to buy more?

I am personally not adding. There was nothing in the quarter that would cause me to add to my position. If I didn’t have a position, I would be adding one. The thesis is essentially the same one I wrote about. After listening to CC and reviewing results against the historical, it doesn’t look like there is anything fundamentally wrong with the stolen vehicle recovery segement; it was just a slow quarter for the industry and they are still getting intermittant sales internationally. And the fleet is still too early to garner any insights from it. Management speaks very positively but we know they will and we need to see results before we can really gauge success.

Its a risky story. It could go south if fleet doesn’t work. And you can see how tied they are to the economy, any slowdown in the US and they will get hit. But I dont think there is anything in this quarters report that shows the thesis is fundamentally flawed yet.

Yesterday dissapointing results from LoJack, however management remained positive about the development of fleetmanagement “making significant inroads”.

Some facts from TomTom results regarding Telematics.

Churn rate 0,5% (shows the quality of the product!)

Key figures

(€ in millions, unless stated otherwise) Q1 ’14 Q1 ’13 y.o.y. change

Hardware revenue 7.8 6.6 18%

Subscription revenue 17.3 12.8 35%

Total Telematics revenue 25.1 19.4 29%

Monthly ARPU (€) 17.00 17.40 –2%

WEBFLEET subscriber installed base (#) 348,000 252,000 38%

#long Tom2,LOJN

Thanks for the figures. In particular the ARPU is useful. Do you happen to know how much of those sales overlap with the US focus of Lojack?

Srry, I don’t have that information, contacted the IR department of TomTom but they reffered to Q1 report/annual report.

thanks for trying