Taking a position in a recent IPO moonshot: Ichor Holdings

Over the last couple of weeks I spent my spare time listening to presentations from the Needham conference.

Most of what I heard was pretty boring. A few were from companies that I own (Radcom, Radisys, DSP Group, Oclaro, Nimble and BSquare) and I adjusted a few of my positions upon review (I reduced Radcom a little, added to Oclaro). But most were new companies that I haven’t heard of before.

I was on the lookout for a good idea and I think I found one. The company is called Ichor Holdings. They provide fluid delivery systems for semi-conductor equipment manufacturers. In particular they produce two products, one a gas delivery sub-system and a chemical delivery sub-system.

The stock was an IPO in December (here is the prospectus). The IPO went for $9, which was a steal. It’s over $15 now, which means its traded up significantly.

I bought some at $14. I haven’t mentioned the stock until now because I kept waiting for a correction so I could buy more (well it came briefly one morning when it dipped into $12’s for a couple minutes but I was at work and not available – argh). So now it broke out and I’ve given up. I probably am rushing this write-up out a little, but given the move in the stock I feel like if not now then maybe never.

So you are looking at a stock here that is up almost 50% in the last couple of months. Caveats apply. Nevertheless, here’s what I think, why I bought it at $14 and you can choose if you want to wait for a correction or not.

There is a narrative for not waiting.

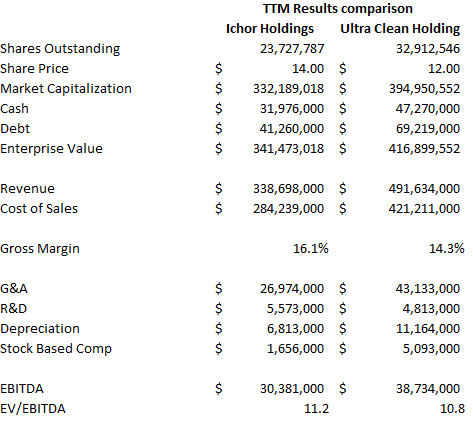

There are two big players in the outsourced semi-conductor equipment market that manufacture fluid delivery sub-systems: Ichor and Ultra Clean Holdings. These are fairly similar companies. I think that Ultra Clean also does some more general component manufacturing and Ichor has a chemical delivery business, but overall the two companies are comparable.

Ichor and Ultra Clean compare favorably based on TTM results.

Everything seems reasonable so far. But here is where it gets interesting. Both companies pre-announced very strong fourth quarter revenues in the last few weeks. Here is Ichor’s announcement and here is Ultra Cleans.

Ichor’s revenue growth in the fourth quarter was a rather incredible 104% year over year. There was a small acquisition (Ajax, which contributed $13.4 million in revenue since it was acquired in April 2016) that brought the company into the chemical delivery business but apart from that it was all organic growth. Ultra Clean had an impressive 67% year over year growth. Again, organic.

Ichor said that revenue in the first quarter would exceed the fourth quarter. So we have at least three more months of this tremendous growth.

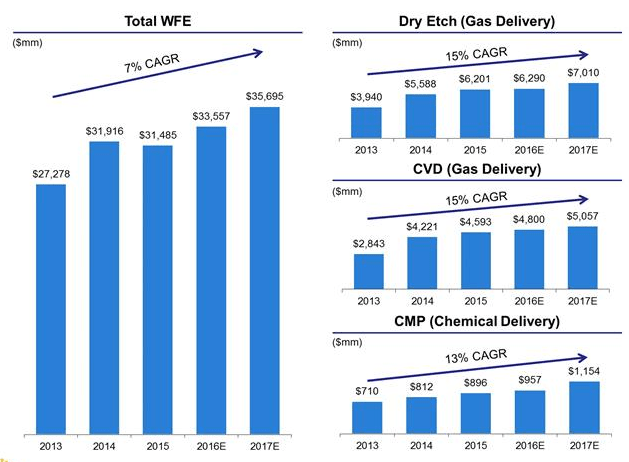

There are a couple of takeaways from Ichor’s and Ultra Clean’s Needham presentations (here and here) that help explain the growth. First, both are benefiting from decent wafer fab equipment demand growth, around 6%.

Second, as chip complexity increases and moves to “multiple patterning, tri-gate, or FinFET, transistors and three-dimensional, or 3D, semiconductors” (eg. 3D NAND), deposition and etch sub-systems growth becomes even stronger (Ichor says 15%). Each layer that is added to the chip requires another etch, deposition and CMD step. Ichor says this dynamic in the market only began in the second half of last year and is “still in the early innings”. The following is a slide from Ichor’s presentation:

Finally, their customers, the OEM process tool providers (LAM, Applied Materials, etc), are outsourcing more of the equipment manufacturing, so Ichor and Ultra Clean are gaining share that was previously held by their customers.

Ichor has the added bonus that they are growing their chemical delivery business at an even faster rate. I think that the acquisition of Ajax earlier this year brought them into the business, but they may have had a small footprint prior.

The chemical delivery business (via Ajax) was a single digit million revenue business a few years ago but has grown 10 fold the last few years. They currently have 10% market share so there is room for further growth.

Ichor doesn’t provide a detailed breakout of revenue between their gas delivery and chemical delivery businesses but did say at Needham that Chemical was about one-ninth of revenue and they could see it getting to one-third.

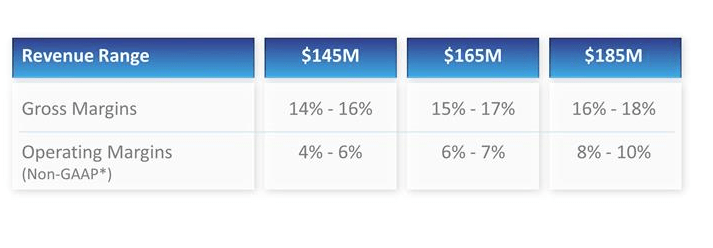

The other consideration that applies for both companies is the business model has good leverage to revenue increases. While Ichor was a little vague on this, only saying that they have a “variable cost structure that drives highly leveraged earnings model”, and that their operating costs remain relatively flat as revenue increases, Ultra Clean was more specific, providing the following table in their slide deck at Needhams:

So I took a reasonably sized position at $14. I’m willing to watch how this plays out over the next few months. But I look at this as more of a trade. If the stock gets up to $20 in the next couple months, I’ll be a seller.

So I took a reasonably sized position at $14. I’m willing to watch how this plays out over the next few months. But I look at this as more of a trade. If the stock gets up to $20 in the next couple months, I’ll be a seller.

The thing is, I don’t know how long this cycle is going to continue. It will turn. I haven’t done a lot of work on the semi-equipment cycle and I don’t even know where to start to determine when that inflection occurs. And surely the kind of revenue increase we saw in the fourth quarter isn’t going to continue forever.

Nevertheless, with the fourth quarter numbers that Ichor has guided to, they are trading at well under 10x EBITDA (I didn’t run any scenarios yet so I can’t say exactly where I think that ends up). They are an IPO, which means they are under-followed and probably being estimated conservatively by analysts. And they have already forecast at least one more quarter of significant growth. So the runway is clear for another few months. I’ll look forward to any pullback.