After a Week

(Note: I wrote this post last Sunday and never sent it out. Just got busy and forgot to. It’s kind of interesting for me to read over again in retrospect of another week. Wherever it says “Note:” is where I added some updated comments this morning)

Whatever success I have in the stock market generally comes from juxtaposing two opposing views at the same time: what makes sense that will happen and what actually is happening.

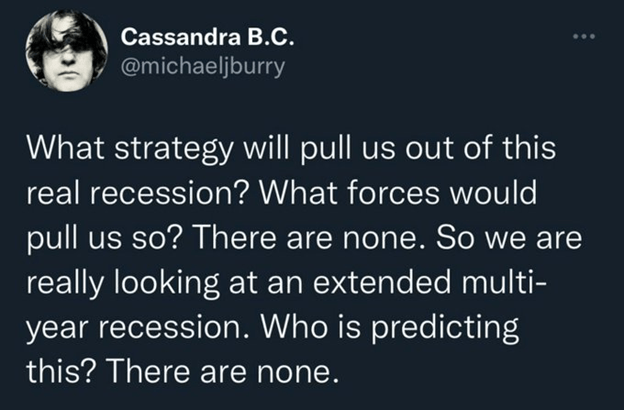

There have been plenty of bearish voices the last few months and they have been wrong. These are not your usual contras. One investor that I personally hold in high esteem, Michael Burry, tweeted this a week or two ago.

While Burry is not forthcoming on reasons (in fact we only get to see his tweets for a blink of the eye before he deletes them) others are more specific. One follow of mine that has been mostly right throughout this bear market put numbers to it:

$230 x 17-18x = S&P 500 at 3,910 – 4,140. There’s your range.

So far, that is not bullish or bearish. But as he pointed out, there is plenty of downside to those assumptions. Earnings could easily come in much lower next year if there is a recession. A 17-18x multiple is quite high if rates are in the 5% range. It could easily be 14-15x – which would result in a pretty big drop from here.

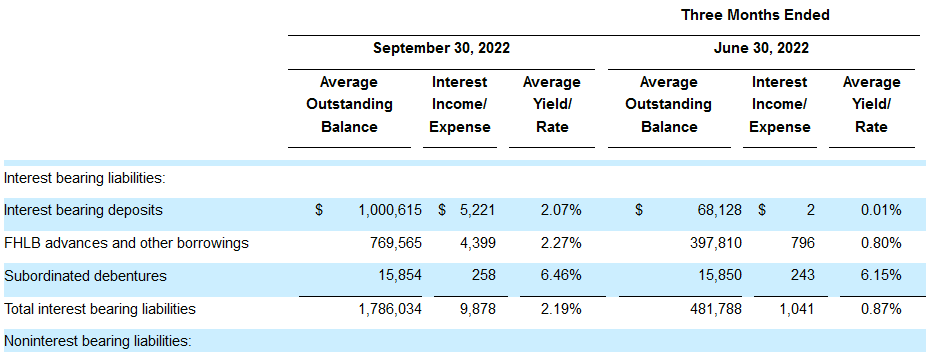

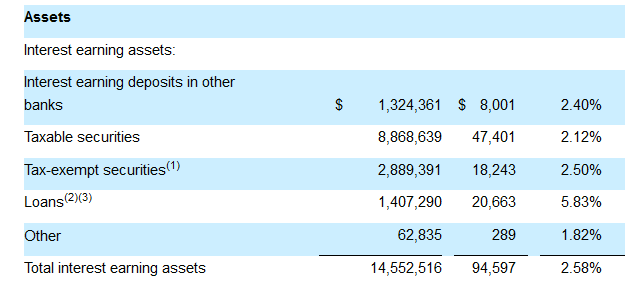

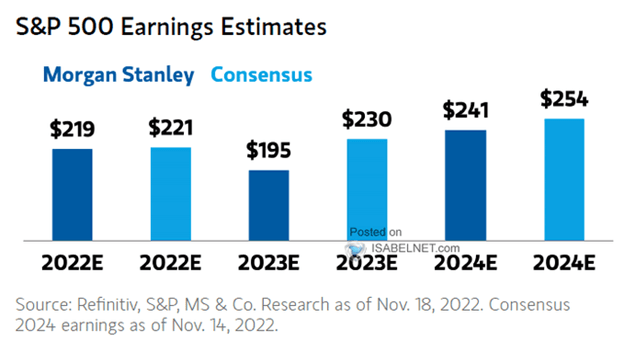

This potential downside to 2023 earnings estimates seems be getting realized by the bank estimates.

On November 7th Goldman Sachs reduced their 2023 S&P earnings estimate from $234 to $224.

Last week Morgan Stanley reduced their estimates to $195 from $212.

This week J.P Morgan did it one better, reducing next year earnings to $205, down 9% from an earlier forecast of $225.

You kind of look at all this and can’t help but think, hmmm, this doesn’t seem like a great time to be going hog-wild risk-on here.

And yet….

Stocks go up. (Note: Maybe that is ending though?)

Let me tell you why I hate macro so much. It is such a waste of time. Yet it isn’t.

You do a bunch of work and you form an opinion that seems based in fundamentals and reason. And then the market opens up and does the opposite, so you dump all those thoughts for the time being and just trend follow the direction of least resistance.

Which makes it seem like a waste of time.

But acting on big picture macro isn’t really what it is for. I think it is more for reacting.

Your big picture assessment is sitting in the back of your mind. It informs you by degree. If you are bearish, it does not mean you don’t act bullish-ly if the market is bullish. It means you act less bullish. And you turn more quickly if the market turns.

Right now, while the market seems expensive, there are pockets that do not.

Consider Dicks Sporting Goods. I didn’t make a lot of trades the last 4 weeks (Note: 5 weeks now, still not too many trades). Less than 10. Dicks Sporting Goods was one of them.

Buying Dicks was a bit odd for me. Quite honestly, I thought these pandemic sporting good winners would go up in flames once we got back to normal (remember I used to own Big 5 Sporting Goods last year and I had revisited the stock a few times, but wasn’t convinced enough to buy it back).

I came across Dicks on the morning of their earnings release. Just going through my usual morning routine, reading the press releases of companies reporting.

Dicks reported and they were extremely good numbers. No real deterioration. A lot of free cash flow.

And the stock? Well, it is cheap… if those number are close to sustainable – which, with that earnings release, we know they are for at least another couple months.

Yet lots of investors are short Dicks. The short interest is 21%. I can see why – same reason I was thinking sporting goods was done. Collapse in sales, collapse in profits.

Except that hasn’t happened. At least not yet. Dicks did $1.3 billion of FCF in 2020. They did $1.3 billion of FCF in 2021. They are well on their way to doing a billion+ this year. The stock had a $8b market cap that morning I bought it after earnings. The market had bid it up a couple bucks but really not much at all.

So I don’t know. Maybe Dicks is still going to implode. If the recession is extreme enough, it probably has to. I feel like this is a favorite of hedge fund shorting, who certainly know more than me.

But this is a stock trading at 7-8x FCF on a FCF number they have hit for 3 years running now. It is a stock with a large, short interest that isn’t working out right now and is staring down being short a company at a single digit free cash flow multiple.

This is a trade and I admit I still don’t know what exactly is sustainable for Dicks so I don’t know how much patience I have with it. Dicks is a good example in another way – a stock I am long but don’t have a lot of conviction in. The reason you don’t see any real stock writeups from me (other than that Snap one a month back).

The point I’m making here is more general – that this a market that is expensive and in some ways it really isn’t. And there are a lot of people offsides the ways it maybe isn’t expensive if things don’t go down just right. (Note: still holding Dicks this week, still have very tepid conviction)

So I don’t know. I just don’t know…

Let’s see, what else… well, my Home Capital idea did not go well. I’ve said it before – I don’t make a short more than 0.5% because you just never know. Fortunately, I stick by this rule religiously, and so even when a huge premium takeover bid for Home Capital happened, I only took a small punch in the mouth from it.

To be honest, I cannot fathom an economic reason why you buy Home Capital now at the price it was bought for. It makes zero sense to me. You are buying it at a higher price than it has ever traded at, at a time when Canadian real estate transactions are at their lowest point in many major markets in 20 years?

It really is like, huh? As I made clear in my post on Home Capital, the business is probably not as sensitive to default as you might think because of the short-term nature of their loans and deposits, but it is extremely sensitive to transaction volume and those have fallen off the cliff. GTA home sales for November were down 54%. Vancouver home sales down 53%. Calgary sales down 20%. I mean this is not good for Home Capital.

Anyway, if you ask me the whole thing smells a bit odd. (Note: this whole situation still seems odd to me. The Canadian RE market looks worse today then even a week ago. I took a small put position bet on HCG as a low-probability bet that the deal falls through. If HCG falls back to its pre-deal level it will make ~30x. If it doesn’t, I lose the small amount I put into the puts).

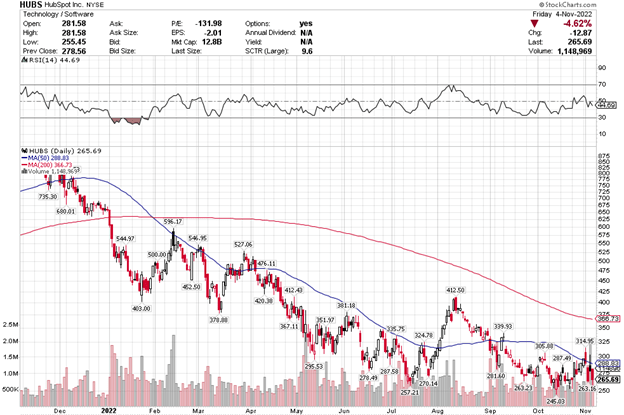

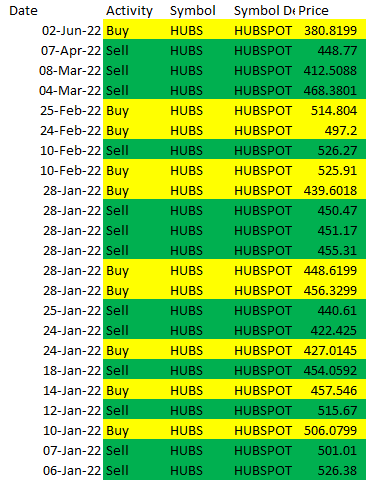

Final thing I’ll mention is a second bet that hasn’t really worked out yet. I have still not given up on my SaaS bets but I have to admit, my patience is wearing thin.

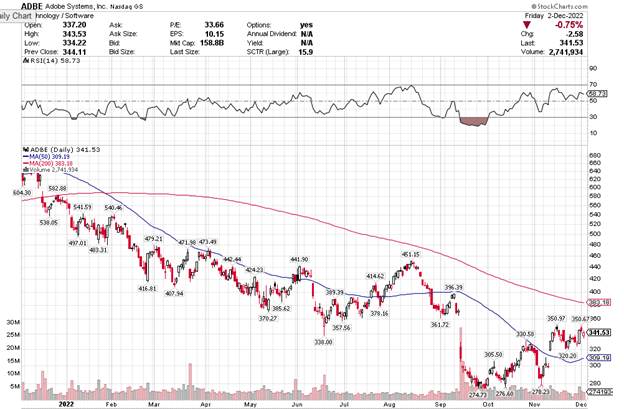

A couple months ago I took bets on Datadog, Zoom and Adobe. They were all pretty bombed out and it just seemed to me like it was worth betting on at least a bounce.

Of the three, only Adobe really worked. It worked because it was bombed out so bad. One thing that has worked pretty well in this market is to wait until a stock is absolutely decimated and hated and then buy it. It happened with Netflix. With Meta. And Adobe.

I bought the stock in the $270s and sold it in the $320s. That is a long way from where Adobe was a few months ago. But it is also a quick 15% gain.

With Zoom and Datadog though, it hasn’t really worked. I already sold Zoom after earnings. The trouble I had with their earnings is just that even though Zoom is a heck of a lot cheaper than it was a year ago or even a few months ago, its not really cheap, cheap. It is still a 19x PE, a 11x EV/EBITDA, and its not growing all that much at the moment. So its like, I don’t know…

As for Datadog, they are really not cheap, even still. I worked through a bunch of discounted cash flow scenarios for Datadog and I still only can get a fair value of $100 and that is even before you account for stock compensation dilution. So again, I’m holding it still for the moment, but I don’t know… (Note: still holding Datadog, also even though I was quite negative about SaaS last weekend, I also held onto SentinelOne and Twilio, at least for another week).

(Note: like I said at the start, I wrote this post last Sunday, so before the Eiger results came out. So these were my pre-results thoughts, which as I note, I unfortunately did not follow up on)

One last loser I will talk about. Eiger. I’ve talked about it a bunch and I’ve been basically wrong on it. And now, with a read-out coming up on their HDV program, I feel more like making sure I limit my losses than trying to make it all back. I plan to sell down my Eiger position by half and take the loss (Note: So, I didn’t actually do this. I took the loss).

This one is all about managing the risk. I guess-estimate that if the HDV numbers (which they are going to release sometime this month) miss, the stock is probably going to go down another $2. If the results are good enough, it could go up $2-$4. So I basically asked myself, how much risk am I willing to take on this. I have to size appropriately.

(Note: I wish I would have done the following but didn’t) I am actually considering dropping the position entirely to just buy some calls on the stock – to keep the upside but make the downside a fixed number. I may do that this week if the option prices make sense. It is a good situation for it because it’s a fixed event, a known timeline, and you can fix your loss.

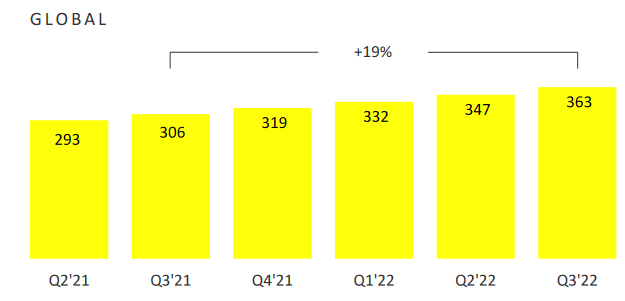

(Last Note: So yeah the Eiger results were unexpectedly poor. I read the Citigroup note that came out Friday and they said that lonafarnib still will likely be approved, they gave it a 75% chance, but with a far smaller revenue potential – $250mm max.

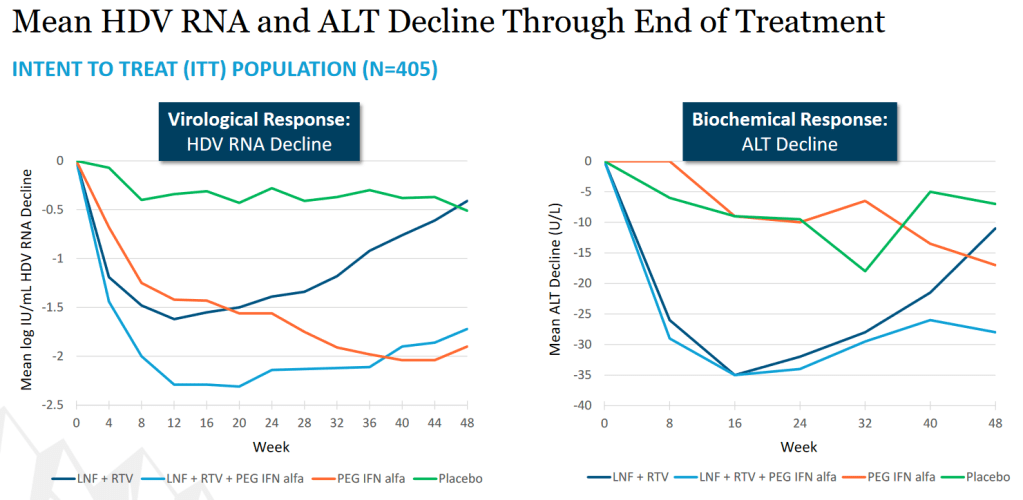

The problem essentially is that the drug works for about 16-24 weeks and then effect wanes. See the slide below, particularly the virological response:

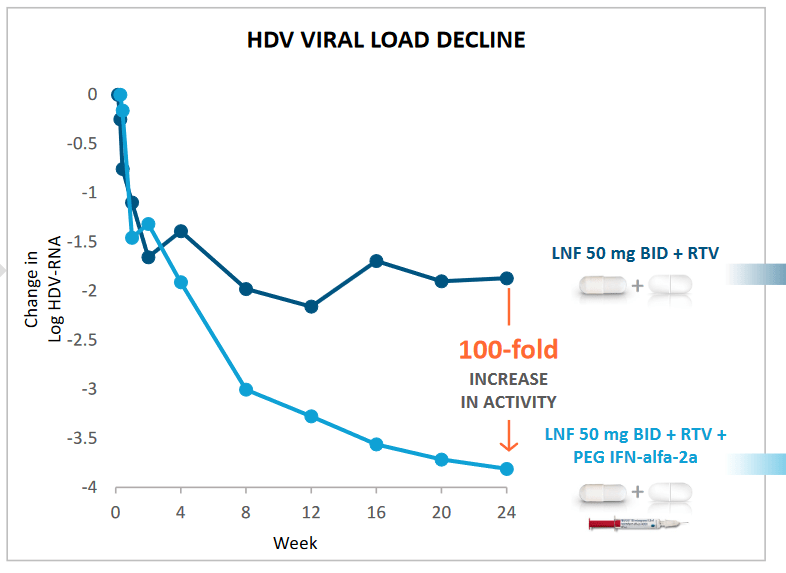

Eiger doctors running the study were as surprised as anyone. If you go back to the Phase 2 trial (those results below) you saw the leveling out, but it wasn’t really evident that the effect would reverse like it did:

If the drug is approved it would be as a short-term stop-gap for 6 months or so. It has some value because its an oral drug with few side effects (compared to the other options) it does seem to work quite fast and the other drug is a daily injection that works more slowly.

Like I said above, even though going into the study I was wary, for some reason I held on to the stock, I guess showing a blind side of having held it so long, wanting to see it through.