Reviewing the Opportunity in India presented by Niko Resources

I have been tweeting about my position in Niko for a few weeks now. I built a small position in the $7’s which I added to in the $8’s and $9’s as news on the new gas contract in India has been confirmed. As I’ve said before, I am often slow coming out with posts and updates on all of the stocks I own because it takes time to write these opuses but I do try to make fairly timely updates on twitter when I add new positions or decide to exit others. Feel free to follow me there.

Niko Resources is a pretty simple story. The stock is a former Bay Street darling that has struggled mightily with reserve write downs and exploration disappointments. The stock has been pretty much left for dead by analysts and fund managers who have watched their dollars disappear as it fell from over $100 to less than $10 (bottoming at $5 and change a few months ago).

I owned Niko briefly before Christmas. My short stint with the stock is an example of needing to own something in order to be motivated to think a bit harder about it. After having gone through that process, I sold the stock and wrote the following:

The discomfort I developed with Niko was partially the result of another batch of less than stellar drilling results, but mostly the result of my conclusion that this isn’t the right time yet. The driver of the share price will be the settlement of a new gas price contract in India. I don’t think this is likely to occur until the existing contract expires, which is not until next year. In the mean time Niko will continue to experience production declines in India, and they are open to negative news flow on drilling.

Of course you could argue they are also open to positive news flow, and that’s totally true. But the point is, its a gamble. If they report a hit then I will miss out (though I suspect that such news might get me to jump back in). Absent that, I’m going to keep watching Niko until we get closer to year-end and to where the market can begin to price in a new contract.

Since that time I have continued to watch Niko, and indeed there has been positive news flow on the exploration front (the company had a new significant discovery in India), and terms of a new gas contract were released. And honestly, with all the news that has come out, I would have expected the stock to be higher. Nevertheless, I have been pleased that the stock has traded below where I sold it back in December when, in my opinion, the uncertainty surrounding the company’s outlook was much more unclear. Sometimes the market is fickle and that has given me a chance to get back in.

The D6 Block

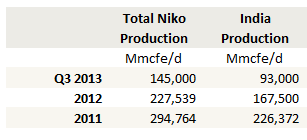

The main reason that Niko’s stock collapsed from $100 was the declining production from India. Most of Niko’s production from India, and as far as I can tell virtually all of the gas production, comes from a single field known as the Dhirubhai 1/3 unit (D1/D3) which is part of a larger block called D6 (the D6 block also includes the MA field, from which the majority of Niko’s oil production comes from). 14 wells currently produce from the field. My understanding of the history of the D1/D3 unit is that the initially high expectations were based on a misunderstanding of the connectivity between reservoir compartments. It was believed that there was a much higher degree of communication (ie. high permeability fracturing) between the individual compartments than turned out to be the case, with the result being that well production declined at a much faster rate than anticipated and that the initial expectation of reserves was overstated. The following are the production numbers over the past 3 years for the company and for India segment for which the D1/D3 unit.

Meanwhile, the very low gas price contract with the Indian government has led to little in the way of development outside of the already producing D6 area. I’ve read some accusations that the Reliance/Niko/BP consortium that owns the area have been purposely delaying development as leverage to the gas price negotiations, and while this may or may not be the case, I think its worth pointing out that these are high cost off-shore developments and $4/mcf gas (which was about what they have been getting from the existing contract) does not provide a lot of wiggle room for that kind of risk.

That should change with the new gas price agreement. The pricing incorporates an average of the current LNG import price into India and the current prices in the United States, Europe and Japan. Based on current prices, if the agreement were to come into effect today Niko would get double the price that it is currently getting. The new contract will take effect April 2014. Niko said in a July 3rd news release that they expected the price to be $8.40 when it takes effect.

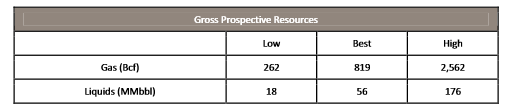

When they spud the MJ-1 well Niko provided the following estimates of potential resource. On BNN the CEO said that he expects the resource to come in at the upper end of the estimate, in the 2 Bcf range.

New Production

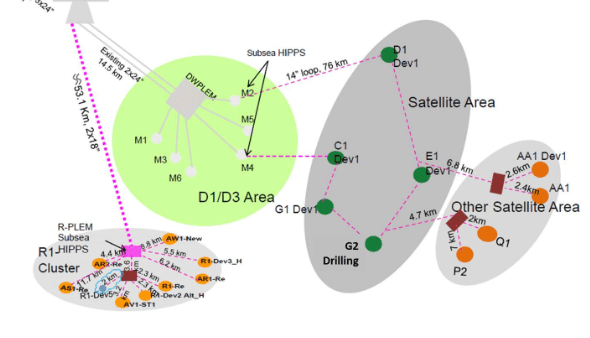

While the two existing fields, the MA Field and the D1/D3 area, are fully developed, there are three satellites around the D1/D3 field that have recently received approvals for development by the Indian government and should increase Niko’s production significantly when completed. Below is a map taken from Niko’s May presentation that shows where these areas (R1 Cluster and two Satellite areas) are:

While the May presentation rather nebulously refers to production from the R1 Cluster and the Western most Satellite as having the potential to add 100MMscfd without specifying whether they are referring to total production or Niko’s share of production (Niko only owns a 10% interest in these assets so its quite a difference), I was able to dig up an earlier presentation clearly states that this is Niko’s share.

While the May presentation rather nebulously refers to production from the R1 Cluster and the Western most Satellite as having the potential to add 100MMscfd without specifying whether they are referring to total production or Niko’s share of production (Niko only owns a 10% interest in these assets so its quite a difference), I was able to dig up an earlier presentation clearly states that this is Niko’s share.

When you consider that in the third quarter Niko produced 145MMcfe/d of gas, the potential additions from these two satellites are significant.

Another area with future production potential is the NEC 25 block. The NEC-25 block is North of the D6 block along the Bay of Bengal. I have not been able to find much information about the expected size of this block once developed. First Energy noted here that there were 11 successful discoveries on the block. This post from InvestorVillage points to Reliance commenting that the area contains 2.5tcf, which is significant, as it would imply 250bcf net to Niko, which is only a little less than half of Niko’s total YE 2013 reserves.

From the diagram Niko provides in their May presentation, it looks like they are planning to drill 9 wells in the first phase of development. If I were to guess-estimate the production based on 9 wells and the combination of 6″, 8″ and 10″ pipelines they are using to tie in the wells I would suspect that they are anticipating about 10 MMcfe/d of gas for the 6″ tie-ins, 15-20MMcfe/d for the 8″ tie-ins and maybe 25MMcfe/d for the 10″ tie-in. This would mean around 150MMcfe/d of total production from the block or 15MMcfe/d net to Niko. I should note that I don’ think the NEC-25 block is expected to produce commercially until 2017-2018 so it’s further off in the future.

Niko was not able to book reserves on any of these three fields until this year because of the requirement that a field development plan be submitted first. A plan was submitted for the R1 Cluster and the Satellite areas in January, and a plan for the NEC 25 block was submitted in March. Presumably a large part of the companies increase in reserves announced in mid-June was because of the increases booked in these fields.

Finally, there is the recent MJ-1 discovery below the D1/D3 field. The following description of the well, taken from this press release, is impressive:

Formation evaluation indicates a gross gas and condensate column in the well of about 155 metres in the Mesozoic reservoirs. In the drill stem test, the well flowed 30.6 million standard cubic feet per day (mmscfd) and liquid rate of 2,121 barrels a day with a choke of 36/64″ with a flowing bottom hole pressure of 8461 psia suggesting good flow potential. Well flow rates during such tests are limited by the rig and well test equipment configuration.

The CEO of Niko was on BNN at the end of May to talk about the MJ-1 discovery. It was really this clip that gave me the impetus to buy a substantial amount of the stock. In the interview he talks about his expectation that the discovery contains somewhere in the neighbourhood of 2tcf of gas. 2tcf of total resource would be 200bcf net to Niko, which is a significant addition to existing proven plus probable reserves, which are ~800 Bcfe. Given that that the Mj-1 was drilled directly underneath the existing D1/D3 field, infrastructure for the discovery should be a lot easier to integrate than a greenfield development.

I made a quick comparison to get an idea of how the Mj-1 compares to the original D1/D3 discovery. Niko and its partners originally drilled 18 wells on the D1/D3 gas discovery (as per the 2010 Annual Information Form). Exit production in 2009, which I will assume approximated peak production for the block, was around 210 MMscfe/d net to Niko in 2009, or 2,100MMscfe/d gross. Assuming all 18 wells were contributing to that peak rate, that works out to 117 MMscfe/d per well. The test rate of the MJ-1 well was 42Mmscfe/d, which in my opinion compares quite favourably considering the relatively high bottom hole pressure (8461psia) that it was flowing at.

Further investigation into the test rates of the initial D1/D3 discoveries provides more confirmation of the size of the MJ-1. While Niko doesn’t makes its press releases from that far back available (most of the wells were being drilled between 2002-2003) they are available on Sedar. http://www.sedar.com A perusal of the press releases during 2002 and 2003 showed a number of wells in the D6 block being tested at rates in the 30-40 MMscf/d range, or about the same as the discovery at MJ-1.

My conclusion from this crude comparison is that the productivity of the MJ-1 well and (hopefully) subsequent step-outs will be ballpark the same order of magnitude as the original D1/D3 field production. Of course we don’t know the extent of the field or the number of wells that will be drilled yet, so it would be too much guesswork to try to extrapolate this to a production forecast, but I feel it’s enough to be comfortable that future news released as the MJ-1 field progresses will be encouraging.

Cash for Development

With the amount of development on its plate, Niko is going to need some cash. As of Dec 31st, the company had $44 million of cash on hand. They also had a credit facility for $100 million, of which they had $90 million borrowed against it. I think though that with the new gas price contract and with the increase in proven reserves Niko won’t have too much trouble getting this facility increased. Niko said the following about the credit facility in the December MD&A:

The Company understands that the revised borrowing base was determined assuming that the price for gas sales from the D6 Block in India would remain unchanged at $4.20 per MMBtu for the life of the gas reserves. The Government of India is currently reviewing a new pricing mechanism for domestic gas produced in India that, if approved, would result in a significant increase in the price for the D6 Block natural gas sales contracts that expire on March 31, 2014. When a new price formula is approved, the Company will exercise its contractual right to have the borrowing base of the facility reviewed. Further, if contingent resources are converted to reserves, the Company will exercise its right to request a further borrowing base review.

In addition, at the end of March Niko announced that it was in the process of selling non-core assets that would raise $157 million. I think that the silence on the status of the asset sales since then has been detrimental to the share price, and I look at a finalization of the asset sales as a potential catalyst to move the share price to another level. By all accounts, between the Indonesian exploration assets, the Bangledesh producing assets and the Trinidad development assets, Niko has no shortage of potentially desireable assets to sell. The $157 million that would be brought in on confirmation of a sale would go a long way in assuring investors that Niko can self-fund the expansion of the D6 satellites, the MJ-1 development and the NEC-25 development.

Cash flow from operations

Finally, I roughed out the expected cash flow from operations at the new agreed upon gas price. My cost assumptions are based on comparisons to the third quarter and trailing nine month numbers. My production estimate is slightly above Niko’s 2014 guidance, so it doesn’t reflect the upside of the above mentioned development projects once they have been brought on-line. The take-away here is that the company still should be able to generate $180 million, or $2 per share (fully diluted), in operating cash flow, which should be more than sufficient to fund exploration and development activities.

Conclusions

As is the case with many of the stocks that I invest in, there are two very different ways that you can look at Niko. You can look back at how the company has performed in the past, at the declining production, falling cash flow, and exploration misses, and you can basically write it off as a never-will-be and move on to something else. But I think that what you are seeing with Niko are critical elements of a turnaround. With potential production increases from the Satellite, R-Series, NEC-25 and the new Mj-1 discovery, with the new gas price contract that will deliver much higher profits, and with pending asset sales to fund both the development of the India blocks, I think the future may be different. And I haven’t even discussed the Indonesian and Trinidadian exploration upside. Niko is drilling and will continue to drill potential elephants in these regions. I don’t like to put too much value on exploration because its such a black or white outcome, but when the underlying producing and development assets are undervalued, as is the case here, I love to have the upside gamble for a big winner that Niko’s exploration portfolio provides.

I’m pretty excited about the stock and I’ve got a pretty big position in it. I sold out of a lot of my YRC Worldwide position to add to Niko, which seems to me to have the better upside of the two. But I am also aware that oil and gas stocks are difficult, perhaps more difficult than your run of the mill commercial or industrial business. There are a lot of things that can go wrong and a lot of room for failure. I suspect that with Niko there has been so much failure in the past that the stock price reflects this and then some, and with a little bit of luck from the drill bit there will be a significant price re-valuation when the market comes to release this.

Have you considered the impact if they are forced to make up the shortfall in production at the $4.20 rate? Couldn’t that put off the higher price by up to a year?

Yeah well that is the risk here. If they don’t get the gas price increase, and worst case if they are forced to take $4.20 on the next few years production to make up for the shortfall, then a lot of the upside goes out of the stock. I’m sure the move from $9 to $7 is a consequence of the supreme court review, the finance minister comments, and the governmental panel comments.

I’m willing to accept this risk because I haven’t actually heard an explanation of why the government should go back on its decision that that doesn’t sound more like partisan politics than anything else. And there doesn’t appear to be anything that can force the government to go back on its decision apart from perhaps a sumpreme court ruling that they acted unconstitutionally. But that seems like a pretty big leap.

Meanwhile the MJ-1 discovery has, IMO, been totally overlooked by the market. Its possible I am misunderstanding what they’ve found, but based on what I’ve read and heard from both Niko and BP suggests that this is a huge resource. Even at $4.20 gas we may find value in Niko because of this discovery.

So certainly not a story without its risks, and you have highlighted the big one.

Yeah I don’t think reversing the decision is very likely but I wanted to make sure I understood things. Reliance is threatening to halt exploration if they don’t get a price increase and given their size they might have some sway with government. Having said that, I really don’t know anything about indian politics.

Any insight as to why this stock has plummeted to below $3? Could be major upside even in a bounce here.