Week 298: Keep on Truckin

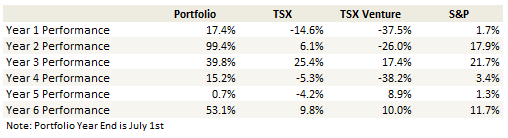

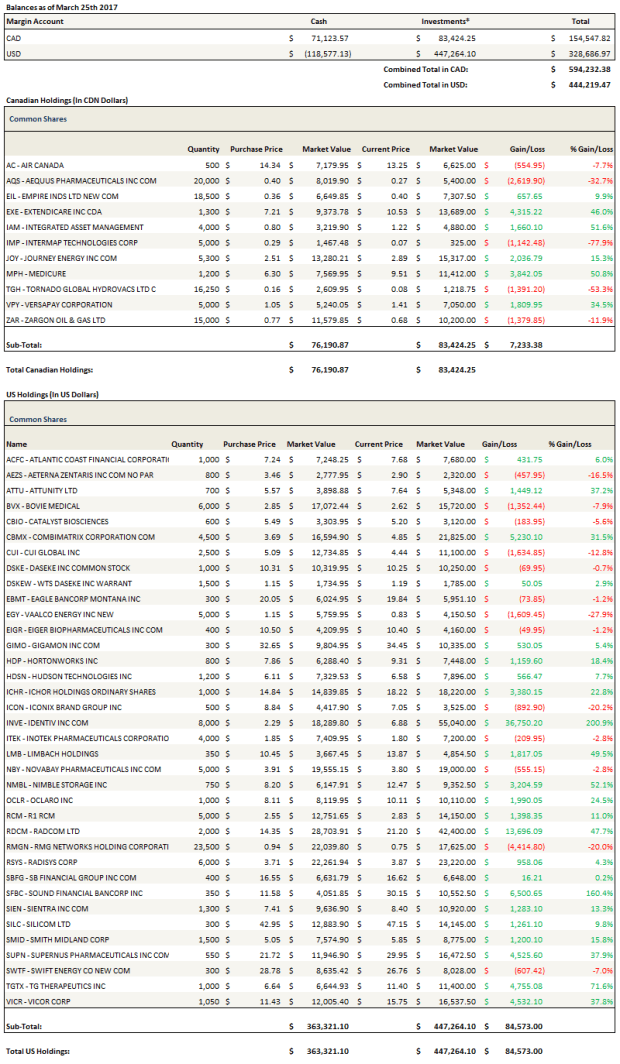

Portfolio Performance

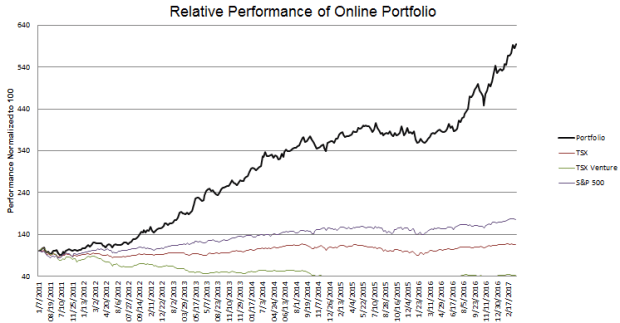

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

No great insights this month. My portfolio continues its upward climb even as the market stalls. I continue to be buoyed by my large position in Identiv and more recently my large position in Radcom. Combimatrix is consolidating in the $4’s but it looks healthy and I am hopeful it will break out on another leg up soon. Silicom has helped a lot and I will talk more about that shortly, as has Supernus. I still have a bunch of stories that I think are on the cusp and waiting for that final catalyst, Radisys, Vicor, and maybe even CUI Global, which I wrote about a little earlier this week. Overall, no complaints.

New Position: Daseke Inc.

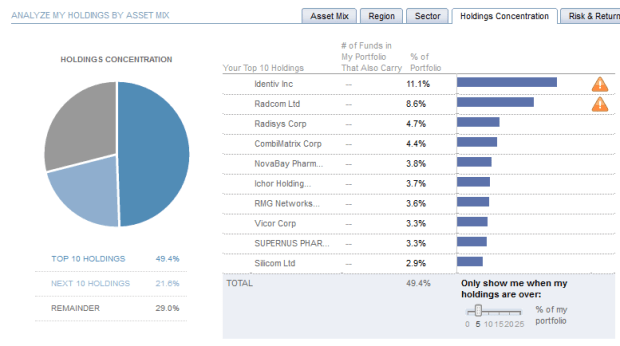

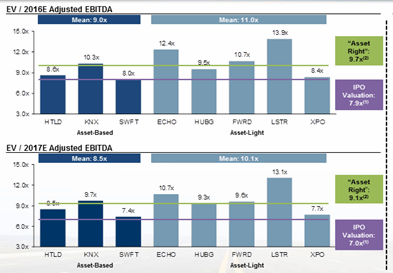

I added a new position in Daseke after reading this write-up by Dane Capital. The story seems pretty straightforward. Daseke is born of a special purpose acquisition company (SPAC) that acquired the previously private company, its trading cheaply relative to its peer group (see chart below from their presentation) and is in an industry that should see a tailwind as economic activity, infrastructure spending and oil and gas capex pick up. There is not point repeating what Dane Capital already wrote so I recommend going to the article for the details.

I added both warrants and shares. I’m not really sure whether the warrants are fundamentally overvalued or undervalued compared to the shares, I just thought they represented a good upside given that the stock is probably around two times EBITDA lower than it should be and that if it traded up to an appropriate level it would get to the high teens, which would be a triple for the warrants.

What I added to

I added to four companies over the past month. In each case I was persuaded by an upbeat outlook about the future that was given by management on the calls. I’ve already written my thoughts on Vicor. Likewise I wrote up CUI Global just the other day.

I also added to Accretive Health, which has changed its name to R1 RCM. I last talked about R1 RCM here. Not much has changed, they are making progress on-boarding Ascension and finally moved their stock over to the NASDAQ. I figured the NASDAQ listing would be a bit of a catalyst, so I added the day prior to that.

Finally I added to Silicom on this news. This is just a huge contract for the company with an $17 million initial purchase order and $30 million expected annual run rate. I read somewhere that the customer is likely with Gigamon.

I do intend to write-up Silicom, I just keep getting tied up with other stories, and I wanted to spend time understanding their whole product suite before putting any post up. The good news is that as I have dug more, I have become even more comfortable with the company.

What I sold

On the sell side of the ledger, I already wrote about my sales of Nuvectra and Rubicon Project, and my reduced position in Bovie Medical.

In addition to these names I also sold the last of Willdan Group. Willdan has been a great name for me. I added the stock in the single digits, around $8, and am selling the last of my shares in the low-$30’s. The business is still humming, and the company seems to have shifted to an acquisition strategy that so far is fueling further growth. Yet at this price I just feel like the upside is priced in, with the stock trading at 25x the upper end of their 2017 guidance (which is $1.20 diluted EPS).

A couple late Biotech Buys

I also bought starter positions in a couple of mid-stage biotechs at the end of last week: Eiger Pharmaceuticals and Inotek Pharmaceuticals. I got both of these names from Daniel Ward, who comes up with a lot of good ideas. I’ll try to write up some details on both companies in the near future, but you can get a pretty good overview of the investment thesis if you listen to their recent conference presentation (Eiger at the BIO CEO and Investor conference and Inotek at the Cowen Healthcare conference).

The Catalyst Biosciences Catastrophe

Finally there is Catalyst Biosciences. This is so painful. So on Friday I put in a market order for Catalyst in the practice portfolio. I always use market orders with the practice portfolio because it doesn’t always work to put in limit orders. With limit orders sometimes you get filled, sometimes you don’t, even if the stock moves below your limit. But because I didn’t like the bid/ask spread on Catalyst (it was something like 5.20/5.45 at the time, so really big), and because the stock bounces around a lot, in my actual account I put in a limit order at 5.10. I liked the stock because it was at a big discount to cash, but it didn’t seem like there was any reason to chase it.

It was with great pain that I watched the open this morning. Catalyst opened in the $9’s and proceeded to move to as high as $18. I made a killing in my practice portfolio (its not reflected in the update because this update is for the four weeks ended last friday) but I made nada in my actual account.

I hate, hate, hate limit orders. I rarely use them and this is a big reason why. If you want to buy a stock, buy it. If you want to sell it, sell it. All the pennies I may save putting in limit orders over the next year will not amount to what I should have made on Catalyst today. It makes me a little ill to think about it.

Portfolio Composition

Click here for the last four weeks of trades.

Someone made the comment to me about above market limit orders. I hadn’t thought of that angle but that is something I do all the time. I’ll often put in a limit at or maybe a few cents higher than the ask. That way I get the stock but I don’t get taken by a HFT that jacks up the ask before I can get my order through. I’ve been taken enough times by HFTs with disappearing bids enough to know that putting in a pure market order on some stocks is just playing into their hand. I should’ve been more specific describing my limit order frustrations.

What you are referring to is manipulation by your broker not an HFT. This is more a function of liquidity (or lack thereof) in a given name. Essentially cornering a security in a millisecond or two is possible in a lot of the names you trade because they are nano or micro caps. My two cents as someone whose job it is to monitor the market for manipulation and who has encountered the same issue….

In U.S. stocks in particular, there is a special retail order rule which essentially mandates that retail orders get the best possible price.

Thanks for the clarification