A Bet on Biotechs

I have an awful lot of cash. While I am trying to not be in a hurry to use it (for all the reasons that I have explained in the past few posts), it is hard to pass when I see a decent looking trade.

As I wrote back in December, I am more inclined to believe that we are seeing a new bull market in the Biotech group than I am for other sectors. A longer-term chart of the XBI, which consolidated for years heading into this break, certainly looks that way.

Well, if that’s what I think then at some point I have to put my money where my mouth is. Therefore, after selling out of many of my biotechs during my portfolio purge last month, I have decided to buy back one of those names back and add a couple of others.

The one I am buying back is Renalytix. I wrote about the stock previously here.

Renalytix is developing a platform that will help physicians diagnose chronic kidney disease (CKD) early on. The platform is called KidneyIntelX.

KidneyIntelX takes in a range of patient data, including validated blood-based biomarkers, inherited genetics and personalized patient data from the EHR system. It uses a repository of patient histories with CKD to compare to the patient data, and then, using an “AI” algorithm, it spits out an assessment of where the patient stands in terms of risk of having or developing CKD.

This is a brand-new platform, so the company does not have any revenue yet. What they have so far are partnerships that look pretty good to me.

Their first partnership was with Mount Sinai health system. Right now, they are in the process of rolling out their first test reports to physicians in the Mount Sinai network. Mount Sinai will use KidneyIntelX to manage their 65,000 patients with DKD (that is diabetic kidney disease). They have another 150,000 patients with CKD.

Next Renalytix announced a partnership with Davita in January. Davita is one of the largest providers of kidney care services (205,300 patients at 2,809 outpatient dialysis centers) in the U.S. They wwill rollout KidneyIntelX to three states to start with, in hopes of identifying CKD patients earlier on.

Finally Renalytix announced this month that they had secured a partnership with the University of Utah to implement KidneyIntelX system-wide at University of Utah Health, which would include 1,700 clinicians across six states.

Renalytix also said in their March Q2 news release that they expected more partnerships announced before their June YE.

There is an upcoming catalyst this week. Renalytix should hear back from the FDA on their final submission for breakthrough device designation. In February 2021, the FDA sent written notification to Renalytix stating that it expected the final review process would return to normal no later than April 15, 2021.

If Renalytix gets final approval, which I would assume they will, KidneyIntelX will be approved for Medicare coverage via a rule called Medicare Coverage of Innovative Technology (MCIT). This rule, which was just finalized by HHS in January, provides for “opt-in national Medicare coverage determination for medical devices and diagnostics approved or cleared out of the FDA Breakthrough Device designation program.”

Pricing for the test has already been finalized at $950 per. The number of people that have CKD in the United States is 37 million and the Medicare spend on CKD is $120 billion. Worldwide the number of people with CKD is 850 million (!!).

There is a big problem with catching CKD early on. 38% of patients with CKD initiate dialysis with little or no prior clinical specialist consultation, and up to 63% of patients with CKD initiate dialysis in an unplanned fashion with a central venous catheter and/or during emergency hospitalization.

When I look at the Stifel initiation report for Renalytix, they estimate revenue of $46 million in 2022 and $85 million in 2023. These numbers were primarily based on the Mount Sinai patient population (Renalytix did not have Davita or Utah Health partnerships at the time of the report) so they should be even higher now.

The stock is not cheap – the market cap is about $800 million at this level. But if Stifel is right about how many tests and how much revenue we’ll see, it could begin to look very reasonable on a P/S basis, particularly if those 2022 and 2023 numbers go up with Davita and Utah Health.

What’s more, I know this market is all about TAM and quite honestly this looks like a very big TAM to me. Unless I’m missing something (which is possible – maybe there is a hiccup with the FDA or the test volume Stifel is estimating is too optimistic) then the stock could go quite a bit higher I think.

The second biotech I have added is a new position. Lyra Therapeutics.

I have had Lyra on my radar since December. It is one of those stocks where my timing has sucked. I had resolved to buy it on February 10th – the day before the stock popped $3 on an analyst initiation report.

I waited and waited and now it is pretty much back to that level. So I bought it.

Lyra has developed a drug delivery system to the nasal cavity, called their XTreo platform. XTreo is a patch that is implanted by the ENT during a “brief, noninvasive procedure”.

The patch carries with it momestasone furoate (MF), which is the standard of care treatment for chronic rhinosinutitis (CRS). The MF dose is time-released to the cavity and will last 6 months.

The upside of XTreo is that it can deliver the drug directly to the site of the inflammation rather than through a nasal spray or injection. The six months of time-release means the patient does not have to be compliant with administering it multiple times a day. And maybe most importantly, the indication that Lyra is going after is very broad – CRS with and without nasal polyps – which means that they will cover a lot of patients if approved.

The last point is the most important one I think. There are a number of drugs out there that treat CRS, but none with quite the combination that Lyra’s drug and delivery, LYR-210, offers.

The closest comparison is IntersectENT’s Sinuva. It was approved in 2017. Like LYR-210 it is a patch and it time releases MF. But it was only approved for post-surgery patients with nasal polyps. That is a small population. In 2020, which admittedly was likely impacted by covid, Sinuva only did about $5 million in revenue.

Optinose’s Xhance did much better – $48 million in revenue in 2020 after $30 million in 2019. Xhance is a nasal spray, it has to be administered twice a day, it is $425 per dispenser and each dispenser only lasts 15-30 days.

Merck’s Nasonex, which is the original MF nasal spray, did $200 million last year. But the drug has been off-patent since 2014. Merck did a little under $1 billion in sales with Nasonex the year before generics came to market.

Bank of America estimated 1.8 million patients a year that would qualify as the pre-surgery addressable population. At $2,000 per procedure that would be $4 billion of TAM.

Lyra had Ph2 results released in December and they were viewed unfavorably by the market (you can see that the stock tanked early-December, when they were released). But the issues with the results seem to have had more to do with COVID then with the performance of LYR-210.

The company could not enroll as many patients as they wanted, and because they had a smaller enrollment pool they needed a bigger effect from the drug versus the placebo to get the P-value (estimate of clinical significance) that they needed.

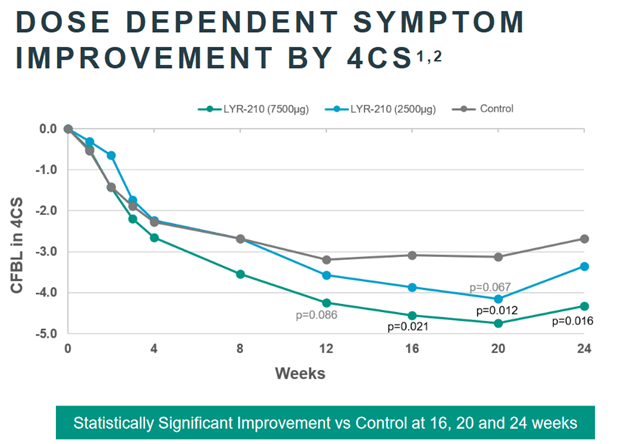

As it turned out, LYR-201 still reached clinically significant results for 8, 12, 16, and 24 weeks of treatment (it is the 7,500 micro-gram dose you want to look at in the chart below). But they did not for 4 week data, which was the primary endpoint.

Here’s the thing – the Ph3 trial that they expect to start later this year is not going to use the 4 week endpoint. It is going to use a 24 week endpoint. This should be a far lower hurdle for them to leap over.

Lyra has a ~$150 million market capitalization and about $75 million of cash. While it is not a perfect stock – I mean the indication is crowded, Optinose is in a Ph3 of their own for CRS, and Lyra isn’t developing a new drug, just a new way of delivering it – it seems like a reasonable bet on decent results now that the stock has tailed back off.

So those are the two I wanted to talk about.

We’ll see. I might be wrong – maybe the run in biotechs is over and they are back to a bear market. But I just find that hard to believe given the liquidity in the market, the strength of the market, and the chart of biotechs having broken out from such a long base. Anyway, we will find out shortly if this is an extended downturn or just another test.