The upside is not reflected in King Digital

I added a new position in King Digital Entertainment (KING) this week.

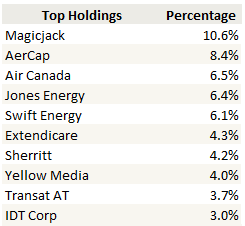

I discovered the company while perusing through 13-F filings. I search for hedge funds that have performed well in the last few years and look for tickers of either large or growing positions in those funds. I found King via a fund called Steadfast Advisors.

King Digital is out of my usual area of competence. The company is a video game developer and I have never invested in a video game developer before. I’m not much of a gamer. Nevertheless the company is extremely well-priced for scenarios outside of a collapse of the business, and I am an avid opportunist of market inefficiencies.

King is also a busted IPO. The stock priced at $22 in March and is now $16. The timing of the IPO was bad, both in terms of the market and the business. It was a bad time for the market because tech has taken a pounding. It was a bad time for the business because the biggest grossing game (by far) in the history of the company, Candy Crush, was beginning to go into decline. Read more