Thoughts and Review

I have been on vacation on and off since the beginning of July, so my posting has been sporadic. I should get more regular again in my posting by the end of August. I don’t have good internet access and so I won’t be posting my updated portfolio until I get back.

I wrote a few weeks ago about my thoughts on the Canadian dollar. At the time, I was frustrated by the move but I did not see a fundamental reason for it to continue. I therefore concluded that I was comfortable holding onto my US dollar stocks and maintaining my US dollar exposure.

That turned out to be a poor decision.

The Canadian dollar has continued to rise. Its not the only currency to do so. I see similar moves from the Australian dollar, the Euro, etc. What we are seeing is broad based US dollar weakness.

Since that time I have become worried that what is happening has nothing to do with Canada. I’m worried that the strength of the Canadian dollar is because of a growing recognition of just how bad the US government is. That there is significant dysfunction that goes much deeper than the circus we see on CNN and Fox News.

There was an article published this week in Vanity Fair by Michael Lewis (the author who wrote Moneyball and The Big Short). In it he describes the transition from the Obama administration to the Trump Administration at the Department of Energy (DOE). Basically, the Trump team was uninterested in learning about the department, made no effort to replace key positions, and even 6 months into the administrations tenure many appointed positions have been left unfilled and policy directions unsaid. The DOE, to put it bluntly, is running on fumes.

If this is representative of how the Trump administration has approached governing as a whole, it suggests a large degree of dysfunction. Dysfunction that is deeply rooted into the core of the government departments that run the operations of the country. Who knows what this will lead to. It certainly does not give confidence in the country as a whole.

I remember that one of the things that Donald Coxe used to talk about was how you can’t have a strong currency with a weak government. Much of his assessment on the direction of a country’s currency was based on the political climate of the country.

We know that on the surface, the Trump administration has proven to be reality TV. But maybe behind the scenes things are actually worse. If it is much worse, then maybe the currency moves over the last few months are just the beginning. This move in the Canadian dollar is notable for its strength. It does not want to quit. I have learned that ignoring a very strong move in an asset class is unwise. It is often brought about by seismic shifts to the economic landscape that are fully understood only after the fact. I’m really worried that is what is happening here.

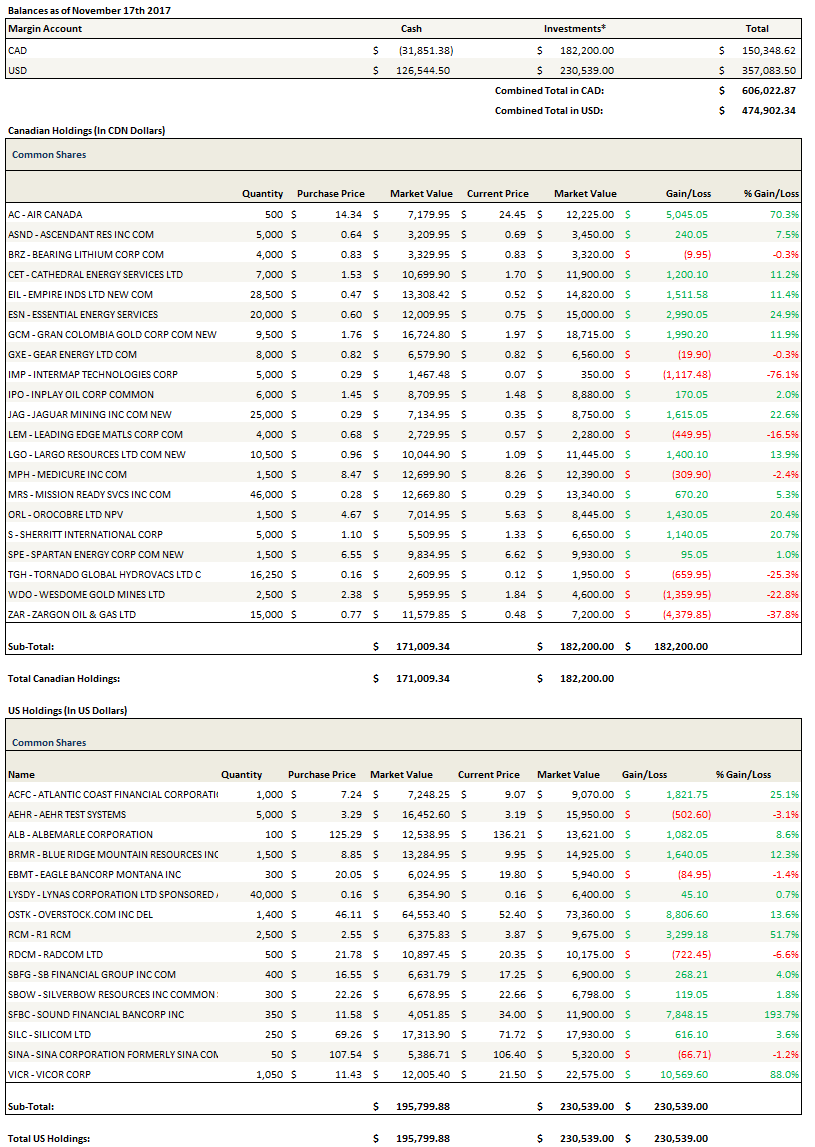

I regretfully reduced my USD exposure yesterday. I sold down a number of US dollar positions and converted those US dollars into Canadian dollars. I didn’t sell out of any position because there is nothing wrong with any of the stocks I own. So I reduced everything across the board so that I could turn those US dollars into Canadian dollars. The process was depressing.

I’ve always held the rule that if my portfolio falls 10% from its peak I will start to significantly reduce my exposure. This is my “2008 rule”. I won’t let 2008 happen again. In 2008 the first 10% down was followed by another 10% and so on and so on. Before I realized what was going on it was too late. To prevent this, I decided that at 10% I draw a line in the sand.

I have held to this rule a few times over the last few years. In 2014 when I was getting killed on oils. In January 2016 when I was getting killed on everything.

What is unique about this time is that its almost all currency. I’m down 9.5%, but a little over 7% of that is the Canadian dollar. Its depressing to see most of my stocks holding their own at levels similar to where they were 2.5 months ago and yet my portfolio is down significantly from that point.

But 10% is 10% and I have to do something about it. So I sold it all down.

Air Canada Earnings – out of the park

Air Canada released second quarter results this morning and they were well above anyone’s expectations. The company blew away second quarter EBITDA estimates, guided gross margins higher, and guided free cash flow for 2017 of $600 million to $900 million. The free cash flow guidance is up from previous guidance of $200 million to $500 million. Air Canada has a market capitalization of a little over $5 billion, so the new free cash flow guidance means that the stock is trading at 7x FCF based on the new guidance.

Combimatrix Takeover – finally some positives!

Its been such a frustrating couple of months. The Canadian dollar has been on an unstoppable march upward. My moves into oil and gold to hedge the exposure have had mixed results at best. Radisys laid an egg. But things took a big step in the right direction tonight as Combimatrix has been taken over by Invitae Corporation. From the news release:

Based on the Company’s current forecasts and estimates of Net Cash, and based on a fixed price per share of Invitae’s common stock of $9.49, the Company presently estimates that the CombiMatrix price per share received by CombiMatrix common stockholders would be between approximately $8.00 and $8.65.

This was a much needed win. Combimatrix was one of only a few US stocks that I didn’t reduce over the last few weeks. I’ve yet to sell my shares here. I may start to reduce them as they get to $8.

Radisys lays an egg

Radisys reported and it was not good. My thoughts are: A. I’m glad I sold down my position as much as I did, B. I’m less glad that I bought a little back a few days ago, and C. I’m wistful that I just would have sold the whole block back when they lowed guidance at the beginning of July.

Radisys reported second quarter earnings last night and the guidance for the third quarter was worse than the second quarter. Verizon has stepped back from DCEngine purchases for 2018 because of changes they have made to their subscriber structure that has pushed off requirements for more capacity.

Listening to the call, apart from the revenue headwind that occurs when your largest customers steps back for 6 months, the company moved forward in all other respects. They are seeing a material increase in engagements around CORD (central office as a data center), shipped for lab trials to a US Tier 1 which presumably is AT&T, closed on the “master purchase agreement” with the Tier 1 (again I assume AT&T) that they had alluded to in May, they were named systems integrator for a Tier 2 service provider in Europe, and they launched the new FlowEngine TDE and already have had a win with it in Europe. Overall they are up to 15 proof of concepts which is 5 more than they were engaged with in the first quarter.

But none of this is revenue generating in the immediate future.

I held onto Radisys too long. I’m generally good about selling a stock that isn’t working but in this case I was enticed time and again by the promise of a better future. I don’t think that Radisys management was being deceitful, I just think that being telecom equipment manufacturer is hard. I listened to a podcast of a seasoned telecom analyst who said as much. You get one time orders, nothing is recurring, and you are dealing with big, lumbering beasts of telecom companies that can move at a glacial pace and do not care how their erratic decisions impact you. Radisys is a casualty of this dynamic. I sold.

Selling Radcom

I also used the bump back over $21 in Radcom to sell it down further. I had been selling down Radcom over the last couple weeks. I have completely sold out of the stock in one of my portfolios and own a mere shadow of the position that it used to be in the other.

My thoughts on Radcom are related to valuation and timing. I’m worried about the market, and stocks that trade at extremely high price to sales ratios are particularly susceptible in corrections. Radcom reports earnings on August 7th, and I don’t expect that they will have any new contracts in place at that time. I wonder what happens to the stock if their next NFV win is delayed into the fourth quarter and in the mean time the market slides. I’ve decided I prefer to be on the sidelines to watch if that event plays out.

Empire Industries

I will write something more extensive on Empire’s quarter when I am back but the bottom line is that I am happy with it.

On the surface the lower sequential revenue, lower sequential EBITDA, is probably the cause of recent selling but I see a number of positives in the quarter that bode very well for the future.

First, the company generated over $6 million in operating cash flow, including cashing in $4 million from working capital.

From what I see, they paid down about $6 million of debt in quarter! I added up the numbers twice because it seemed like so much but if you add up bank debt and long-term debt it decreased substantially quarter over quarter.

Deferred revenue increased substantially from $10 million to $23 million sequentially. This is related to the big working capital influx. Revenue should follow shortly imo.

I don’t see how you can view the growing backlog as a negative. This is a construction business, size of backlog is directly related to future work. The doubling of the backlog is a huge positive imo.

Keep in mind this is a ~$40 million market cap company that just generated $6 million of operating cash flow for the quarter, roughly $5 million of free cash flow, and has doubled their backlog.

Hudson Technologies

Hudson was a mixed bag. They had a blow out quarter. But they forecast weaker volumes and prices for the third quarter. They also made a huge acquisition, of Airgas-Refrigerants. I honestly had trouble wrapping my head around all the data points, especially with limited internet and time, so I sold.

Hortonworks

Hortonworks had a blow out quarter and gave solid guidance. The stock rose significantly, which was nice. I sold out after the jump, which had more to do with my market outlook than any insights with the company.

Vicor

Vicor had a wait and see quarter. Revenue, bookings and backlog were all up, but less than I would have liked them to be. But the company forecast a much better third quarter and reiterated their guidance for a $75 million run rate by year end. I still really like the stock and it is on the of the few I hold in size.

What’s Left

The only positions that I have right now that are greater than 2% position in the portfolio are the following: Vicor, Combimatrix, Air Canada, Empire Industries and Americas Silver. Every other position I own is less than 1%. That kind of sums up where I stand right now.