Week 279: Cautious on trade(s)

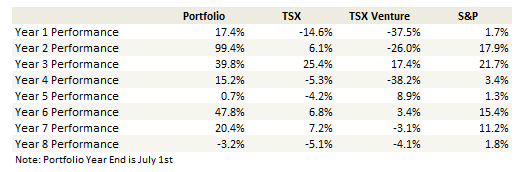

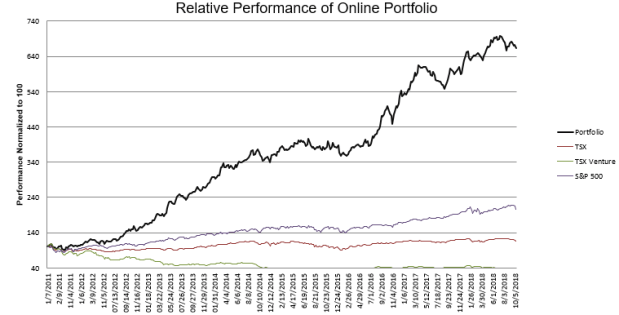

Portfolio Performance

Thoughts and Review

I haven’t written a post since my last portfolio update. Up until this last week I did not add a new stock to my portfolio. I have sold some stocks though. Quite a few stocks really.

I have been cautious all year and this has been painful to my portfolio. While the market has risen my portfolio has lagged. I have lagged even more in my actual portfolio, where I have had index shorts on to hedge my position and those have done miserably until the last couple of weeks. In fact these last couple of weeks are the first in some time where I actually did better than the market.

My concerns this year have been about two headwinds. Quantitative tightening and trade.

Maybe its being a Canadian that has made me particularly nervous about the consequences of Trump’s protectionism. With NAFTA resolved I don’t have to worry as much about the local consequences. But I still worry about how the broad protectionist agenda will evolve.

I continue to think that the trade war between the United States and China will not resolve itself without more pain. The US leadership does not strike me as one open to compromise. Consider the following observations:

Peter Navarro has written 3 books about China. One is called “Death by China”, another is called “Crouching Tiger: What China’s Militarism Means for the World” and the third is called “The Coming China Wars”.

In the Amazon description of Death by China it says: “China’s emboldened military is racing towards head-on confrontation with the U.S”. In the later book, Crouching Tiger, the description says “the book stresses the importance of maintaining US military strength and preparedness and strengthening alliances, while warning against a complacent optimism that relies on economic engagement, negotiations, and nuclear deterrence to ensure peace.”. The Coming China Wars, his earliest book (written in 2008), notes “China’s dramatic military expansion and the rising threat of a “hot war”.

Here’s another example. Mike Pence spoke about China relations last week at the Hudson Institute. Listening to the speech, it appeared to me to be much more about military advances and the military threat that China poses than about trade. The trade issues are discussed in the context of how they have led to China’s rise, with particular emphasis on their military expansion.

John Bolton’s comments on China are always among the most hawkish. Most recently he spoke about China on a radio talk show. Trade was part of what he said, but he focused as much if not more on the Chinese behavior in the South China Sea and how the time is now to stand up to them along those borders.

Honestly when I listen to the rhetoric I have to wonder: Are we sure this is actually about trade?

Is it any coincidence that what the US is asking for is somewhat vague? Reduce the trade deficit. Open up Chinese markets. Less forced technology transfer (ie. theft). Now currency devaluation is part of the discussion.

I hope that this is just a ramp up in rhetoric like what we saw with Canada and Mexico. That the US is trying to assert a negotiating position before going to the table and reaching some sort of benign arrangement. But I’m not convinced that’s all that is going on.

If this has more to do with pushing China to the brink, then that’s not going to be good for stocks.

I can’t see China backing down.

From what I’ve read China can’t possibly reduce the trade deficit by $200 billion as the US wants without creating a major disruption in their economy. Never mind the credibility they would lose in the face of their own population.

Meanwhile quantitative tightening continues, which is a whole other subject that gives me even more pause for concern, especially among the tiny little liquidity driven micro-caps that I like to invest in.

I hope this all ends well. But I just don’t like how this feels to me. I don’t want to own too many stocks right now. And I’m not just saying that because of last week. I have been positioned conservatively for months. It’s hurt my performance. But I don’t feel comfortable changing tact here.

Here’s what I sold, a few comments on what I’ve held, and a mention of the two stocks I bought.

What I sold

I don’t know if I would have sold RumbleOn if I hadn’t been so concerned about the market. I still think that in the medium term the stock does well. But it was $10+, having already shown the propensity to dip dramatically and suddenly (it had fallen from $10 to $8 in September once already), and having noted that Carvana had already rolled over in early September, I decided to bail at least for the time being. Finally there was site inventory turnover, which if you watch daily appeared to have slowed since mid-September. Add all those things up and it just didn’t feel like something I wanted to hold through earnings.

I was late selling Precision Therapeutics because I was on vacation and didn’t actually read the 10-Q until mid-September. That cost me about 20% on the stock. I wrote a little about this in the comment section but here is what has happened in my opinion. On August 14th the company filed its 10-Q. In the 10-Q on page 14 it appears to me to say that note conversion of the Helomics debt will result in 23.7 million shares of Precision stock being issued. This is pretty different than the June 28th press release, where it said that the $7.6 million in Helomics promissory notes would be exchanged with $1 shares. Coincidentally (or not) the stock began to sell off since pretty much that day.

Now I don’t know if I’m just not reading the 10-Q right. Maybe I don’t understand the language. But this spooked me. It didn’t help that I emailed both IR and Carl Schwartz directly and never heard back. So I decided that A. I don’t know what is going here, B. the terms seemed to have changed and C. it’s not for the better. So I’m out.

I decided to sell R1 RCM after digging back into the financial model. I came to the conclusion that this is just not a stock I want to hold through a market downturn. You have to remember there is a lot of convertible stock because of the deal they made with Ascension. After you account for the conversion of the convertible debt and all the warrants outstanding there are about 250 million shares outstanding. At $9.30, where I sold it, that means the EV is about $2.33 billion. When I ran the numbers on their 2020 forecast, assuming $1.25 billion of revenue, 25% gross margins, $100 million SG&A, which is all pretty optimistic, I see EBITDA of $270 million. Their own forecast was $225 – $250 million of EBITDA. That means the stock trades at about 9x EV/EBITDA. That’s not super expensive, but its also not the cheapie it was when I liked the stock at $3 or $4. I have always had some reservations about whether they can actually realize the numbers they are projecting – after all this is a business where they first have to win the business from the hospitals (which they have been very successful at over the last year or so) but then they have to actually turn around the expenses and revenue management at the hospital well enough to be able to make money on it. They weren’t completely-successful at doing that in their prior incarnation. Anyways, I didn’t like the risk, especially in this market so I sold. Note that this is an example of me forgetting to sell a stock in my online tracking portfolio so it still shows that I am holding it in the position list below. I dumped it this week (unfortunately at a lower price!).

I already talked a bit about my struggle and then sale of Aehr Test Systems in the comment section. I didn’t want to be long the stock going into the fourth quarter report. Aehr is pretty transparent. They press release all their big deals. That they hadn’t announced much from July to September and that made it reasonably likely that the quarter would be bad. It was and the stock felll. Now it’s come back. It was actually kind of tempting under $2 but buying semi-equipment in this market makes me a bit nervous so I didn’t bite. Take a look at Ichor and how awful this stock has been. Aehr is a bit different because they are new technology that really isn’t entrenched enough to be in the cycle yet. Nevertheless if they don’t see some orders its not the kind of market that will give them the benefit of the doubt.

BlueLinx. I don’t have a lot to say here. I’m not really sure what I was thinking when I bought this stock in the first place. Owning a building product distributor when it looks like the housing market is rolling over was not one of my finer moments. I sold in late August, then decided to buy it in late September for “an oversold bounce”. Famous last words and I lost a few dollars more. I’m out again, this time for good.

When I bought Overstock back in July I knew I was going to A. keep the position very small and B. have it on a very short leash. I stuck with it when it broke $30 but when it got down to $28 I wasn’t going to hang around. Look, the thing here is that who really knows? Maybe its on the verge of something great? Maybe its a big hoax? Who knows? More than anything else what I liked when I bought it was that it was on the lower end of what was being priced in and the investment from GSR showed some confidence. But with nothing really tangible since then it’s hard to argue with crappy price action in a market that I thought was going to get crappier. So I took my loss and sold.

Thus ends my long and tumultuous relationship with Radcom. I had sold some Radcom in mid-August before my last update primarily because I didn’t like that the stock could never seem to move up and also because I was worried about the second quarter comments and what would happen to the AT&T contract in 2019. I kept the rest but I wish I would have sold it all. In retrospect the stocks behavior was the biggest warning sign. The fact that it couldn’t rise while all cloud/SAAS/networking stocks were having a great time of it was the canary in the coal mine. As soon as the company announced that they were seeing order deferral I sold the rest. I was really quite lucky that for some reason the stock actually went back up above $13 after the news (having fallen some $4-$5 the day before mind you), which let me get out with a somewhat smaller loss. The lesson here is that network equipment providers to telcos are crummy stocks to own.

Finally, I sold Smith Micro. This is a second example where I actually didn’t sell this in the online portfolio until Monday because I didn’t realize I had forgotten to sell it until I put together the portfolio update. But it’s gone now. I wrote a little about this one in the comment section as well. The thing that has nagged me is that the second quarter results weren’t really driven by the Safe & Found app. It was the other products that drove things. That worries me. Again if it wasn’t such a crappy market I’d be more inclined to hold this into earnings and see what they have to say. They could blow everyone away. The stock has actually held up pretty well, which might be saying that. Anyways I’ll wait till the quarter and if it looks super rosy I’ll consider getting back in even if it is at a higher price.

What I held

So I wrote this update Monday and Vicor was supposed to report Thursday. Vicor surprised me (and the market I think) by reporting last night. I’m not going to re-write this, so consider these comments in light of the earnings release.

One stock I want to talk about here is Vicor, which I actually added to in the last few weeks. Vicor has just been terrible since late August. The stock is down 40%. I had a lot of gains wiped out. Nevertheless this is one I’m holding onto.

I listened to the second quarter conference call a couple of more times. It was really quite bullish. In this note from Stifel they mention that Intel Xeon processor shipments were up significantly in the first 4 weeks of the third quarter compared to the second quarter. They also mention automotive, AI, cloud data centers and edge computing as secular trends that are babies being thrown out with the bath. These are the areas where Vicor is growing right now (Vicor described their core areas on the last call as being: “AI applications including cloud computing, autonomous driving, 5G mobility, and robots”).

Vicor just started shipping their MCM solutions for power on package applications with high ampere GPUs in the second quarter. They had record volume for some of their 48V to point of load products that go to 48V data center build outs and a broader acceptance by data center players to embrace a 48V data center. There’s an emerging area of AC-DC conversion from an AC source to a 48V bus. John Dillon, who is a bit of a guru on Vicor, wrote a SeekingAlpha piece on them today.

I know the stock isn’t particularly cheap on backward looking measures. But its not that expensive if the recent growth can be extrapolated. I’m on the mind it can. Vicor reports on Thursday. So I’ll know soon enough.

The second stock I added to was Liqtech. I’ve done a lot of work on the IMO 2020 regulation change and I think Liqtech is extremely well positioned for it. When the company announced that they had secured a framework agreement with another large scrubber manufacturers and the stock subsequently sold off to the $1.50s, I added to my position.

I’m confident that the new agreement they signed was with Wartsila. Apart from Wartsila being the largest scrubber manufacturer, what makes this agreement particularly bullish is that Wartsila makes its own centrifuges. Centrifuges are the competition to Liqtech’s silicon carbide filter. If Wartsila is willing to hitch their wagon to Liqtech, it tells me that CEO Sune Matheson is not just tooting his horn when he says that Liqtech has the superior product. I’ve already gone through the numbers of what the potential is for Liqtech in this post. The deal with Wartsila only makes it more likely that they hit or even exceed these expectations.

Last Thought

I took tiny positions in three stocks. One is a small electric motor and compressor manufacturer called UQM Technologies. The second is a shipping company called Grindrod (there is a SeekingAlpha article on them here). The third is Advantage Oil and Gas. All of these positions are extremely small (<1%). If I decide to stick with any of them I will write more details later.

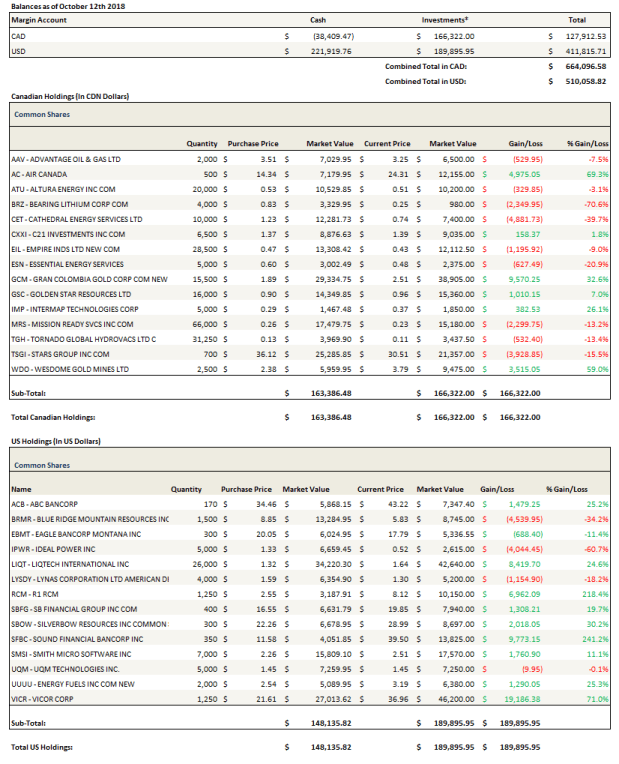

Portfolio Composition

Click here for the last seven weeks of trades.

How are you feeling about MRS, long stretch of silence!

Yeah I have no clue. Maybe its something with the deal? Maybe its because these are military contracts and there needs to be approvals with the DOD before it goes through? Maybe its just getting a financing done? I wish I knew!

Seems like Canadian energy is done. Good call probably. Still surprised you held ATU. They have cash but how long will they be able to grow production when they get next to nothing for WCS?

I dont think the WCS spreads that we are seeing will last forever. In fact I think they will likely narrow in another month or so. Your comments suggests you think otherwise – curious to know why?

I believe Canadian producers will keep pushing the limits of transport capacity for the next few years. It just can’t come on quick enough. They will it fill it with new production very quickly whenever Keystone etc come online. Of course pricing won’t always be so extreme and next few months it will likely improve. I’m confident WCS pricing will remain very volatile and differentials will remain between $15-40 (both rare extremes) for the foreseeable future unless we see drastic action by bigger players.

http://www.petroleum-economist.com/articles/politics-economics/north-america/2018/chill-in-the-air-for-canadian-drillers

Guess what happens when they suddenly do get pipeline capacity? A mini-boom until we are back at square one.

And let’s not forget you run the risk of a left-winged terrorist blowing up a pipeline or two.

Thanks for your thoughts. I guess my thought is more about where “square 1” is. I don’t think we are going back to $10 spreads but I also don’t think that $40-$50 spreads are the new norm. I think when the refinery outages are over, and as rail ramps further we see the $20-$25 spreads that most expected. At those spreads and at $70 WTI companies like ATU and GXE should do ok. Anyways, just my thoughts, and I certainly didn’t predict the blow out in spreads we are having now so take them with a grain of salt!

Energy Fuels Commencing Vanadium Production

…in Q4. I don’t think any of that is reflected in the market cap. They can produce very cheap Vanadium, there is the environmental clean up and Uranium starts moving.

http://www.energyfuels.com/news-pr/energy-fuels-commencing-vanadium-production-testing-new-approaches-to-mining-in-tight-vanadium-market/

Yeah I think so too. That has actually kept me holding onto the stock more than the uranium story.

BXC looks interesting again at $22. There is still pent up demand and if their synergies come through it is at least a $50m+ FCF business. So trading at about 4x FCF currently.

Yeah maybe. I’m not going to step back in there myself.

What do you think of VICR’s Q3 earnings. I liked the direction this company going and looking to start a position but almost every stock is getting cheaper by the day.

What do you think of VICR’s Q3 earnings and RMBL’s getting into used car business?

I was initially skeptical about RumbleOn buying Wholesale. The third quarter numbers, on the surface, weren’t very good. It was what I had suspected when I was watching inventory on a daily basis – in September the numbers flattened out/turned down and they couldn’t hit the unit number. I was surprised the ASP was down too. So when I saw the acquisition I was like hmmm, are they just trying to paper over a bad quarter?

But since then I’ve listened to the CC about 4 times and I’ve changed my mind. First, I’m not sure the quarter and the forward guidance are as bad as they appear at first glance. If you take management at their word, they changed their acceptance criteria for making cash offers, basically limiting offers to cases where they thought they could make at least $1,000/bike. Their “terminated” offers (meaning offers that they didn’t decide to make after the seller went through the trouble) went up from 2% to 15%, so a big increase. That slowed inventory and unit sales, which is what I saw on the site myself. But it also means that going forward they are selling higher margin bikes. They said that their ASP has been much higher in Q4 (anecdotally I saw that too at the end of quarter – that ASP of inventory has definitely gone up).

When I look at Wholesale, I get the lukewarm take on the acquisition. Wholesale margins are tiny, like 4.3%, so even with the volumes they have and even growing 15-20% that’s tough. Carvana has double the margins and the story there is margin expansion as they layer on services. But Wholesale can’t really layer on services because they are selling wholesale, not to consumers.

Therefore on the surface the acquisition kind of looks not that great. But it does look reasonably priced without question (as one analyst on the call pointed out they are getting the business at 12x income and asked why the owners would sell so low).

So that was my first take but I’m more constructive as I’ve thought about it more. Here’s how I’m thinking about it now:

How much would it take RumbleOn to create a platform and distribution network to populate their new car and truck online portal with 2,000 cars and trucks available to consumers, ramp their sales to dealer/auction up to 20,000 per quarter (building out that network in the process), and build the distribution network to manage the supply chain? I don’t know that number but I think its higher than $23 million.

So for $23 million they get immediate inventory that can go to the website, they get a built and operating distribution network to deliver to consumers, and they get, almost as an aside, the dealer purchasing vertical that Wholesale excels at and a couple of retail locations.

Yes margins at Wholesale are really low, but it’s because they buy from dealer, refurbish and sell to auction/dealer. So they seem to me to be essentially traders or arbiters. But I don’t think RumbleOn bought Wholesale because they were enamored with this dealer to dealerbusiness.

Wholesale also has a network and inventoyr that can be leveraged to more quickly build the higher margin consumer purchases and higher margin consumer sales that RumbleOn can add. RumbleOn has the automated cash offer system to drive consumer purchases which will be better margins. They have their site/app/brand to drive consumer sales.

I think that looking at Wholesale’s business as-is or trying to think about how RMBL will improve Wholesale’s existing business is the wrong way to look at this or at least missing the point – yes, they should be able to make incremental improvements on what Wholesale does through data analysis that improve decisions but that’s not the point IMO – the point is layering on the consumer online buy side with the cash offer model and consumer sales through the website, and leveraging Wholesale’s existing dealer network to maximize turns right from the start. Improvements to Wholesale’s existing business are peripheral to what they are really going for here in my opinion.

They said it multiple times on the call – RumbleOn is creating a supply side solution – they are demand side agnostic – consumer/dealer/auction – whatever. They need to be able to access each vertical and the more they can sell to consumer the better but unlike Carvana, Vroom, et al the focus is not sales to consumers. Its closer to the other way around – the focus is buying from consumers. They will sell whereever they can sell fastest to maximize turns. It’s the buy side that matter, procuring as much inventory from as possible from consumers while insuring it’s the right vehicle at the right price. If they get the buy side right the sell side sorts itself out. Wholesale fits nicely into this IMO.

So I like the acquisition. But I also think the logic behind it is complicated and I’m not totally sure the market will agree with me right away. So we may get more pain. Nevertheless, I’m back in the stock as of Friday.

What do you think of VICR’s Q3 earnings report?

So sorry about the repeat questions, i thought i was not able to post.

No problem. I have to approve comments if you don’t give information about yourself. I commented just now, updated it a second ago.

Thank you for the lengthy response. RMBL could be a very good investment indeed. I am watching and waiting at the moment for some stability…Good luck.