Is the Hard Thing the Right Thing?

The reason for the title is that I found it very hard to write this update. Not because I don’t know what to say. I know exactly what I am thinking. But because it is one of those times where I am very conscious that I am not inline with what I’m hearing from most and so very conscious that I am wrong.

Through this whole downturn in the stock market I have been cautious and hedged. Apart from some individual stock episodes (I’m looking at you Caribou Biosciences), I have mostly avoided having my portfolio whacked by this bear.

But with the market now in the 3,600’s, I’m finding it hard to be as bearish as I was at the beginning of the year.

This week I took off a lot of my hedges. I’m less hedged right now than I’ve been in quite some time. It is difficult to write that.

I’ve done it with an extreme skittishness that illustrates how nervous this market is making me and everyone else. I take some off, I get nervous about doing so, I sell some longs to reduce exposure overall and make the nerves subside, then that doesn’t feel right so I buy some of the longs back.

It’s a messy process. It is like searching in the dark for a comfortable chair. I don’t know what it will feel like until I get there but when I sit down on a hard rock, I know it right away that isn’t it.

Thus my portfolio has had a lot of turnover in the last couple weeks. There are a few stocks where it is embarrassing how many times I’ve bought and sold them, as my inner struggle with what I really think waffles back and forth.

The worst has been PBF Energy. I bought it a few weeks ago and did very well. When it got close to $40 I knew it was way overbought and I sold. But then it started to come down and I was torn between A. thinking oil had to come down, B. oil not coming down, C. PBF being on a parabolic move up that usually doesn’t end well, D. PBF still being incredibly cheap if it can over earn on current refining margins for any decent length of time, E. wondering if the government is going to step in and screw the refiners, F. wondering if I should buy the dip now that the news is out that the government is going to screw the refiners and G. wondering if nothing PBF specific even mattered if the market was going to tank.

Its been a rollercoaster. I’ve bought and sold PBF Energy 6 times in the last week, which is ridiculous. It hasn’t been a good trade – with my indecision I’ve lost about half the gains I made on my original purchase. But I don’t own PBF any more. I think I’m done with it now.

In fact, the reason I’m finally okay with being done with PBF is the same reason I’m feeling a little more positive. We saw oil crack on Friday. We saw rates crack on Friday. That is not necessarily a bad thing.

Of course, both could be spun negatively, and they are – ‘oh look, now oil and rates are saying a recession is coming’. Honestly, if the market wasn’t where it was, I’d probably be inclined to make the same take.

But it would not going to take much to flip the boat to a more positive narrative. Extreme pessimism breeds a new positive narrative.

There certainly is a lot of pessimism to go around.

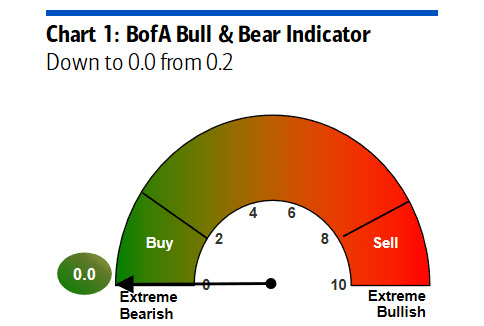

Bank of America’s Bull/Bear indicator has hit the ground:

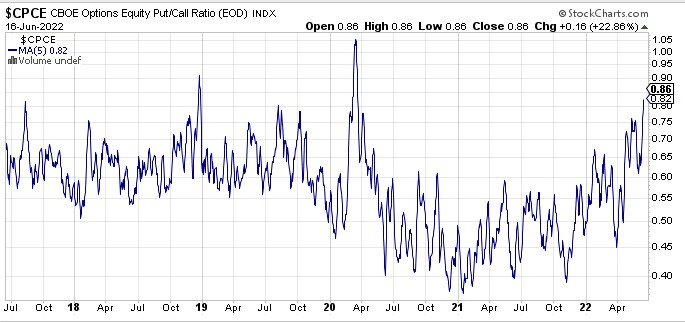

The equity Put/Call ratio is at a level we have only had twice.

The bears are loud on Twitter. Some of the bears I follow, many of whom have a tendency to not be right that often, are tweeting stuff about how they are as short as they can be.

Now I know, I know, the counterargument is that you always have extreme sentiment right before the crash.

But quite honestly, I’m kinda wondering if that isn’t what just happened.

I wrote back in May that my assumption is that this is a Triple Waterfall type bear market. And that this means it will take time.

To me, the important takeaway from this is that what we are experiencing now is not about some one day “crash” that flushes away excess, cures the system of its malaise, and allows us to buy TDOC, SE and PTON again with reckless abandon. If this is a Triple Waterfall, which I think it could very well be, we will not be let off so easy. This will be drawn out for a few years more (I don’t know if I agree with the decades he describes) until the last of hope of the past belief has been vanquished.

This is still what I’m thinking now. I don’t think we are going to have a big 1987 type crash but I also don’t think this is going to be over any time soon.

Absent a big crash though, everyone is so bearish and the market has already come down so much, it seems like a decent time for a counter trend rally.

I don’t believe this enough to be really long here. I am actually less long than usual. The difference is on the short side, where I have taken off a lot of my index shorts and reduced individual name shorts to the one’s that are really crappy.

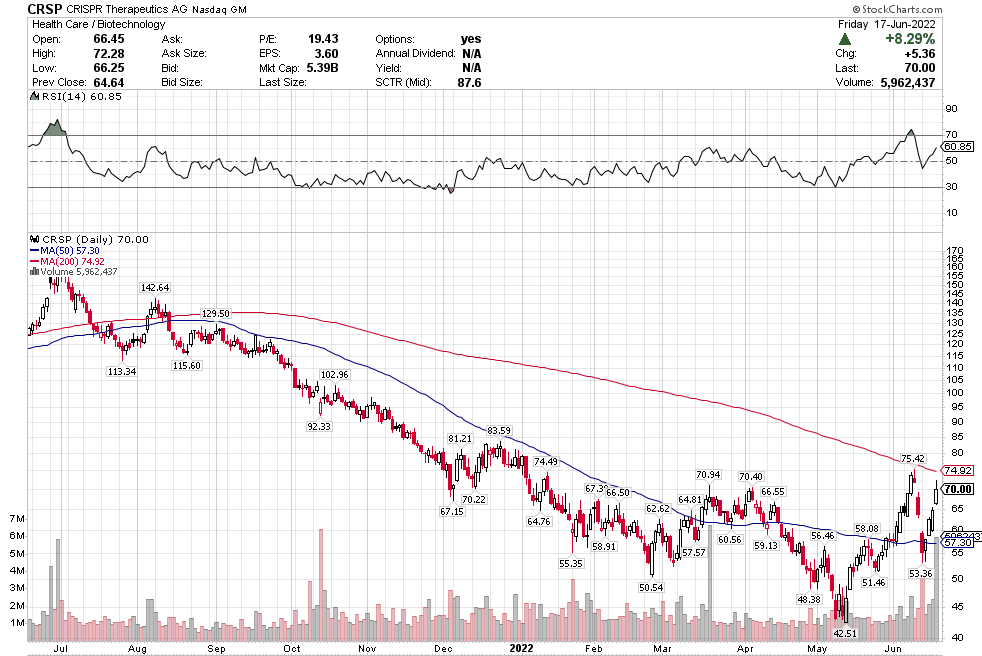

You have to remember, sentiment can change quickly. Just go back to that May post I linked to. My other main topic of conversation in that post was CRSP and how I couldn’t believe how cheap it had gotten, how negative everyone was on it, and yet it was well on its way to having its first approved drug in a few months.

Fast forward to and a month and a bit later and CRSP is 50% higher. Things change.

On the long-side, what did I do this week?

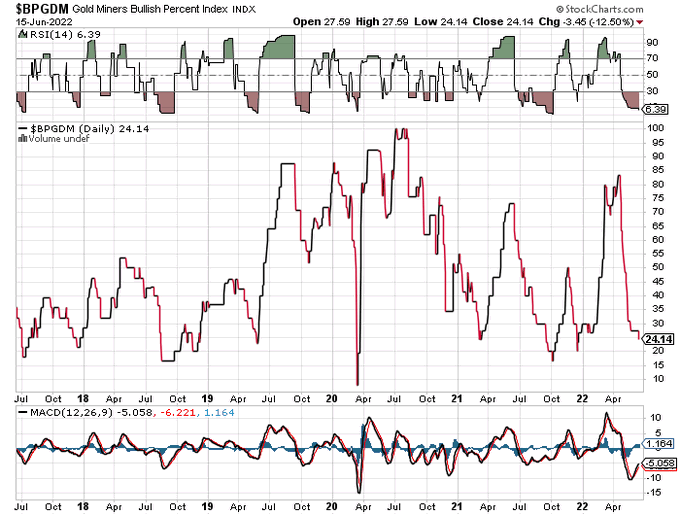

I bought back a bunch of my gold stocks. Speaking of negative sentiment, the gold miners bullish index is plumbing the depths again, which, if you can take the ridicule and a few more days of pain, is usually an indicator that miners are going to go up again.

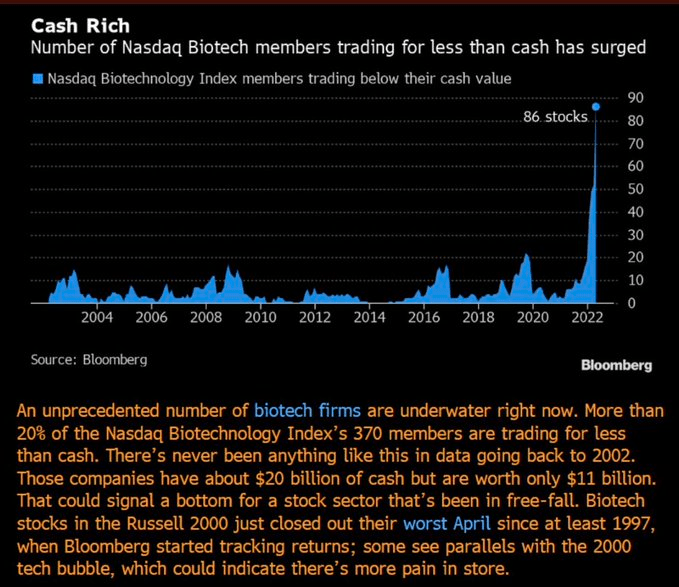

I also held tight my biotechs. I am very, very cautiously optimistic that they are bottoming. CRSP is the leader here and you’d never know how bad this week was if you just looked at its chart:

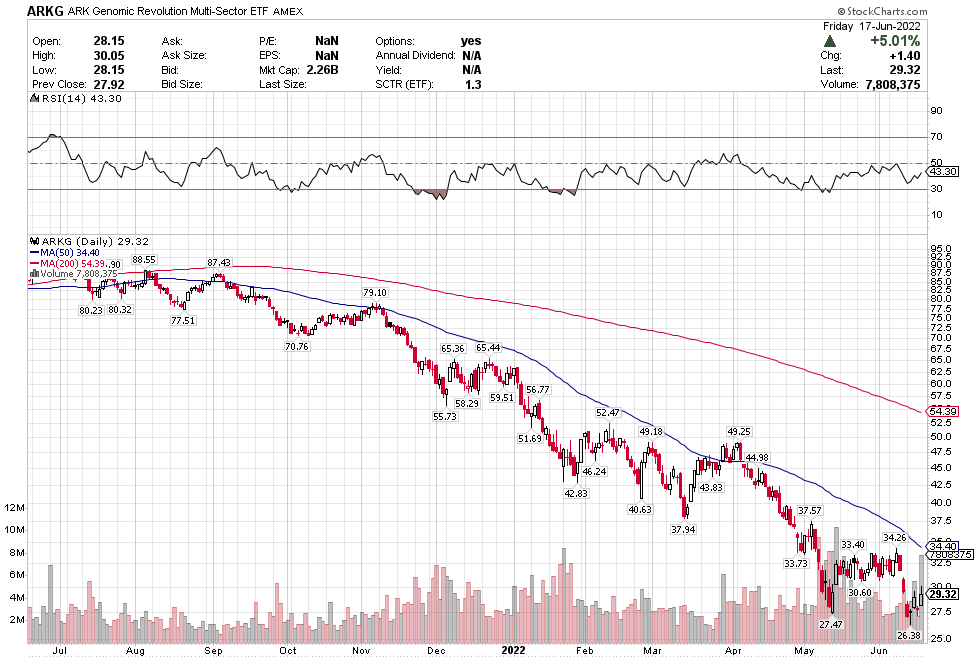

Even ARK Genomics fund held its own during the last 4 days of the week amid the market carnage, including a big volume day Friday.

As for me, I have taken it on the chin in a few names.

I had a big miss with Caribou, which I should probably write about because I made a stupid mistake there. I knew the Caribou data was not going to be great. Everyone knew it. Yet I kind of just forgot to sell the stock. It was a total oversight and a costly one.

And Eiger has not panned out so far. I’m sticking with it. The stock is down because at the Jefferies conference they said they would not be submitting their EUA to the FDA for Lambda until after June 30th. This after they had said they would submit it by June 30th previously.

This isn’t great and the market reacted as such. You could read into it negatively if you’d like. I’m still optimistic though, because:

A. The same day that they announced the delay, Eiger announced a new credit facility to replace the old one and on better terms. Plus the lender took $5 million of stock at $6.60, or above the price at the time. This lender is almost assuredly aware of all the details of what is going on with the FDA and the EUA, so why lend this money out and take equity if it was bad news?

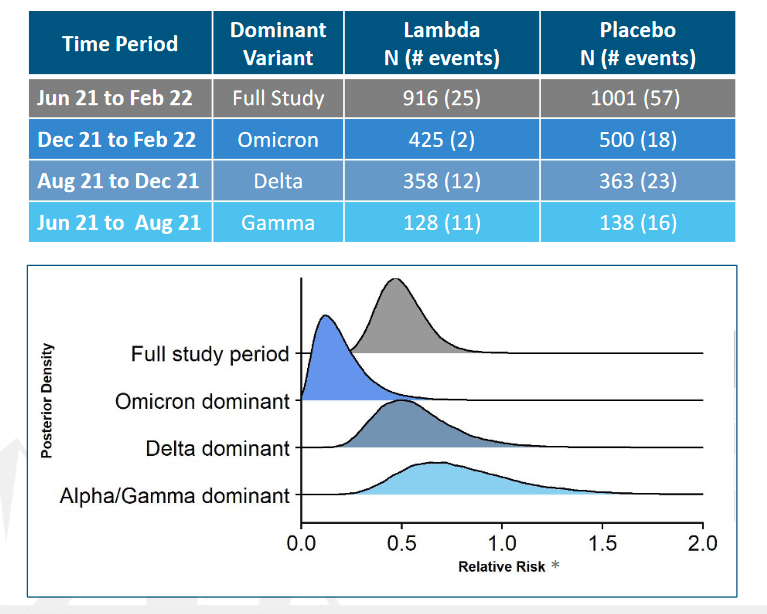

B. This whole EUA process is a bit suspect. If you listen carefully to what was said at the Jefferies conference, Eiger said they were submitting data the FDA had requested, including analysis of how Lambda performed with each variant of COVID. Wait, what? The EUA is the data submission. You didn’t hear about VERU (another COVID treatment play which I don’t really think much of) submitting data ahead of their EUA or having the FDA request data (and believe me, with those guys you would). But here we have EIGR is submitting data in advance of the EUA? And the FDA is requesting that data in advance of the EUA? What is really going on here?

C. That variant analysis was illuminating. It shows that Lambda worked way better with Omicron than it did with Delta or Gamma.

This is interesting because with just about every other treatment it has been the opposite. Omicron is escaping what worked previously. It also starts to make sense why the one earlier trial of Lambda, back in 2020, had kind of lackluster results. But with Omicron, Lambda appears to be extremely helpful

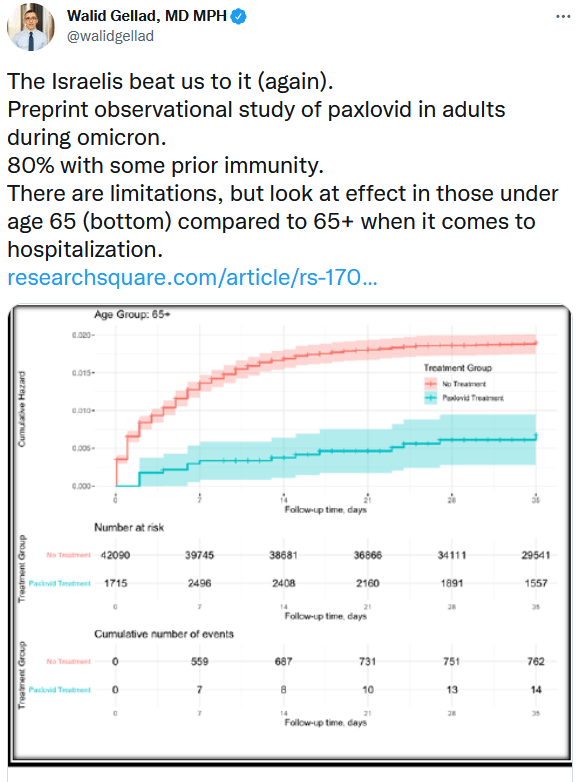

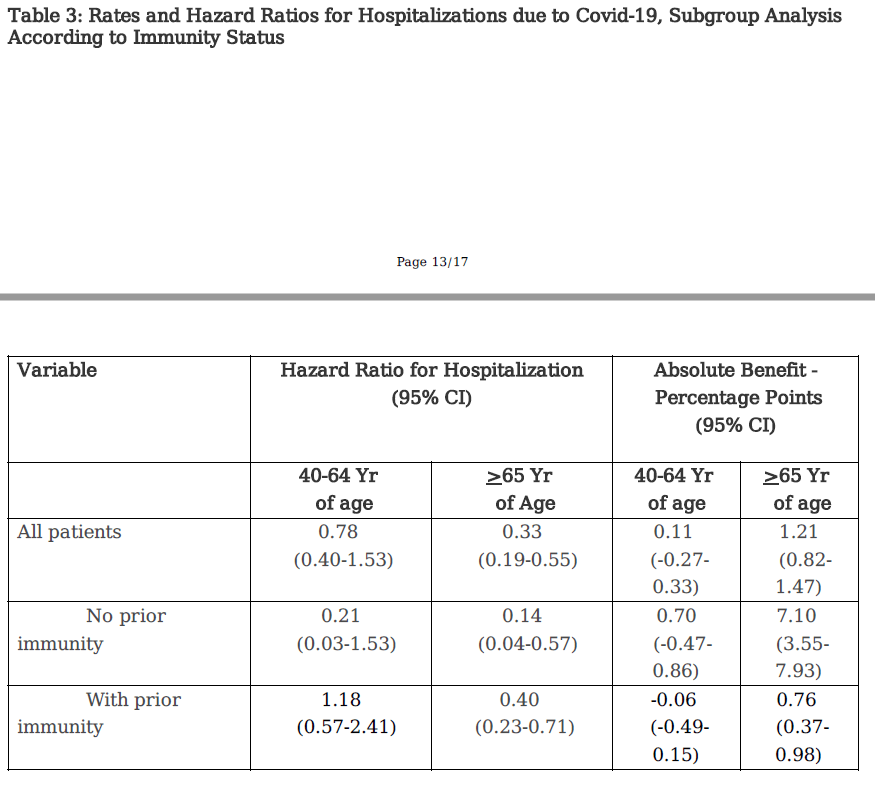

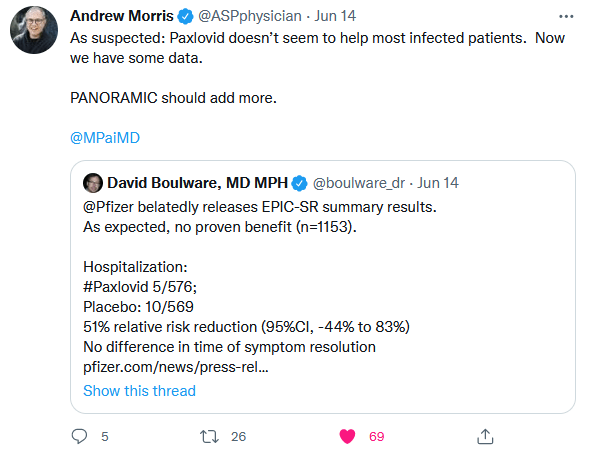

D. We had evidence out that paxlovid isn’t all its cracked up to be. Pfizer had data from their second study out, the one where they had mysteriously removed vaccinated patients half way through. Well, we know why.

E. Covid is over and not over. Yes, it seems past for most of us. We are getting on with regular life. But a couple things here. First, if you follow epidemiologists closely, they are a little worried how COVID keeps evolving. There was a paper out just this week about how the virus is sitting in people with long-COVID for 12 months or more, and all that time it is adapting. Another recent paper is suggesting that the most recent Omicron variant has figured out how to be more virulent against people that were infected with the first COVID variants – its kind of like having inverse immunity. There is all kinds of stuff going on under the surface. Hopefully none of it amounts to anything. But as a government, I think you’d still be crazy to not try to be prepared for it, have a war chest of therapeutics at the ready, just in case one of these new mutations goes off the tracks. Lambda really looks well positioned to fit into that box.