Pan-ning for Midway Gold

I originally intended this post as a weekly update where, among other things, I would talk about my new position in Midway Gold and about my large increase in my Pacific Ethanol position. But my description of Midway has turned into a post of its own, so I will leave the details about Pacific Ethanol until later, and only say here that I think the stock presents a good near-term risk/reward and that my current position (20% of my portfolio) reflects my enthusiasm.

As I remarked in my last portfolio update, the only new positions that I have taken of late have been gold stocks. This has turned out to be a well timed endeavor. My first three positions, Argonaut Gold, Endeavour Mining and Rio Alto Mining, are all up 30%+ in only a little over a month.

I continued my move into the miners by adding another (soon to be) producer shortly after my last post. I took a position in Midway Gold (MDW). As I tweeted at the time:

I added another gold name today Midway Gold $MDW, heap leach deposit in development in Nevada cc: @VermeulenGold

— L.Sigurd (@LSigurd) June 27, 2014

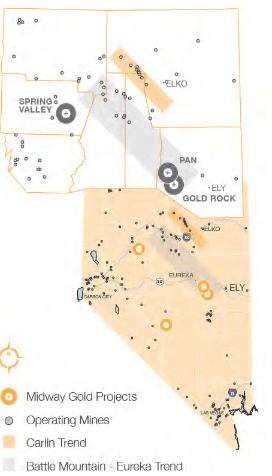

Midway has three deposits in various stages of development in Nevada as well as other prospective lands. Midway’s 3 deposits are Pan, Gold Rock, and Spring Valley. At the current price its market capitalization is a little more than $150 million. The company has $48 million in preferred share debt and $70 million in cash. Much of its cash will be spent over the next 6 months as the company brings its Pan deposit into production.

Pan

Pan is a low grade heap leach deposit that the company expects to be producing commercially in the second half of 2014. I don’t usually like to buy into late stage development projects because I’ve had some bad experience with early hiccups and the market usually is unforgiving to such delays. You can often buy the stock much cheaper by waiting until after production begins but before the kinks are worked out. Nevertheless dipped my toe in with Midway because of timing with the price of gold (as I wrote in June I thought the next few months would be positive one’s for gold and gold equities) and because Pan appears to be a very straightforward deposit.

Pan consists of three pits, the North, Central and South. Below is an overhead view of the pits. The Central pit is quite small and I’m not sure if its factored into the current mine plan.

The North and South pits contain most of the gold, with the North resource being around 450,000 oz and the south around 650,000 oz. Mining will begin on the South pit if the company follows the feasibility study. (Note: if the feasibility study is followed strictly for the first 6 months both the North and South pit will be mined, but for the 3 years thereafter mining will come exclusively from the South pit. I’m also not sure the North pit will be mined at all up front given changes made to crushing as I will discuss below).

Based on the 2011 pit designs total life of mine recoverable is expected to be about 650,000 oz, or about 81,000 per year. These reserves were based on an optimized pit design at 1,180/oz gold. If a higher gold price can be realized, something I am hopeful will be the case, we can expect a larger percentage of the overall 1.1 million ounce resource will make itself into reserves.

There is plenty of room for expansion at Pan. Historical drilling was done the depth of drilling was limited to 500 feet. Most of the holes bottomed out in ore. Therefore the deposits remains open at depth. There are also a number of targets adjacent to the project that remain to be drilled. The company said at one conference they attended that they hope to eventually double the resource through drilling.

As I’ve stated on numerous prior posts, I like gold heap leach deposits that are near the surface because the up front capital is low. Pan fits that criteria; the gold begins right at surface so there is no pre-strip required, the hauls (trip length to take ore from the pit to the leach pad) are short, and for the first 3 years the rock will require no milling.

In the 2011 feasibility study total up front capital required for Pan was estimated at $99 million. This number included $16 million for crushers that management has decided will be deferred until later in the mine life. After having run tests on the South deposit rock, Midway concluded that the run-of-mine ore recoveries for the South pit were sufficient (they saw 95% recoveries) and that the mill could be deferred until the North pit came into production.

So what we have is a very straightforward deposit: dig up the rock, put it on the leach pad and extract the gold. Cash costs in the feasibility were expected to be less than $600/oz (including a 4% net smelter royalty) and this number included the costs of operating the crushers that will now not be needed for 3 years and did not include cost efficiencies expected to be achieved by contract miners, which was a decision made by management in 2013. Maintenance capital is only expected to be a couple million per year. The mine should be a significant generator of cash if gold can stay at current levels.

When I ran through the year by year cash flow using cost criteria set out in the feasibility study (the feasibility study is available here) I found that the cash flow is heavily weighted to the early years of production, when the South pit is being mined. At $1,300/oz gold and assuming the cost metrics laid out in the feasibility study are achieved, the company is going to generate in the range of $30-$40 million in operating cash flow for the first 3 full years. After 3 years the cash flow drops to the $10-$15 million range. This is because of movement of mining from the South Pit, where recoveries are at least 85%(higher if the recent run-of-ore tests prove to be achievable) to the North pit, where recoveries are only 65%.

Gold Rock

Gold Rock is Midway’s second near-surface, heap leach deposit. Its a couple of steps behind Pan in development. Gold Rock is yet to be permitted and still requires more drilling to size it to the 1 million ounces that Midway is targeting. Gold Rock is part of a long fold and thrust belt that has not been explored, so there is plenty of potential to increase the size.

Midway announced a resource update on Gold Rock in May. It showed 500,000 measured and indicated ounces and another 500,000 inferred ounces. What is most attractive about Gold Rock is how similar it is to Pan. Both are heap leach, and Gold Rock is only about 8km away from Pan. Once Pan is fully operational, all exploration energies will be focused on bringing Gold Rock into production and Midway should be able to leverage the infrastructure and their own experience at Pan to help it along.

Spring Valley

Midway’s third project, Spring Valley, is perhaps the most intriguing of the bunch. Spring Valley is a large, heap leach deposit, also in Nevada, that Midway owns as a joint venture with Barrick Gold. The last resource estimate on Spring Valley, which was based on 2010 drilling, was around 2.2 million measured and indicated ounces and another 2 million inferred ounces. Since the announcement of the resource, based on my perusal of subsequent drill hole releases, further drilling seems to confirm the resource and perhaps expand it. As evidence, take a look at here, here and here, which shows a number of long intercepts in the 1-4 g/t range, which is well above the ~0.5 g/t average of the resource. In addition, compare the larger outline of the resource area in the 2013 news releases to this 2011 news release.

Barrick has been carrying the costs of exploration at Spring Valley in return for a 70% earn-in and it was just announced in early May that they had completed this earn-in as the project reach the pre-feasibility study stage. Barrick has committed to spend another $13 million this year to advance the project further.

One interesting element of the joint venture terms is that Midway has the option to be carried to production on Spring Valley if they give up another 5% of their interest. If Midway decided to go this route, Barrick would pay all capital costs until production and Midway would pay back its interest in those costs through cash flow from the mine once in production. This seems like an attractive option especially considering the multiple uses Midway has for its cash.

Conclusion

If gold resumes its downtrend all bets are off because company’s like Midway are going to struggle. But if gold can stick to these level and perhaps even go higher, I think Midway has a reasonable amount of upside. The key is going to be a smooth start-up at Pan.

As I mentioned earlier, in the first 3 full years of production Pan is going to generate in the neighborhood of $30-40 million of cash flow. With minimal capital expenditures a lot of that should all to the bottom line. After that mining is going to move to the North pit and cash flow is going to fall off a fair bit, but by that time they will have generated enough cash to hopefully expand and put Gold Rock into production. There will also be more clarity around the eventual size and timing of Spring Valley.

So there’s a runway of development. If Midway can successfully bring Pan into production they will begin to get credit for not only Pan but Gold Rock as well. While its too early to say much about the economics at Gold Rock, it seems reasonable to me that between it and Pan they will exceed the $30-40 million of cash flow Pan was producing in the first 3 years.

I think that all means that Midway gets something like a 10x cash flow multiple soon after they prove that Pan can work. That would be at least a double from current prices. Add to that the upside option on the price of gold and Midway seems like a reasonable bet.