Schmitt Industries

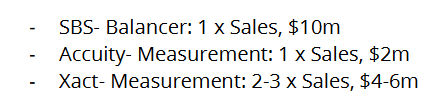

I took a position in Schmitt Industries this week on the wake of news that they had sold their Schmitt Dynamic Balance Systems (SBS) business line to Tosei Engineering Corp. and Tosei America, Inc., for a purchase price of $10.5 million in cash.

The sale sets up an interesting situation whereby Schmitt is now trading at what is essentially cash levels.

After the close of the sale Schmitt will have between $11 to $12 million in cash on the balance sheet depending on closing costs. In addition, the working capital position of Schmitt was quite positive at the end of the last quarter (ended September 1st) at $7.5 million (though I don’t know how the sale of the SBS segment will impact this).

At $3 the stock trades with a market capitalization of the company is $12 million.

For that $12 million, in addition the cash, this is what you get:

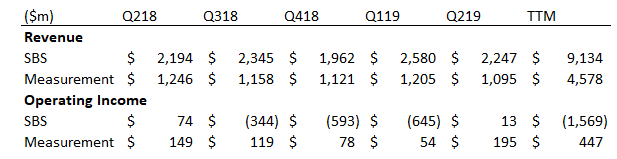

- A measurement business with TTM revenue of $4.6 million, operating income of $447,000 and a recurring revenue component

- 40,000 square feet of Portland commercial and industrial real estate

- An activist investor CEO that is intent of extracting value

The Measurement Business

Let’s talk about the Measurement business. The company has two product lines, Acuity and Xact. They have owned these businesses for a while – Acuity was purchased in 2000 while Xact was purchased in 2007.

The Acuity product line are lasers and white light sensors used for making precision distance measurements. They include short range lasers (3 – 1,300 mm) used in manufacturing processes and long-range lasers (up to 3,000 m) used in construction.

Xact is a product portfolio of remote tank monitoring equipment. There are gauge or ultrasonic sensors that measure water levels. Measurements are transmitted to the Globalstar satellite network where they are monitored and recorded. The Xact product line targets IoT applications with its real-time monitoring capability.

While the SBS business has been the bigger of Schmitt’s two business lines, the Measurement business is in many ways the better of the two. The SBS business has long struggled with profitability while the Measurement business has not.

The Measurement business has another interesting element – it has a recurring component.

Because its targeting real-time measurement of tank fill levels, customers pay for the data on a monthly basis. While sales of measurement products can be lumpy (this is what accounts for the poorer performance this recent quarter) Xact’s recurring monitoring revenue amounted to $367,000 last quarter, or about 35% of the segment’s total and up 16% year-over-year.

Gross margins of the combined Xact and Acuity businesses were 46% last quarter.

Xact also recently partnered with the start-up Tank Utility, which will offer their gauge readers to their customers.

Xact and Tank Utility can offer an industry-leading package of tank monitoring products and related monitoring services to the delivered fuels market, regardless of where customers’ tanks are located. Tank Utility’s leading-edge cellular technologies will cover customer needs wherever reliable cellular connections are available and Xact’s industry leading satellite-based solutions will fill in the coverage gaps with dependable service.

What you are left with a businesss that has a profitable and recurring revenue stream and is partially levered to the growing IoT vertical. I don’t think it is unreasonable to speculate whether the Measurement business should be valued similarly to the SBS business.

Real Estate

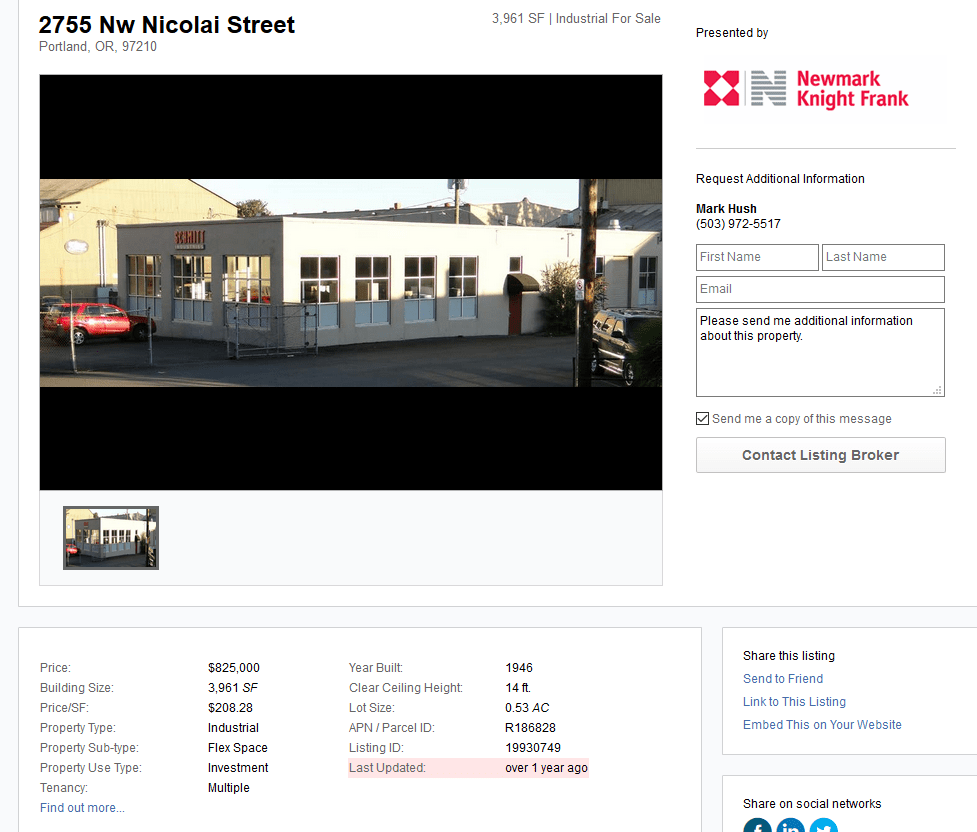

Schmitt owns 3 buildings with 40,000 square feet of real estate in Portland Oregon. As best I can tell, these buildings have two addresses: 2765 Nicolai St and 2755 Nicolai Street and comprise two offices and a manufacturing space.

The 2765 Nicolai Street address is where the company main offices have been.

The 2755 address, which is a 3,961 square foot office, was up for sale a couple of years ago for $825,000, or around $200 per square foot.

The 2765 address building is a lot bigger than the 2755 building at 7,712 square feet. It also appears to have had better upkeep, at least from the outside.

Though I wasn’t able to find a square footage associated with the manufacturing floor, I believe the rest of the building space is manufacturing space.

Part of the SBS deal is that Tosei agreed to a 10-year lease on at least part (maybe all?) of the facility.

Activist Investor

An activist investor approached Schmitt last summer and this started the ball rolling on what has so far resulted in a sale of SBS.

Michael Zapata and Sententia Capital sent this letter to Schmitt management. Zapata and Sententia own about 18% of outstanding shares of Schmitt.

Sententia followed up with a second letter in August where they became more hostile and nominated two board members. They also produced this research piece on the company. Zapata eventually took over as CEO in August of this year.

For more depth about the company I would recommend reading their piece.

The bottom line is that Schmitt should be worth at least $4 per share. Probably more.

While I don’t expect the Schmitt to become a multi-bagger, this seems to me to be a very, very well set up risk/reward situation. I am purchasing shares of Schmitt for what is basically the cash value. They have sold less profitable of their two businesses and now have what I would suspect to be the easier task of selling the profitable one.

In Sententia’s report they valued the SBS business at essentially what they sold it for.

If they are similarly prescient on their estimate of the Accuity and Xact businesses, sale proceeds would be $6 million to $8 million. This would mean $1.50 to $2 per share.

In addition, Sententia estimates that the real estimate is worth another $7 million to $9 million. This would be another $2+ per share.

While I don’t know if all this value will be realized, I think it is safe to conclude what Sententia’s intentions are. In one of their letters Sententia expressly said that they would sell the Accuity and Xact business lines if given the chance.

After the sale of SBS it seems likely that the intent here will be to sell the entire business and realize the value. As much as I like the Xact business, stand-alone this seems to small for a public company and I suspect Sententia would feel the same way.

I made Schmitt one of my largest positions after the stock opened on Thursday. I added to that position Friday. I think it is a very favorable risk/reward.