Precision Therapeutics – Buying into the Sales Ramp

Precision Therapeutics (AIPT) is roughly a $12 million dollar market cap company. They have 11 million shares outstanding and no debt. After a January share and warrant capital raise (which I am including in my share count) they should have about $4 million of cash on hand. They also have a $1 million note receivable from joint venture partner Cytobioscience.

The recent share and warrant raise diluted shareholders significantly. The placement was for 2.9 million units, consisting of shares at $0.95 and 0.3 warrants prices at $1 per share. This was a $1.50 stock as recently as November.

Precision raised the cash because they are burning cash. I estimate cash burn per quarter is about $1 million per quarter. This will probably continue.

Those are the facts, most of them not pretty. So why did I take a position?

The STREAMWAY System

Precision markets a medical fluid waste disposal system called the Streamway System. The system is a wall mounted device located in the operating room. During procedures surgical waste fluid is continuously removed via suction, passed through proprietary filters, measured and recorded, and then passed directly into the building’s sanitary sewer.

This is very different than traditional waste handling during procedures. Competitive solutions use mobile carts and disposable cannisters that have to be replaced, often multiple times during the procedure, and in many cases treated with gels to minimize the chance of contamination. Even so, accidents occur and they are expensive. Hospitals spend $4,500 on average for a mishap.

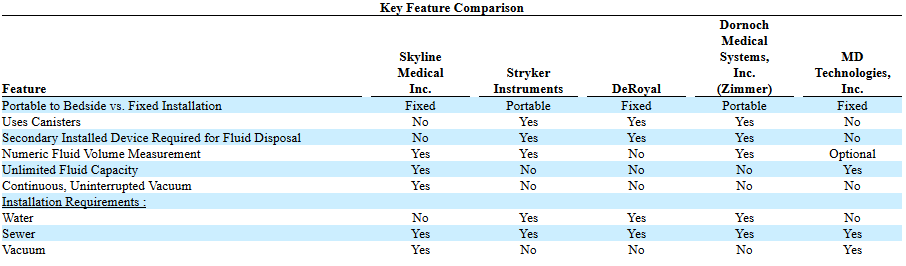

Here is a look at Streamway (Skyline is the former name of Precision) and its competition:

The Streamway system has a number of advantages over incumbent waste disposal options:

- Price: Cost of the unit is similar to slightly less than competition (Stryker system plus docking station costs $34,000 though I suspect they have been discounting to try to squeeze Streamway), but the disposable cost is 1/2 to 1/8 of the cost of replacing cannisters

- Safety: no chance to spill fluid or to have an accidental catheter removal during a cannister change

- Labour: cannisters have to be changed during a procedure anywhere between 2-10 times. This is entirely eliminated with Streamway

- Accuracy: can more accurately estimate volume extraction than the manual estimation using cannisters

- Ease of use: removal of clumsy cannisters, latching, and replaces with simple instrument panel with instructions

- Time: Procedures do not have to be stopped to replace cannisters which can result into 20-50% faster surgery

The primary negative with Streamway is installation. It has to be hooked up to the sewage line and therefore the operating room needs to be shut down and the wall cut open to complete the install. This has been a sticking point, particularly as hospitals are not unhappy with the mobile carts they’ve been using. Precision has taken to emphasizing the improved safety of using Streamway.

The cost advantage of Streamway is significant. This is from the last 10-K:

A study by the Lewin Group, prepared for the Health Industry Group Purchasing Association in April 2007, reports that infectious fluid waste accounts for more than 75% of U.S. hospitals biohazard disposal costs. The study also includes findings from a bulletin published by the University of Minnesota’s Technical Assistance Program. “A vacuum system that uses reusable canisters or empties directly into the sanitary sewer can help a facility cut its infectious waste volume, and save money on labor, disposal and canister purchase costs.” The Minnesota’s Technical Assistance Program bulletin also estimated that, in a typical hospital, “. . . $75,000 would be saved annually in suction canister purchase, management and disposal cost if a canister-free vacuum system was installed.”

A second study, by the Tucson Medical Center, found similarly significant savings. They estimated they would save $22,000 per year in a single operating room. Bottle costs for the mobile unit they had installed previously were $107 per procedure. The Streamway disposable cost brings that down to $24 per procedure.

In general, the $24 price tag is a favorable disposable expense compared to the costs of replacing cannisters, waste disposal, gel costs and labor for the competing Stryker and Zimmer systems. Those systems need to have cannisters replace anywhere between 2-10 times depending on the procedure. The material and waste disposal costs can be between $25 – $100 (or more) and on top of that there are labor costs and the time cost of having to pause the procedure to empty the cannister. You add to that the risk of a contamination event (which is going to be a $4,500 hit) and its easy to see how Streamway saves money.

Struggling Sales

So you can make the argument that Streamway is a superior system. Nevertheless the company has had a horrible time ramping sales. On the third quarter conference call the CEO Carl Schwartz, came clean about what had been happening:

When I took over as CEO in 2016 like many of you I thought the Streamway System was a slam dunk…Nothing could have been further from the truth. We had two very entrenched competitors, Stryker and Zimmer, who have their units at most hospital facilities in the country. In addition they were able to bundle their units in with other operating equipment, offering substantial discounts. Furthermore, it became increasingly evident that many institutional hospital customers would not allow us to connect to the hospital sewer system because they did not want us to open the operating room wall. Given these challenges and the fact that their unit and ours effectively removed fluids, what was our competitive advantage? After several months of effort we discovered that our most competitive advantage was our ability to avoid the spread of infection in the hospital by eliminating any contact between the infectious materials and the patients and staff and we have been hammering that home where ever we present the Streamway system and in newspaper articles all over the country. As you know it has been a slow going but we are making substantial progress.

In addition to pressure from the competition in the United States, the company has been slow getting regulatory approval in non-US districts. Up until this year their sales staff and list of distributors was sparse. It was a situation where you had a solid, superior product, but it was competing against well-funded incumbents, and marketing and sales dollars were not enough to mount an offensive.

In fact it seems like management had begun to give up themselves. There was a failed merger with Cytobioscience in the summer. There was a subsequent joint venture with Helomics and a proposed one with Cytobioscience. Indeed even the strategy for 2018 includes the following statement:

To expand Skyline’s business to take advantage of emerging areas of the dynamic healthcare market. To this end, management is implementing a Merger & Acquisition strategy focused on finding and acquiring high-growth companies that have established operations and the ability to drive both revenue and capital appreciation for the Company, or entering into strategic relationships with these companies.

Even if management was just being strategic with its new diversification approach, investors were frustrated. Listening to conference calls in 2017 is a painful exercise. Lots of frustrated investors, many of them long time investors, having been expecting a steep sales ramp, saw unit sales trickle in a 1 or 2 a quarter and the share price lag.

With cash levels dwindling, management had to raise capital with the dilutive raise I mentioned previously. That, along with the failed Cytobioscience merger, was likely the last straw for many investors.

As a consequence, the share price hasn’t done well. The one year chart illustrates the disappointment:

Things are turning

I’ve had Precision Therapeutics on my watchlist for the last 6 months. I can’t remember why I added it, I’m pretty sure it was mentioned by someone on twitter though I don’t remember who. When I looked at it a number of months ago I thought they had an interesting product but there was no indication that they were gaining any sales traction. So I passed.

However that appears to be changing. In early January the company announced that they had sold 5 Streamway systems in the fourth quarter. They sold another 6 systems in January alone. I wish I had been paying a bit closer attention to the company when this news release came out, as I would have probably started buying it back then.

I did pay attention to the second news release that came out last week. Precision projected 100 systems sold in 2018 from the United States alone. I caught the stock soon after it jumped on the news.

Precision sold 10 systems in 2017. This includes at least 1 system sold in Canada. So the projection for 2018 is for at least 10x 2017 sales.

While up until now sales have drifted aimlessly, the company has been doing a lot of work behind the scenes that has set themselves up for this type of increase. They have:

- Hired 4 regional sales managers and a VP sales in early 2017. Up until the end of 2017 they had a single regional sales manager and no VP Sales.

- Signed a contract with Vizient, which is a healthcare improvement company with a $100 billion in purchasing volume, in the summer

- Partnered with Intalere, a health care supply chain manager

- Signed a 3 year agreement with Alliant Health, a Service-Disabled Veteran-Owned Small Business that sells medical device products to the federal government, to sell STREAMWAY to into Federal Hospitals

And while early sales have been sporadic, they do mark first steps toward greater penetration, opening up the opportunity for more significant deployment once the systems benefits are experienced. Take for example, the two units sold in the third quarter. Both sales were to single operating rooms across much larger hospital networks, in one case a 6 facility network and in the other a 11 facility network. On the third quarter call Schwartz said they were in discussions to standardize waste management across each network.

Foreshadowing the increase in sales, Precision did 92 demos in the first three quarters and equaled that amount in the fourth quarter alone. They did 145 quotes in the first 3 quarters, and more than 75 in the fourth quarter.

International sales have been even slower to come then domestic, but in the last 6 months Precision has made some strides there as well. In June they got the CE mark for the system, which allows them to start selling the devices into Europe. Later in the year they partnered with Device Technologies, which will be selling Streamway in Australia, New Zealand, Fiji and the Pacific Islands (they seemed quite excited about the Australia opportunity on their third quarter conference call). They added a distributor in Canada as well as have been selling systems directly. They added another distributor selling into Switzerland in November and opened a European office a few days ago. Its worth pointing out that the 100 unit sales projection is not including any sales outside of North America.

One time and Recurring Revenue

Streamway systems retail for about $24,000 per unit. 100 units should equate to around $2.4 million in revenue.

That will be a big uptick from 2017 revenue. The company has been printing quarterly sales in the $100,000-$150,000 range for the last few years, so the 5 Streamway units sold in the fourth quarter and the 6 and January should provide a nice revenue ramp.

However maybe the more important consideration is that as more Streamways are installed into operating rooms, recurring revenue will scale as well.

Precision generates recurring revenue from the sales of disposable filters and cleaning fluid. According to the 10-K, the filter and fluid retail for $24. The company recommends changing the filter and cleaning the unit (with the fluid) after every procedure.

I think hospitals are doing this more like every 2-3 days. Nevertheless, Precision has been generating about $100,000 of revenue per quarter from the sales of the disposables. Given that there is about 100 units currently in operation, it works out to $1,000 of revenue /unit/quarter. While the company doesn’t provide margins from disposables, its pretty easy to estimate them. In the second quarter no Streamway units were sold, and the company generated $106,000 at 80% gross margins.

It looks like the average operating room performs 2-3 surgeries per day. If hospitals actually used the disposables after every surgery, I estimate revenue would be more like $4,300 to $6,500 per quarter per unit sold, or over 4-6x what I estimate it is now. That’s a lot of reason to promote proper usage.

Even at the current disposable usage rate, 100 extra units means $400,000 more high margin recurring revenue annually. Add that to existing consumable revenue, and add on the $2.4 million from unit sales, and I get annual revenue of about $3.2 million for 2018.

CRO Joint Ventures

Probably because Streamway sales have been slow, management has looked to alternative lines of business to boost interest in the stock. The initiatives kicked off in the summer with an announced merger with Cytobioscience, a contract research organization (CRO) that specializes in testing the cardiac safety of drug compounds. The merger was subsequently postponed in favor of a joint venture in November, and at the same time a second joint venture was announced with Helomics, another CRO company.

As it stands now, Precision has a 25% ownership stake in Helomics and a $1 million loan to Cytobioscience. The joint venture with Cytobioscience was supposed to close by year end but I haven’t seen anything to that effect. Listening to the last conference, it seems like even the merger with Cytobioscience may take place once audits and accounting work are completed (it was suggested that the merger didn’t transpire because of auditing required on Cytobioscience before it could be merged with a public company). On the other hand this article, which I can’t read in its entirety, says that Cytobioscience walked away from the merger, so who really knows.

I don’t know what to make of these two joint ventures and the move into CRO. It seems like the CRO business is growing. Whether these companies are at the forefront is anyone’s guess. Cytobioscience said on the second quarter call that they expected $700,000 of revenue a month by the first quarter of 2018. Helomics, which specializes in customizing cancer treatment based on finding patterns with their patient database, is in a growing field.

I’m also not entirely sure why these companies want to merge with Precision. The Streamway doesn’t really have a strong connection to the CRO businesses that they operate from what I can tell. Precision does have net operating losses of $11 million that could be utilized against future profits. So maybe that’s it?

Just last week the Economist dedicated an article (and a cover) to the emerging field of using data to provide better diagnosis and treatment. The article talks about using AI to better customize treatment to patients. That is essentially what Precision will be trying to do in their partnership with Helomics.

Summary

Cash on hand should be enough to get Precision through 2018, and maybe further depending on how these sales develop and how much they end up spending on partnerships. If I ignore cash, the price to sales (P/S) multiple that the company trades at is 3.5x. Including cash its more like 2.5x.

Given the growth (10x the revenue in 2017), the margins (gross margins of 80%), and momentum in engagements across the United States and internationally, this doesn’t seem out of line to me.

The stock is hated by investors because it has disappointed for so long. There is a long list of bashers I’ve seen on twitter and a few on SeekingAlpha. None of these bashers have brought up a point that has concerned me though. They are mostly just rehashing past price declines.

I think the stock moves higher. At the very least it should get back to its November levels, which were above $1.50. If there is evidence that the strengthening of sales of Streamway is sustainable over multiple years though, that should just be the beginning. The recurring nature of the disposable sales adds a lot of value as more systems are installed. Finally, if the Cytobioscience merger becomes a “go” again, that would be another catalyst to the stock.

So you have a beaten down stock, pretty clear indications of sales momentum, and the outside chance that something bigger is announced. All around it seems like a decent bet.

Note: I have been told there is a SeekingAlpha article by Jonathon Verenger on Precision that is quite good. I haven’t read it yet because I wanted to write up my own ideas first without influence.