Portfolio Performance

See the end of the post for the current make up of my portfolio and the last four weeks of trades

Thoughts and Review

I’ve been trying to stick to core ideas over the last four weeks, not taking fliers and taking a very close look before I purchase anything. If you remember, last month I reflected back on the last year, where I really didn’t do all that well, and concluded that my so-so performance could be attributed to too many mistakes with peripheral ideas that I either held too long or should not have gotten into in the first place.

At the same time I’ve been willing to tweak my exposure to stocks up a notch because my two main worries have abated. As I wrote in my February post what worried me was:

- The collapse of oil bringing about energy company bankruptcies that a. lead to investor losses that start to domino into broad based selling, and b. lead to bank losses and bond losses that cause overall credit contraction

- The collapse of China’s banking system leads to currency devaluation and god knows what else. Kyle Bass wrote a terrifying piece (which I would recommend reading here) about how levered China’s banking system is, how their shadow banking system is hiding the losses, and about how government reserves are not large enough to pacify the situation without a significant currency devaluation.

Both of these events seem off the table, with the first maybe completely eliminated and the second at least postponed.

Still the market is back to that 2,100 level and it is difficult for me to get excited about another move higher. Where I can I have added some index shorts and also some individual tech name shorts to balance in case of a pullback.

Still finding new ideas

Even as I try to be cautious, I still have found a lot of new stocks this month. I added positions in Swift Energy, Clayton Williams Energy, Granite Oil, Medicure, Rentech and Oclaro. It was a busy month and there are lots of stocks written up below. I feel pretty good about all the ideas, with the usual caveat that if oil starts to go south my oil stock positions will be reduced quickly (not Swift though, which is a special situation as I will describe).

Canadian Dollar Doldrums

I’ve had some decent gains in the last month and am back within a a few percent of my highs. But quite honestly my portfolio would be back to its high already if this damn Canadian dollar wasn’t killing me.

About half of my portfolio is in US stocks but as a Canadian I report my gains and losses in Canadian dollars. Lately, every day the market is up the Canadian dollar is up (usually a lot) and because of that a chunk of my gains disappear. To give it perspective: since the beginning of the year the Canadian dollar has gone from about 1.38 US to 1.27. Every $100,000 I had in US dollars was worth $138,000 at the beginning of the year; today its worth $127,000. Its been a headwind.

I’ve been saved by picking some US stocks that have done very well. Radisys continues to be huge. Apigee is a big winner off its lows. Clayton Williams has doubled in a few weeks. Both Iconix Brands and Patriot National have had big runs off their lows. Things would really be rolling if I didn’t have to deduct 10% from the aggregate sums.

Oh well. The Canadian dollar going up means that oil is going up, and living here in Calgary I can tell you that is a good thing. Things are unquestionably slow in the city. If you are in the oil and gas sector, its depressing.

Cowtown Slowdown

As an aside with respect to my home town; I honestly don’t see the Armageddon situation that some have described. I bike past downtown condos every day and while the sun is up so I can’t count the lights, I can count bbq’s and bicycles on the balcony in these supposedly empty apartments. I live in one of the downtown “high-end” neighborhoods where its been said that “every second house is for sale” and yet I see only a smattering of for sale signs and a number of them sold. The restaurants I walk by still seem busy. To be sure, things are slow and if you work downtown in the patch they are miserable, but overall it seems not very different than a year ago. Is this what depression looks like? Or do I just not have the clear perspective of an outsider, what I see being distorted by a home town bias?

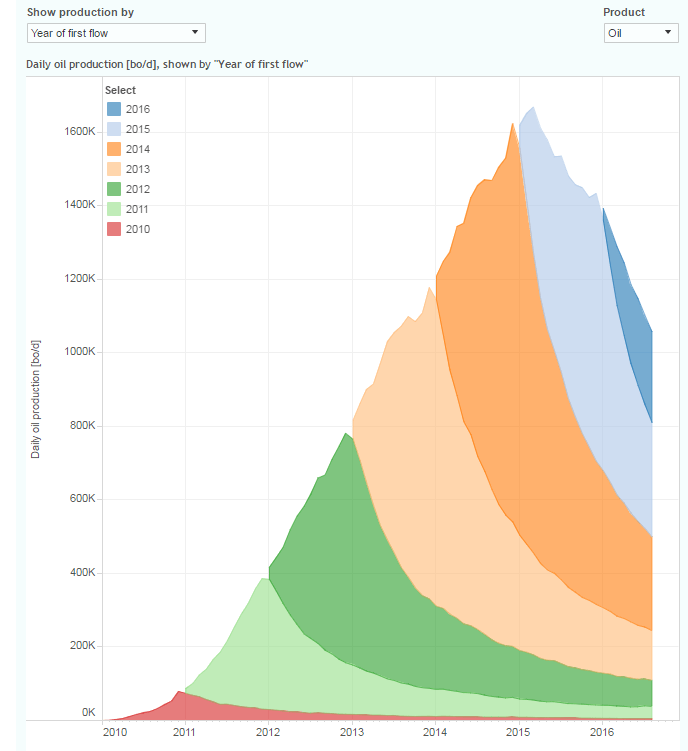

Oil move

I’ve given up trying to predict whether this is the real move in oil and if not when that move will come. So just like all the other head fakes, I’ve added positions on the move up with the expectation I can be nimble enough to squeeze out some profits even if this turns out to be another short term blip.

I will repeat what I wrote in September about oil, which could be paraphrased to say “I don’t think anybody really knows”:

But with all that said, I remain neutral in my actions. I’m not going to pound my fist and say the market is wrong. I’m just going to quietly write that I don’t think things are as certain as all the oil pundits write and continue to be ready to pounce when the skies clear enough to show that an alternate thesis is playing out.

With that let’s talk about some stocks because I have a lot to say, starting with two of the three oil stocks I bought (I’ll talk about Clayton Williams at a later date).

Swift Energy

I think this would could be a legitimate 20 bagger if it all pans out. If only I had the confidence to make a Cornwall Capital style bet on it. I tweeted about this last week because I wasn’t sure if I’d be able to mention it in a post before the effective date. Unfortunately that looks to be the case as the stock was halted all day Friday.

Swift is in bankruptcy. At the end of last year they prepackaged a plan with bondholders. That plan has been approved by a judge and the company should be coming out of BK shortly. In the plan existing equity actually does quite well, retaining 4% of the new company shares plus 30% of equity via warrants. The warrants are well out of the money compared to the current pink sheet price. But they are also very long term, with half of them expiring in 2019 and the other half in 2020.

The bankruptcy plan converts ~$900 million of bonds into equity. The company that emerges from bankruptcy will have $325 million of bank debt and, net of cash, somewhere around $250 million of net debt. So the balance sheet is very de-levered compared to the company pre-bankruptcy and also compared to its peers.

The pink sheet implies a market capitalization of around $240 million and an enterprise value of just under $500 million. That means that the market is giving Swift an EV/flowing boe valuation of $16,000. Checking that against the RBC universe, peers trade at between $30K and $100K. On an EV/cf basis, which I again compare off of the RBC price deck for 2016 ($40 oil and $2.50 gas), Swift gets a 5.5x multiple versus 10-20x average for the RBC coverage universe.

As I said the warrants are way out of the money but by my calculations they provide an extremely healthy upside scenario. You get 7.5 warrants per share. Half of those warrants are in the money at ~72 cents, with the other half at ~78 cents. If you get a stock price of 90 cents by 2019 you are looking at nearly a $2 return on your ~20 cents purchase. $1 gets you close to $3 return. See the model below:

Of course a lot has to go right for all this to happen but its a long runway and even at 90 cents you are looking at an EV/flowing boe of around $43K and EV/cf of 15x assuming flat production, $40 oil and $2.50 gas.

The dream scenario is that natural gas prices go up some time between now and 2019. If we hit $4 gas again Swift is going to make a lot of money, and a $2 billion enterprise value is not impossible (would still only be $62,000 per flowing boe on current production). That would give you a 26x return on a 20 cent stock purchase.

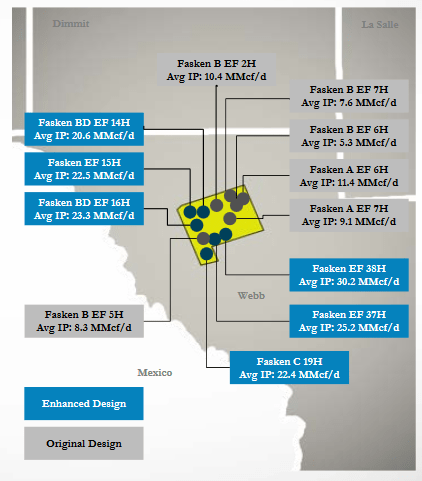

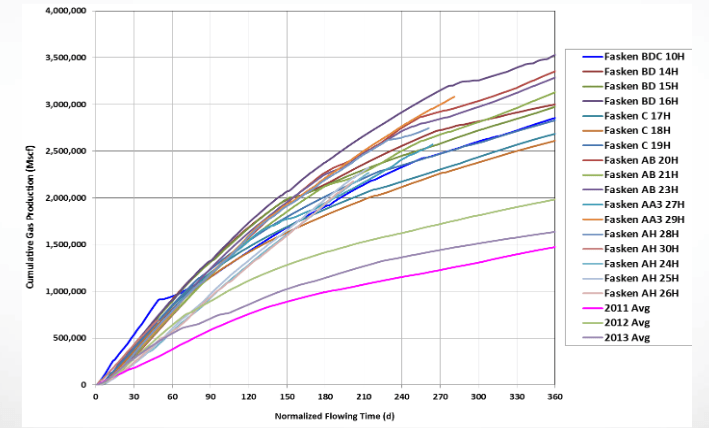

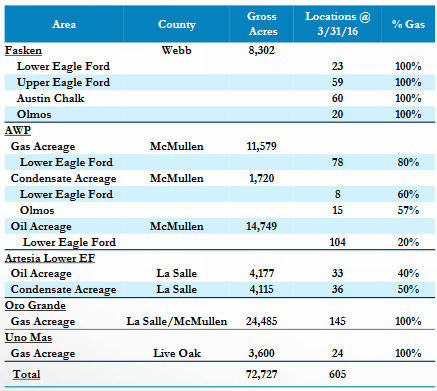

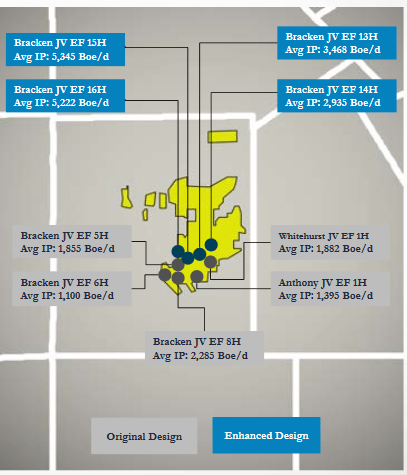

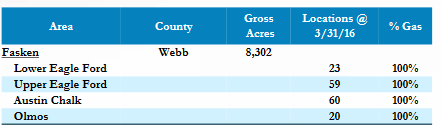

On the downside, obviously management is not ideal. Went into downturn with no hedges and way too much debt. Operationally it actually seems like they’ve done pretty well though. And the acreage they own, particularly Fasken, looks like some of the best of the Eagleford.

Granite Oil

This is an oil stock I’ve held in the past and that I bought again after it appeared that oil was going to make a legitimate run. I have added to it in the last week as oil has stayed very firm in the face of some bad news (Doha, Kuwait).

But I’m a bit worried. Granite just doesn’t seem to be performing like it should. Below is a performance comparison I stole from this Investorvillage post:

The problem with investing in any of these Canadian juniors and intermediates is that production data comes out semi-publically through a subscription you pay for via IHS. I of course, do not have access to this data. So there is a chance that some are seeing declines in January and February and getting a head start selling on what will be a weak first quarter.

Granite also hasn’t put out a new presentation since February, which you can construe a few different ways, both positively and negatively.

Granite may also be in the penalty box because the same management team sold out their shareholders when they took an offer for Boulder Energy (of which Granite had split last year) at around $2.50 per share, or about one quarter of what Boulder traded at last year. I imagine there are pre-split shareholders of both names that decided to jettison Granite in disgust after the Boulder news.

Granite currently trades at a $200 million market capitalization and has $40 million debt. In the third quarter they produced 3,476 boe/d. Their valuation is roughly inline with peers, though Granite’s low debt position should allow for some premium in my opinion.

They have proven themselves to be solid operators; in 2015 they “decreased capital costs by 29 percent through the year to $2.0 million per well” and operating costs from $7.50 per boe to $6.00 per boe (source).

What I have always found exciting about Granite is that they have a low-decline and relatively low risk development opportunity applying a gas injection enhanced oil recovery technique on known reserves. But they also have a very large surrounding land position, which allows for a significant expansion of the program if oil prices recover and make them attractive to a larger acquirer. Below is a map from their presentation to give you an idea of their current drilling focus and more importantly the expansive land package that surrounds it:

So I like Granite as a reasonably safe way to play a price recovery. I am optimistic that the poor share price activity is an opportunity and not an omen. The company remains reasonably priced with low debt and is one of the very few oil companies in Canada that can squeak out profitability with oil prices above $40.

Medicure

I got the idea for Medicure from a radio program we have in Canada called Moneytalks. It used to be that Moneytalks was full of gold and silver interviews and end of the world enthusiasts so for a long time I did not make time to listen. But lately Michael Campbell has been interviewing more real managers who have been giving out the odd gem of an idea with Medicure being one that I was enticed to buy.

Medicure was recommended by a PM at Maxam Capital. I found this excerpt on the company in one of Maxam’s recent letters to clients:

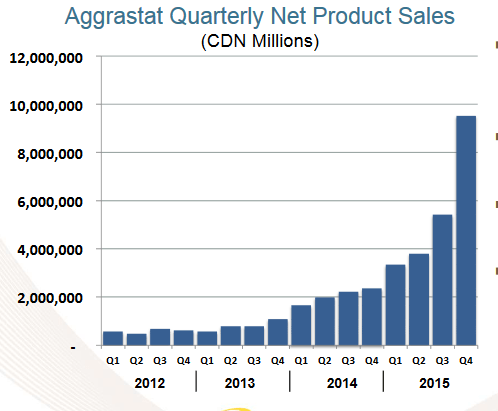

Located in Winnipeg Medicure is a small pharmaceutical company with a drug called Aggrastat that prevents thrombosis and is used intervenously in hospitals. Sales of Aggrastat have been growing rapidly since FDA approval first of recommended dosage in 2013 and then an expanded dosage regime in April of 2015.

On top of their ownership of Aggrastat, Medicure also has an option to purchase a growing generic manufacturer in India called Apicore. This is where things get a bit fuzzy. As part of a financing they orchestrated for Apicore in the summer of 2014 Medicure received a 6% interest in Apicore stock and an option to acquire the remaining shares at any time before July 2017. But in a strange twist, the purchase price of the remaining shares of Apicore is undisclosed. I looked all over trying to find an indication of what the option price is, but to no avail. So trying to value the option is a bit of a guessing game.

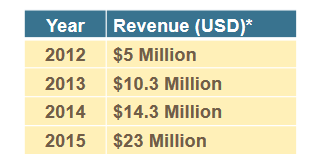

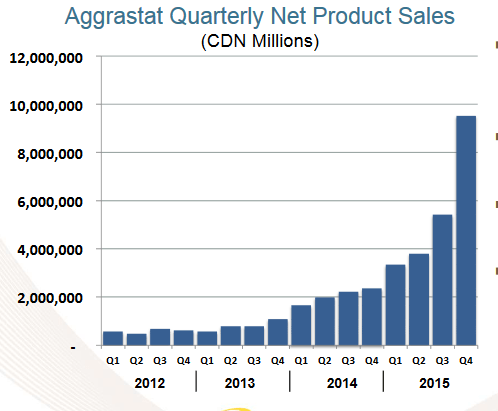

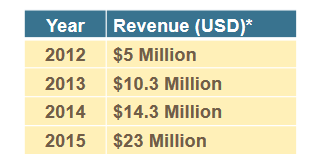

Medicure gives a small hint in their presentation that it is probably worth more today than it was in the summer of 2014. They provide the following information with respect to Apicore’s sales each of the last 4 years:

Clearly there has been significant revenue growth at Apicore since Medicure was granted the option to purchase the company.

The balance sheet accounting of the Apicore interest doesn’t help much because the only changes Medicure has made to the value of their position is due to currency fluctuations.

Medicure trades at a market capitalization of a little under $90 million. They generated operating cash flow of $7 million in 2015 and do not have significant capital expenditures. Aggrastat is growing and so one should expect increasing cash flow going forward. And then you have Apicore on top of that, which must be worth something, though its not clear what. So adding it all up, it seems that the current price of the stock does not reflect the cash flow generation capacity of Aggrastate let alone the value of the purchase option for Apicore.

Rentech

I got the idea for Rentech from @alex_estebaranz on Twitter. Up until this year Rentech has operated two businesses: the first being wood processing (wood chips and pellets) with operations in Canada and the United States, and the second being fertilizer, with two plants producing nitrogen based fertilizer.

In 2015 the company decided to get out of the fertilizer business in order to reduce debt. In August Rentech sold their East Dubuque fertilizer plant to CVR. They followed this up with the sale of their Pasadena facility in March of this year.

The sale of East Dubuque to CVR was the more significant of the two deals. Rentech received 1.04 units of CVR Partner stock in addition to $2.57 cash. The proceeds have allowed Rentech to pay off about $150 million of debt. Even after the payoff of Rentech retains 7.2 million units of CVR (valued at about $60 million). They have $95 million of cash.

Rentech has 23 million shares outstanding so at $3.30, it holds an $82 million market capitalization. The remaining debt they have is about $136mm. Subtracting what’s left of the CVR units and cash on hand and the enterprise value is low, only about $60 million.

What do you get for $60 million? A wood chip business called Fulghum Fibers, a US wood pellet business and a Canadian wood pellet business. Below was 2015 EBITDA by segment in addition to an EBITDA forecast, which I will talk about shortly.

As you can see the Canadian business is a bit of a mess. They are ramping up new two new facilities and having trouble doing so. It’s costing more money than anticipated, they’ve had to replace equipment and there is some question whether one of the facility can be ramped up to the original capacity expectation.

Nevertheless, even with reduced expectations Rentech expects that these facilities can generate between $13 to $16 million of EBITDA. They sell their pellets to Quebec and Ontario Power for power generation, so they have steady customers for their product.

Rentech has also said they are in the process of taking out $10 million to $12 million out of SG&A.

Basically with the sale of the fertilizer businesses it’s a story about turning around the Canadian business and cutting some costs. If the cost cuts materialize and they can generate the expected EBITDA in Canada, EBITDA can probably touch a number north of $30 million. That would make a $60 million valuation far too low and something at least double that would be more reasonable.

Oclaro

I got the idea for Oclaro from a friend who is always coming up with off the radar ideas. Oclaro makes optical transceivers. The optical transceiver business is not a great business; competition is high and there is always a higher speed device on the horizon to upset any market share gains that you might have scraped together.

You can witness this by taking a look at Oclaro’s gross margins, which tend to hover around the 25% range historically. But Oclaro is on the right side of the cycle right now. The move in the high end of the optical market is towards 100G transceivers, and Oclaro has a leg up in this segment.

In particular there is a large build of long-haul optical in China that Oclaro has been winning business from. They have a contract with China Mobile for 21,000 plus line side 100G long-haul ports. The China Mobile contract is going to be delivered in Q1/Q2. There are also contracts with China Unicom and with China Telecom for 8,000-10,000 ports each so similar size to China Mobile, and these are scheduled for early second half of the year. On top of this there is regional demand from metro China customers that is ramping.

The product wins are leading to a ramp of their 100G production lines:

We will ramp both manufacturing lines for the ACO over this calendar year and we expect to go from shipping hundreds per quarter to thousands per quarter by the end of this year. We continue to believe that the majority of the early demand will be focused on data center interconnect

On their last conference call (second quarter) management made the following interesting comment that demand is exceeding their capacity to build the transceivers:

Our growth in Q3 will not be gated by demand. We’re running very tight on capacity for most of our 100G products, as well as our tunable 10G offerings. As a result, we’re adding significant capacity in all these areas. Our ability to grow will be governed by how quickly our capacity comes online, as well as the capability of some of our piece-part vendors to respond to our increased demand.

In the spreadsheet below I’ve tried to model out what I see happening to Oclaro over the next couple of years and their strong 100G position takes hold. Their fiscal 2016 is half over, with revenues of about $180 million, so I am forecasting some growth over the next couple of quarters there.

In 2017 I am making what is probably a pretty optimistic forecast, with 20% growth in revenue and gross margins increasing to 35%. I’m doing this to get an idea of what Oclaro might be able to generate if things go well. I suspect that the 40 cents of EPS that I estimate would lead to a share price in the $8 range, maybe higher if growth is expected to continue to be strong.

Health Insurance Innovations

I sold some of my Health Insurance Innovations position. Not a lot, but enough to reduce my risk if something goes wrong. I got this across my google alerts and while I don’t know what to make of it, it doesn’t sound positive.

Arkansas News Bureau

LITTLE ROCK — State Insurance Commissioner Allen Kerr said Monday he has issued a cease-and-desist order against a Florida-based company over allegations it has used deceptive practices to try to sell short-term health insurance plans in Arkansas.

Kerr also released a list of tips for avoiding falling prey to dishonest telemarketers trying to sell health insurance plans.

The cease-and-desist order directs Health Plan Intermediaries Holdings, doing business as Health Insurance Innovations, to stop immediately the sale, solicitation or advertising of any insurance plans using unlicensed agents and to stop intentionally misrepresenting the terms of contracts or applications.

Kerr said in a news release that in a phone call with Insurance Department investigators, a Health Insurance Innovations employee offered insurance plans and gave price quotes despite admitting he was not a licensed insurance agent. Also, several company representatives falsely told investigators that two short-term plans, HealtheFlex and Principal Advantage Plan, were in compliance with the federal Affordable Care Act, according to Kerr.

I don’t really know what to make of this news. It’s probably nothing. Still, I felt a little better with a little less exposure to the name.

Radcom

A couple of data points occurred with Radcom in the past month.

First of all Netscout did a call on the NFV market and their service assurance offering. The call was broken into two segments, with the first segment being the more interesting of the two.

In the first segment is an industry expert from Analysys Mason gave a pretty good overview of the NFV opportunity, its risks and why service providers are inevitably going to move towards an NFV solution. His projections for assurance seem a little light based on what I see so far from Radcom, but I guess we will see how that plays out shortly. The call is worth listening to in full.

Second, I listened to the Amdocs fourth quarter conference call. Amdocs gave lots of commentary around what they are doing with NFV and even provided some reference to how RDCM fits in. Here are the comments I note (I highlighted a couple comments in particular):

When speaking about who will be the winners in this new market:

we think that actually the early adopters would come and the disruptor will come from the small companies. There is a lot of startups in this field, and we believe that some of it will go to the tradition, Cisco or Ericsson and the like but a lot of it will go to smaller companies.

Speaking of carrier advantages of NFV and their role as consolidator:

You can imagine that if you have a network that is all software devices, if you want to accelerate capacity or to change features instead of sending a technician that go to the box and do something, you just tweak it on a control plane in the data center. It’s like managing a huge data center. So the bottom line is that the trend is absolutely there. The nets are trying to fight it as much as they can, we are the disruptor, there are very few others, definitely not in our scale. We believe we could be the integrator of small companies.

And in terms of which carriers are getting a head start on their deployment:

In terms of the geographic spread that you asked, AT&T is probably by far the most advanced company with its theory and its power line under the Domain 2.0. You see some activities in Singapore Telecom, in Bell Canada, in Vodafone Group.

…So in the next 12 months to 18 months, you will see the big guys making decisions, that is to say Bell Canada in Canada, AT&T and Verizon in the USA, Singapore Telecom in Asia, Telefônica probably, Vodafone, these are the guys that will make decision.

Finally, what Amdocs will and will not do:

We will not try to build a better virtualized probe than the people that I expect on this or virtualized– if you see packet core (50:39) or something like this, we would not. So we are mainly after the high-end NFV component and maybe some services and integration on the SDN.

Radcom hasn’t performed terribly well as the market has recovered. The stock has been essentially flat. But this isn’t unexpected. It’s still a $100 million dollar company that reported revenue of a little over $2 million last quarter. I don’t expect a significant move in the stock until it either reports some big numbers, announces another contract, or gets bought out. The problem is that the last two items are game-changing events, and you can’t predict if one of them is going to happen tomorrow or next year. So I wait patiently.

Portfolio Composition

Click here for the last four weeks of trades.