Portfolio Performance

(Note that I am now posting my portfolio composition and list of trades at the end of the post)

Update

I didn’t get around to writing an update last week because I was busy with other research that could not wait. So its been 3 weeks since I updated my portfolio and transactions and quite a bit has happened over that time.

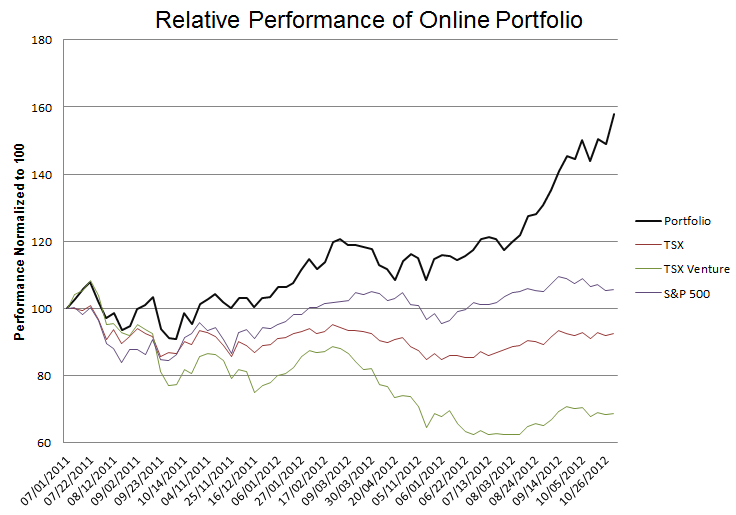

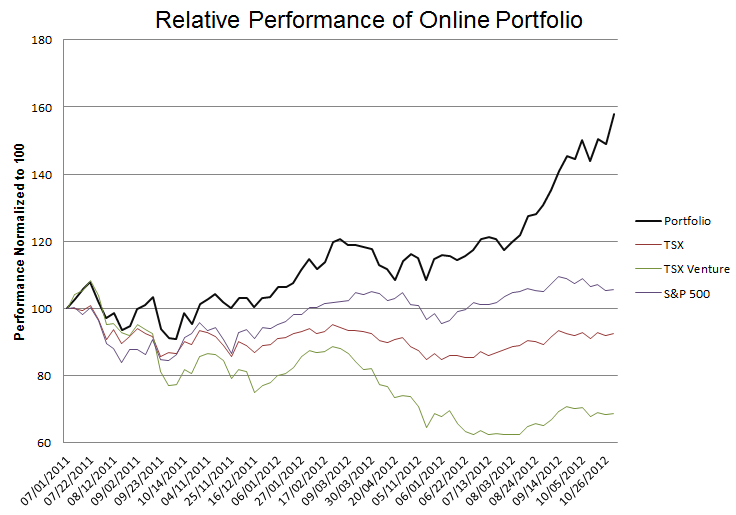

Over time my portfolio has slowly morphed into a vehicle for playing the housing recovery. I had large moves to the upside in a number of my housing related positions, with the most pronounced being of course Impac Mortgage (IMH), but also from Radian Group (RDN), MGIC (MTG) and a number of my regional banks with strong mortgage banking operations. Its been a good 3 weeks.

In this post I want to talk about some of the changes I’ve made over the last 3 weeks. To summarize:

- I sold out of all my gold stocks other then Atna Resources (ATN)

- I made a brief foray into, and then out of, US E&P’s

- I am out of JC Penney (JCP)… for now

- I am into Avenex Energy (AVF) and a homebuilder (HOV)

I will address each of these in order, followed by a brief discussion of what to expect from Nam Tai, which reports earning on Monday and of which I want to be clear of my expectations and actions. But first I want to talk generally for a moment.

Twitter

I’m finding that I am using twitter quite a bit to post what I am doing on a more regular basis. Whenever I find a relevant article, or if I start to buy a new stock, I try to put a post up on twitter. I have also found a number of folks on there that have been useful to follow. Its a useful tool, and has the advantage over the traditional message board format in that you follow a person rather than a subject. So you aren’t wading through garbage to find nuggets. You can follow me @LSigurd. Read more