Portfolio Performance

Portfolio Composition

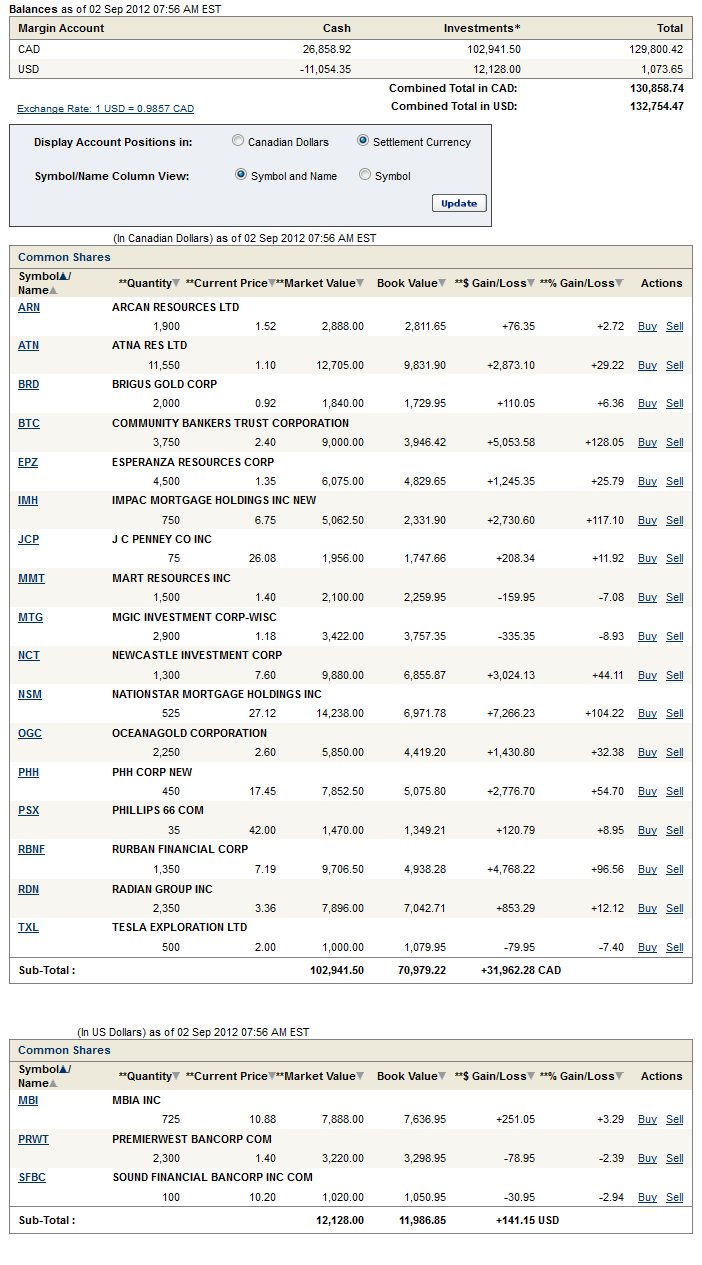

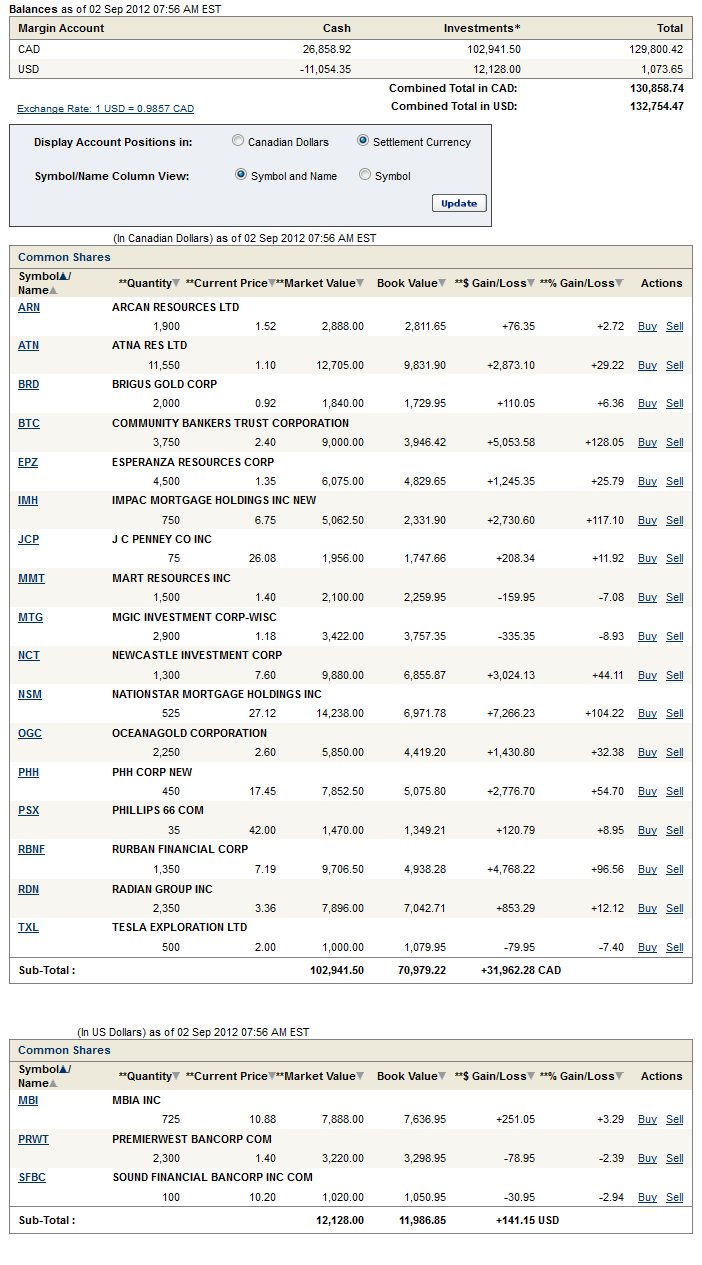

Note: I have begun to add all new US holdings in US dollars. This will make it easier to distinguish between US dollar and CDN dollar holdings. However, I cannot move currencies for existing stocks and preserve gains so existing US stocks in the portfolio will continue to show up in the CDN Holdings portfolio.

Click here for the last two weeks of trades.

Portfolio Summary

The Pareto principle (also known as the 80–20 rule, the law of the vital few, and the principle of factor sparsity) states that, for many events, roughly 80% of the effects come from 20% of the causes.

– Wikipedia

If I may propose a 80/20 rule for investing, it would be that I can get 80% of the returns for 20% of the work.

Now to be sure, I don’t mean this as an exact, quantitative measure. You’re not going to get exactly 20% more returns by putting in 80% more work.

But qualitatively, I think its reasonable. Let’s call it the good enough returns / best returns rule. If you put in the work, you are going to get good enough returns. And if you put in a bunch more work, you’ll get the best.

Don’t be fooled by it being only 20%. 20% is only relative to the amount of work you would need to do to get the best returns. The absolute amount of work required to reach 20% is still a lot.

I think I put in more than 20% of the work, but not 80% more. Maybe 30-40%. Now obviously I write and research and work a lot so what I’m saying is that to get to even good enough, you still have to work hard.

What would the best returns be?

The following is from Warren Buffett:

If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then.

It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.

I don’t think that’s bragging, and I don’t think that its just because he’s Warren Buffett. I think you could do it. But I think that to do it you would have to put in the full 80%.

And what does that other 80% look like?

Let’s take Impac Mortgage. I think it has a few lessons as to where the incremental returns are if you are willing to put in the work.

First, when the news comes out, you have to be available to research the shit out of the name. I’ve already given the history of my initial purchase of Impact mortgage here. Yes, I was on vacation, but if I hadn’t been I would have had to go to work in the morning and I would have at best been able to get an hour of research in before I left. That would have given me enough time to get a feel for the company and to eliminate any major red flags, but not enough time to develop the comfort required to “go all in”.

As it was, by the time I got that comfort, it was 3 days later and the stock was 80% higher. Imagine what could have been. Had I been able to work through the night, read all the 10-Q’s and 10-K’s, listen to the conference calls, basically get to the point where I knew everything there was to know about the company, I would have most definitely went all in the next morning. Instead of being a couple percent position, it would have been a 10% position. It was that clear.

A second example from Impac Mortgage. Once Impac came out with its quarter and skyrocketed, the next logical thing to do was to see if there was another Impac Mortgage lurking around somewhere.

I did a bit of work the next weekend to find it. As much as time would allow. I did some searches and looked for companies with the word home and mortgage in their name and did some google searches with key words like originator and such. But I didn’t find any company that looked compelling and I moved on.

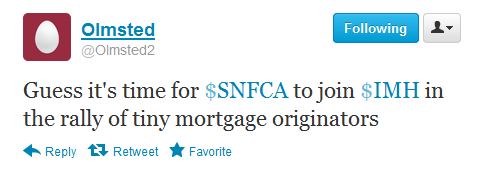

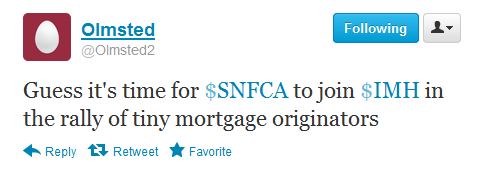

However, it turns out there was a company out there, it was just a bit more well hidden. I didn’t learn about it until Olmstead, a tweeter I follow, posted a tweet on the company.

SNFCA is Security National Financial Corp, which doesn’t sound much like a mortgage company and that is why it didn’t pop up on any of my screens. Nevertheless the company has a large mortgage origination business (in addition to life insurance and of all things mortuary services) and they reported equally strong earnings as Impac in the second quarter.

The stock has risen from $2.50 to over $4 in the last two weeks. I haven’t bought a position yet but I have been actively looking at the stock this weekend and may buy into it next week. But I certainly would have bought it at $2.50 had I known about it at the time.

I’m not complaining. I’m just trying to delineate what it would take derive significantly higher returns. And I believe that to do so, these are the sort of situations you need to have the time to search out and take advantage of.

Adding to my bank stocks, to gold and out of Pan Orient

In the last two weeks I really haven’t made many changes to my portfolio. I only made four portfolio changes. I added two community banks; Sound Financial and Premierwest Bancorp, I added a small position in a gold producer, Brigus Gold and I sold out of Pan Orient.

Sound and Premierwest are two more examples of my theme to look for little banks with upside potential. In the case of Sound, it is a mutual holding conversion (see my writeup here for an explanation of a MHC) that is trading well below book value, has decent earnings and a good loan book.

Premierwest is, in my opinion, traveling down the same path that Community Bankers Trust did. The bank, which was hit hard by the recession, has shown an improving loan loss portfolio and trades at a fraction of their tangible book value. Like Community Bankers Trust was, they are getting close to the point where the Fed will allow them to begin to pay back unpaid dividends on their TARP preferred securities, and if (when?) this happens, the market should gain some comfort with their financial position and revalue the stock to something closer to book value. Remember that with Community Bankers Trust, in the days following the news of their TARP dividend repayment the stock was up well over 50%.

I also bought a small position in Brigus Gold. The company keeps hitting good results outside of their main Black Fox mine and the stock has done nothing to reflect that. I also bought on anticipation that both the Federal Reserve and ECB were more likely to make pro-easing comments than they were to not. So far, with Bernanke’s speech at Jackson Hole, that has turned out to be the case. I think we’ll see more of the same from Draghi and the ECB in the coming weeks. But I admit, I waffle back and forth on the long-gold stock thesis on a regular basis. I wouldn’t look at Brigus as much more than a trade. If gold starts to falter, Brigus will be the first to go.

Finally, I sold out of Pan Orient because along with their second quarter results they announced more problems with their drilling in Indonesia and more delays in their production in Thailand. I have highlighted the key sentences from the news release below:

Jatayu-1 Exploration Well

Since the operations update of July 25th, the well was drilled through the first loss zone at 6,173 feet to a depth of 6,330 feet where total drilling fluid losses were once again encountered resulting in heavily gasified mud resulting in a four meter gas flare when the mud was run through a separator at surface. A cement plug was run to cure the losses and was drilled out to 6,329 feet where losses were once again encountered and the decision was made to run wireline logs and pressure points, which were run successfully. A preliminary interpretation of the wireline logs and pressure data collected over the interval of interest was unable to confirm the presence of gas pay.

Two further attempts were made to drill through the loss zone at 6,330 feet with a maximum depth of 6,346 feet achieved before once again having to set a cement plug in an attempt to deal with the drilling fluid losses. Presently, one last cement plug has been set and the well is currently drilling cement just above the loss zone. In the event that the drilling fluid losses that are unable to be controlled are experience in this latest attempt, the well will be suspended and the rig will mobilize to the Geulis-1 location with that well anticipated to spud in the next three to four weeks.

Thailand – Concession L53 (Pan Orient Operator and 100% Working Interest)

A 20 year production license has been granted over the L53-D East oil discovery. The production Environmental Impact Assessment for this production license and related development well drilling locations was not approved at early August meeting of the environmental regulatory organization and the second hearing is expected to take place in mid-September. Regardless of the outcome of the mid-September meeting, construction of drilling locations cannot take place until the end of the annual monsoon season which typically ends in late October each year. With a construction time of approximately one month per well pad, the drilling of four development wells is not anticipated to commence in Concession L53 until December 2012 with exploration drilling on the newly acquired 3D seismic survey likely to take place late in the first quarter of 2013.

The company subsequently released news that they were able to get through the difficult section and they may at least be able to test the target zone, so I may turn out to have been hasty in my retreat.

I realize that even after the dividend payment that the company has cash on the balance sheet that nearly equals the share price, but they are also drilling high cost (albeit high impact) wells that will consume that cash quickly. Its simply a risk/reward decision. The risk is that they consume cash and do not drill any successful wells. The reward is that they hit and if they do the stock will be multiples of what it currently is. I simply decided that I had enough risk in my portfolio and I didn’t want any more.