Week 340: Back Writing but Staying Cautious

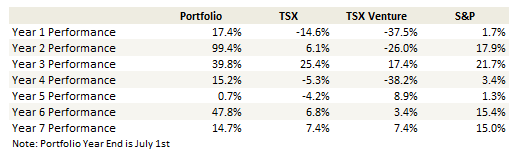

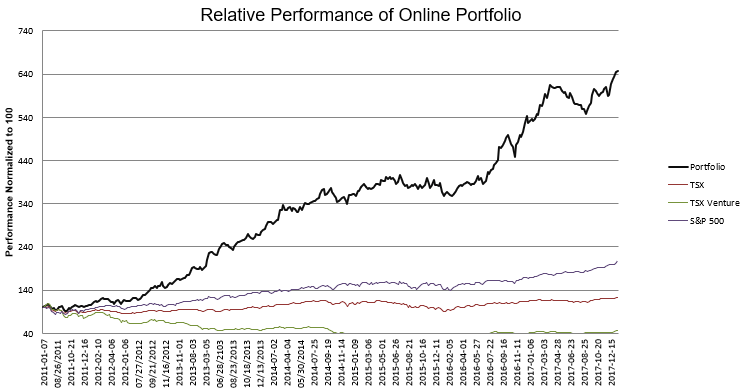

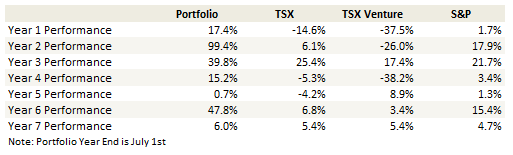

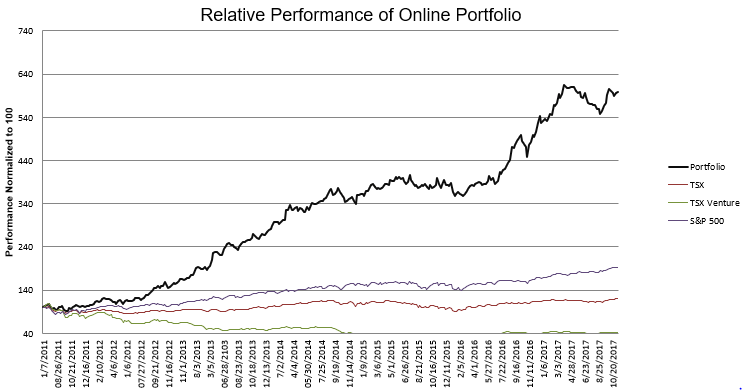

Portfolio Performance

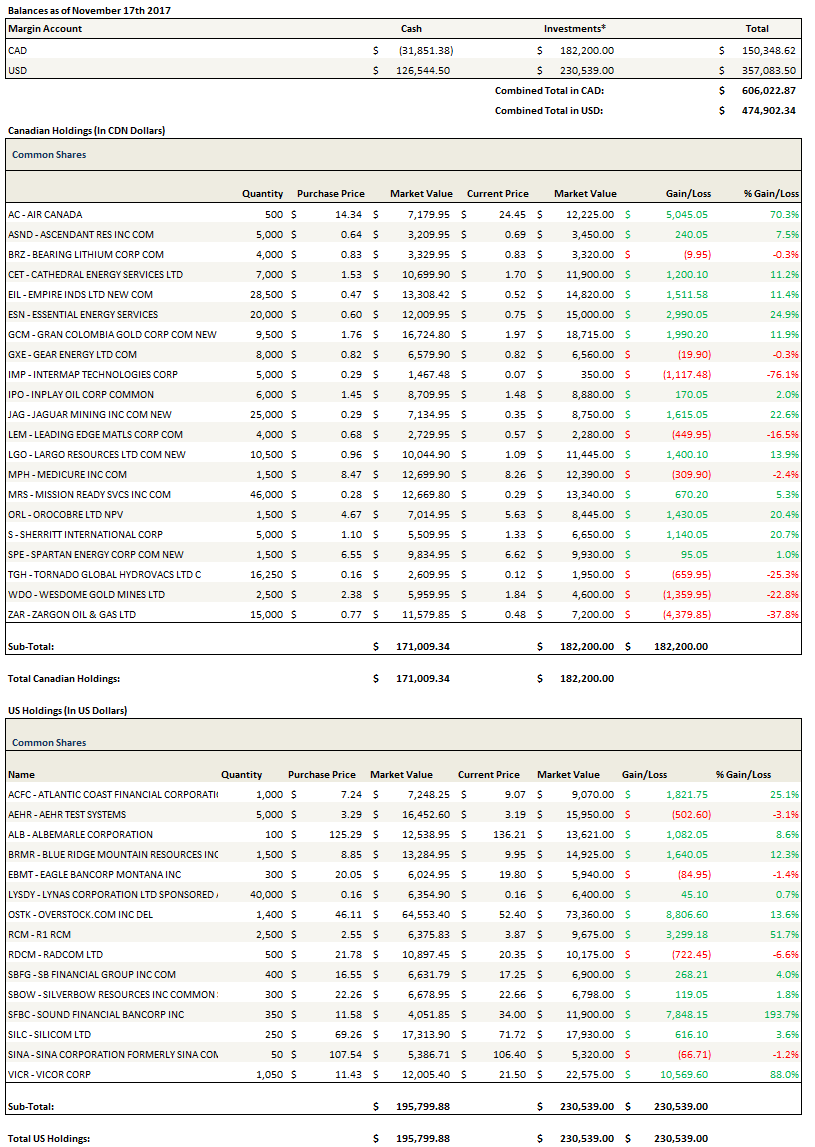

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

I’m back!

Its been a month and a half since I have written. I was on vacation for the last 3 weeks and before that I was so focused on learning about blockchains (and Overstock) that I didn’t have much time to put my thoughts down. I should get back to more regular posting going forward.

Overall, my portfolio is doing okay. I’m keeping up with the S&P, primarily thanks to Overstock. I have a high cash level, which hurts when the market is going up like it is, but I just can’t bring myself to larger exposure when the market seems so lofty. If the S&P keeps going up like it has been, and barring another Overstock type move in one of my small-caps, I will likely continue to struggle to keep up with the index. I’m okay with that.

Overstock

Since the last time I wrote the only big thing that has happened is that Overstock worked. After a big run up I reduced my position down to a more reasonable level before Christmas. It was simply too big. Its not very often that an investment causes me to lose sleep, but when Overstock was a 30% position, a level that is unheard of for me, it was doing that. I reduced too early of course, in the low-$70’s. I remain holding a more modest 5% position in the stock, which means it remains large, but not to the ridiculous degree it was before.

Apart from position size, I had a few other reasons for reducing Overstock.

First, after reading the offering memorandum for the tZero ICO, it looks like Overstock hasn’t started developing the ICO trading platform. So this is still early days.

Second, in that same documentation there was no mention of the stock lending platform, which I had been hoping for an update on.

Third, and I might be wrong about this because I’ve heard to the contrary, but it appears to me that the tokens are locked up for a year before they can be traded, which if true removes the upside of “price discovery”, or maybe bubble-discovery if you prefer, that I had been hoping for when the tokens became free trading.

Fourth, Byrne has been on the circuit giving interviews and his comments aren’t always consistent. I’m still not exactly sure what his plans are with e-commerce, yet I feel like at $75 the stock is pricing in some expectation of sale and a premium price. Take for example these comments. They were actually made after I reduced my position, but illustrate how uncertain the direction here is.

“Maybe it’s about time we stop seeing Overstock as two separate businesses,” he said. “Our retail platform had 40 million unique people come to it last month. So as we’re developing these blockchain applications, these blockchain companies, the retail business is an extremely valuable retail business to have in terms of bringing awareness and traffic to the blockchain properties that we anticipate developing.”

It doesn’t seem like the thing you would say if you were in the mid-stages of selling the business. So I’m not sure what to expect next.

Blockchains

More broadly, while I am very excited about blockchains and what they can do, I also think this is a long game and we are in the very early innings. I dedicated a significant amount of time over the last two months to blockchain research. I read books and a whole pile of white papers on individual companies. I think the opportunity is real, but it is mostly still in a very speculative stage where picking winners is hard.

I started to make some investments in the token space over the past couple of months. They have gone well, but mainly because the whole sector went crazy in December and not because of any particular insight I had. The token space is insane of course. It makes no sense to me that they have valuations in the $100’s of millions or billions of dollars when in many cases there isn’t even a platform yet. Moreover when you read many token white papers, the structure is often premised on a reasonable transaction fee that would seem to me to be negated by the current token valuations.

Nevertheless, the momentum could continue for some time yet. This is because A. there is a real value that will eventually be realized in blockchain applications, much like there was real value the internet in the 90s, so there is a basis for the enthusiasm, and B. the moves thus far have been mostly retail dollars and if even a sliver of fund gets involved in the next year the bubble should inflate further.

Apart from the tokens, I’ve been in and out of a few different blockchain related stocks over the last couple of months but I’m reluctant to mention them because they are generally pretty sketchy and you buy them for the single reason that you think someone else will buy them higher in short order.

Its all pretty insane. On the token side, let me just take Factom for example, which I pick because it actually seems like a solid platform and could eventually have all kinds of uses, it has backing and is established and it has an Overstock connection. It also has a $525 million capitalization for the token. If you assume that all of the economic benefits of the platform confer to the token holder, that means the platform is worth $500 million already? This isn’t a hit on Factom, they are really interesting and maybe someday when services use their platform to tie in mortgages and deed titles and stock ownership into their platform then that valuation will be reasonable, but man, $500 million? All these tokens are trading at multiples that suggest the platforms are mature and with robust usage. And we just aren’t that far into the game yet.

The irony is that the valuations perpetuate themselves. You end up trading on relative values and picking up “cheap” tokens that are in reality extremely expensive in their own right. I bought another token called Tierion because it seemed like a reasonable alternative to Factom at ¼ of the price. But its still a $100 million market cap for a platform with still limited utility.

It’s all pretty crazy, but I bet it has further to go before it ends.

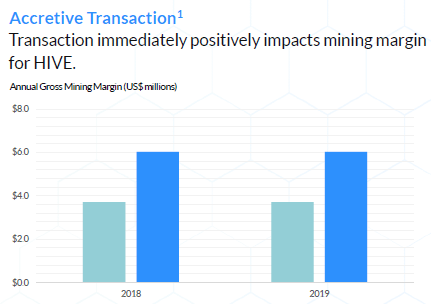

On the stock side of blockchain the only one (other than Overstock) that I find somewhat interesting is Global Blockchain Technologies. The stock is expensive (around $175 million market cap at current prices), they provide only a fuzzy idea of what their assets are (crypto mining and a token fund) and they have a ton of cheap warrants outstanding that are likely keeping a lid on the price. So those are the reasons not to own it, or maybe to short it.

But I think there could be an interesting short-term play with the stock. The chairman of Global Blockchain is Steve Nerayoff. He seems to get a lot of flack on twitter, many think he’s nothing more than a promoter. They may be right. But he also happens to be a strategic advisor to tZero. In these two positions it would seem to me that Nerayoff basically has two responsibilities. A. to find tokens for Global Blockchain to invest in, and B. to help make the tZero ICO successful. So it seems like a reasonable speculation that Global Blockchain picks up a piece of the tZero ICO. News of the Kodak ICO investment (which is only about $2 million), briefly sent the stock up 45%. I have to think that similar news with tZero would be regarded with equal or even more exuberance.

Commodities

As I alluded to earlier I have been reducing exposure to stocks. Apart from a speculative blow-off its hard for me to add to positions with the market having run so far and with it being so long since the last correction.

However I have been willing to add to my commodity stocks. I continue to hold a number of base metal names, mostly those with ties to electric vehicles and batteries. I note that Largo Resources has had a nice run up, even after the company diluted shareholders once again at bargain basement prices. I also continue to own Lynas, Ascendent Resources, Leading Edge Materials, Bearing Lithium, Mkango Resources (very small position), Sherritt International and Norilsk Nickel. Ascendent Resources announced fourth quarter production numbers on Friday and while mixed, they are still making progress on the mine ramp. The stock is trading at roughly 4x free cash flow if they can reach their 2018 guidance.

Gold stocks have not done much of anything and interest in the miners must be at record lows. I’ve heard a few people articulate the theme that bitcoin interest is eclipsing gold and that the metal will continue to suffer as a consequence. I’m not so sure about that. Gold dynamics are so complicated, with factors from jewelry demand, Indian economics, Central bank proclivities and of course investment interest from individuals and institutions. I have found that trying to predict the direction of gold from any single thesis usually turns out to be wrong.

What seems to be the best predictor of gold and gold stock movements is sentiment. When everybody hates gold stocks, that is when they will go up. And vice versa. This is primarily what my thesis is here. Nobody wants to own gold stocks, so I think they will do well.

My largest gold stock position for some time has been Gran Colombia, and I really like the way the chart is setting up here. I think the agreements they signed back in the summer with the artisanal miners give a legitimacy to their business that they haven’t had in the past. If the market agrees with me the stock will go higher.

I have smaller positions in Jaguar Mining, Wesdome, Alamos Gold, New Gold and Orvana Minerals.

I also have a bunch of oil positions, though I’m a little more reserved about these. Oil just seems to have such a dismal longer term outlook to me. I know that the dominance of electric vehicles and renewable power is still a ways off, but I think its inevitable, and I wonder if it accelerates faster then anyone expects as the momentum snowballs.

But in the short term I doubt the market will look far enough ahead to care about that eventuality. Right now oil inventories are dropping and with oil prices at current levels, the stocks look pretty attractive. I still like the Canadian services names the best. The three I own are Cathedral Energy Services, Aveda Energy Transportation Services and Essential Energy Services. All of these companies trade well below book and have seen improving results over the past few quarters as oil prices have firmed. I would expect that to continue in the coming year.

On the producer side I still own Spartan, Gear Energy and InPlay on the Canadian side and Silver Bow and Blue Ridge Mountain on the US side. Blue Ridge Mountain is one of the few gas names that hasn’t moved at all over the past month. This is because it doesn’t trade at all. The company sold their Eureka Midstream interest in September for almost double of what the assets were held at on the balance sheet. In the process they reduced their operating costs, gave them more flexibility for drilling and freed up prospective land that had previously been tied up due to proximity to the pipeline. The company is now a pure play on the Utica/Marcellus. It’s got to be worth at least $12 or $13 if not much higher, given the run up in other gas names.

Other Stocks

Just some brief mentions of a few other names in my portfolio.

Aehr Test Systems had a good quarter and announced a new customer for their FoxXP test system. There is still a lot of selling pressure on the stock, pretty much every pop is sold. If you read through the third quarter conference call its hard not to come away enthused about their prospects. They have unique technology that provides a tangible efficiency benefit for testing many of the new components that are being developed. Its just a matter of bringing in more customers and building momentum. I’ve added to the stock on weakness in the last couple of months.

I’m still holding Mission Ready Services even though the company hasn’t announced its first PO yet. I came away from their December 7th conference call with many of my fears allayed, in that they seem to be building a legitimate business. The research I have done on the people they’ve brought on-board and what I’ve already described about the products (and technology) itself make me inclined to wait it out until the first order and hopefully some other good news. However, the stock is under pressure and probably will continue to be as long as there is no announcement and more existing investors get frustrated and leave.

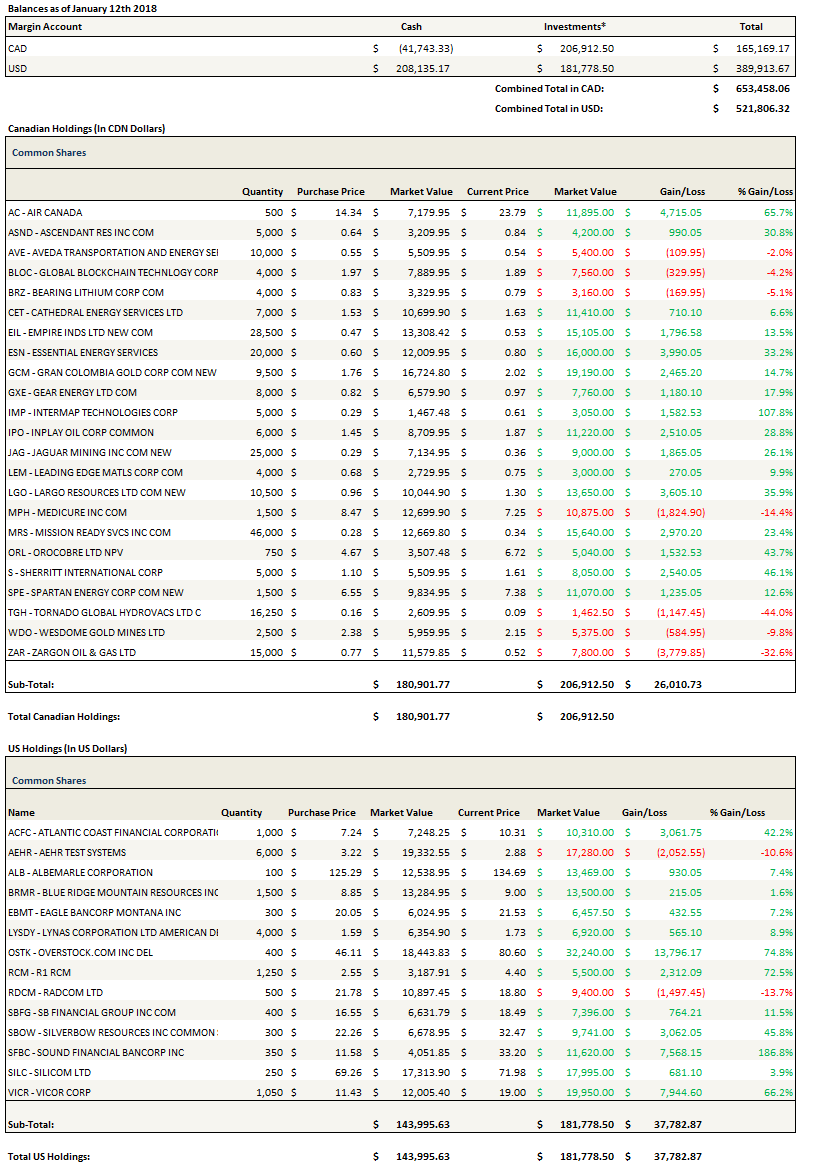

Portfolio Composition

Click here for the last eight weeks of trades. Note that the prices below are as of Thursday, January 11th.