Week 149: Earnings Update on a few companies

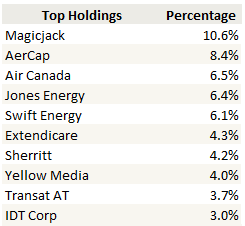

This isn’t a complete portfolio update. I won’t be posting my performance or trades; I will leave that for another week. I just want to give a short update on some of the earnings reports that have come out or are still to come out while the thoughts are still fresh in my mind. Here is a quick snapshot of the top positions in my portfolio as of Friday’s close.

MagicJack

MagicJack earnings come out Monday after the market close. I’m nervous about them, because the stocks action has been poor, it is a large position for me and because I’m not convinced the numbers will be great.

The company lowered advertising spend significantly in the quarter in anticipation of the release of the new version of the device and the app. That will help costs, but it will also probably hurt revenue. On the fourth quarter call the company said that they expected the first half of the year to be “soft”. Read more