Week 146: Some thoughts on agility

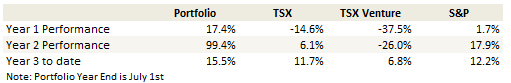

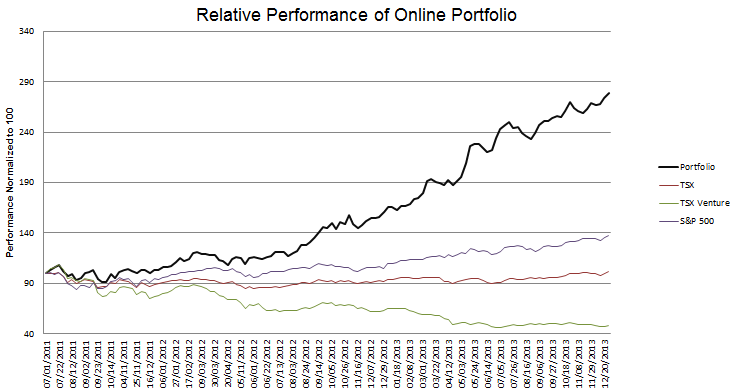

Portfolio Performance

See the end of the post for the current make up of my portfolio and the last four weeks of trades.

Recent Developments

Four weeks ago I wrote:

I think an important pillar of my strategy to take advantage of the concentration that I can have. I don’t have anyone pressuring me to be diversified or questioning my risk level or anyone to answer to if something goes wrong. So I don’t hesitate to have a large percentage of my portfolio tied to the names I think will perform the best.

With that said, the names that I am currently of the heaviest weight are, of course, Pacific Ethanol, which remains my largest position by far

Today Pacific Ethanol represents a 2% position for me. Read more