After 3 months of seemingly constant portfolio churn – rotating from shorts to gold to mortgage REITs to SaaS to banks at break-neck speed, in the last couple weeks my portfolio has had a period of relative calm.

The themes have been the same.

- Own gold stocks

- Own work from home/stay at home SaaS names

- Sprinkle in community banks with management teams you trust that will recover eventually

- As always – look for special situations that appear mispriced

If there is a change, it is that I am creeping more to the short side. Not truly short, like I was in February, but I have moved from my early June “not too far net long” description to “pretty much flat” today.

This is, as always, with gold being the wild card. I had a great day on Friday with the market down, and most of that was due to the gold stocks.

So why am I positioned cautiously? The same reasons that I described a few weeks ago. They can be summarized by – I don’t really believe it. On a few levels.

But there is one huge reason that I am not willing to replay my February playbook and go truly short here – the Fed.

I’ll describe these thoughts in more detail at the end (of what is a very long post, I apologize in advance). But first, the interesting stuff: the stocks.

Stay at Home/SaaS

I pride myself on having the only blog in existence that talks about gold stocks and SaaS names in the same post (tell me if I’m wrong about this). I’ll start with SaaS and then to gold.

My SaaS portfolio has seen some churn as I continue to try to figure out the sector. There will likely be more churn to come, but here is where I am at now.

The four large cap names that I own are Atlassian, Workday, Slack and Dropbox. Of the four, Slack is a very small position (because it is so expensive and they don’t generate free cash), while the other three are about the same size.

I have to say though, I’m not convinced about Dropbox. Its more of a “value” SaaS play, if there is such a thing. It doesn’t seem to have the growth outlook that other SaaS names have, and I don’t totally understand how it competes against Microsoft and Google in the long-run. So it would probably be the first name that I drop in a pinch.

The smaller names I own are more interesting to write about. I have bought Onespan, PagerDuty and Intellicheck.

Intellicheck has become one of my largest positions. Honestly, it seems like a no-brainer to me, even after this pop to the mid-$7s.

Intellicheck offers an identity theft/fraud detection platform to banks, which then provide the platform to their retail customers. It seems like a great customer acquisition model – they sign up banks and for every one they sign up that bank does the legwork to onboard a bunch of their customers.

Last week Intellicheck announced that they had signed up their eleventh bank. As @RodiGo_ethe dug up, this is likely KeyBank.

Even in this environment, the customer adds seem to be snow-balling for Intellicheck. They signed up Bank #8 at the beginning of the year, #9 and #10 somewhere in the March to May timeframe, and now #11 here in June.

So 4 banks on a base of 7 in 6 months? Seems pretty strong…

I could spend a whole post going through each bank. I’ve spent hours pouring over their conference calls and separating out the comments for Bank #1, #2, #3 and so on. Maybe I’ll put out a detailed write-up at some point, but for now here’s the Coles notes: they sign up a bank, it stumbles a bit out of the gate getting ramped, then it brings on a few retail clients, then a few more, then a few more, and so on and so on.

It is the ultimate land and expand strategy, but with the banks doing the heavy lifting.

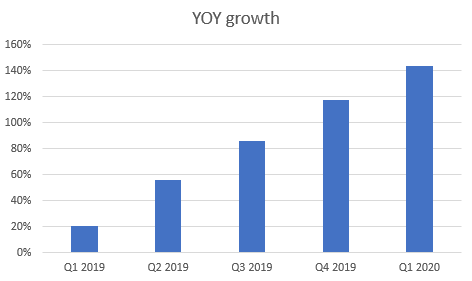

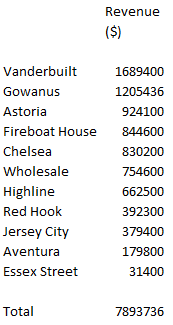

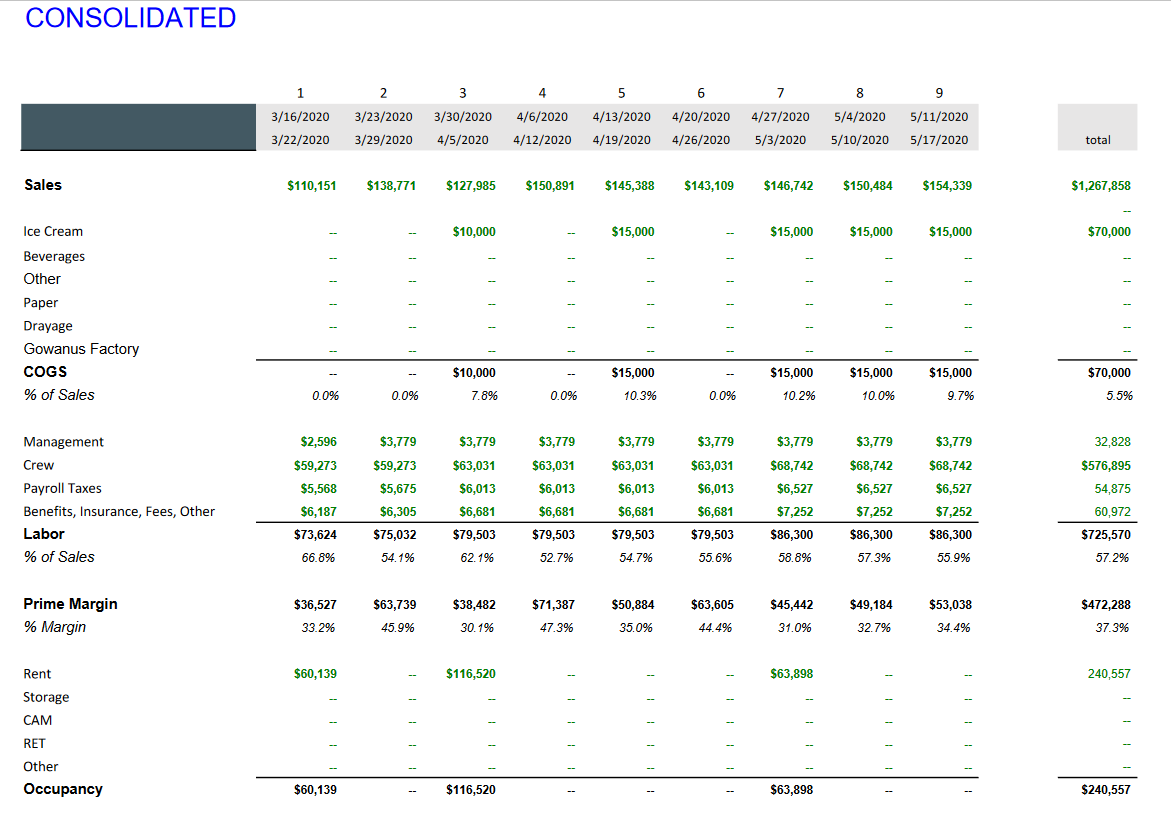

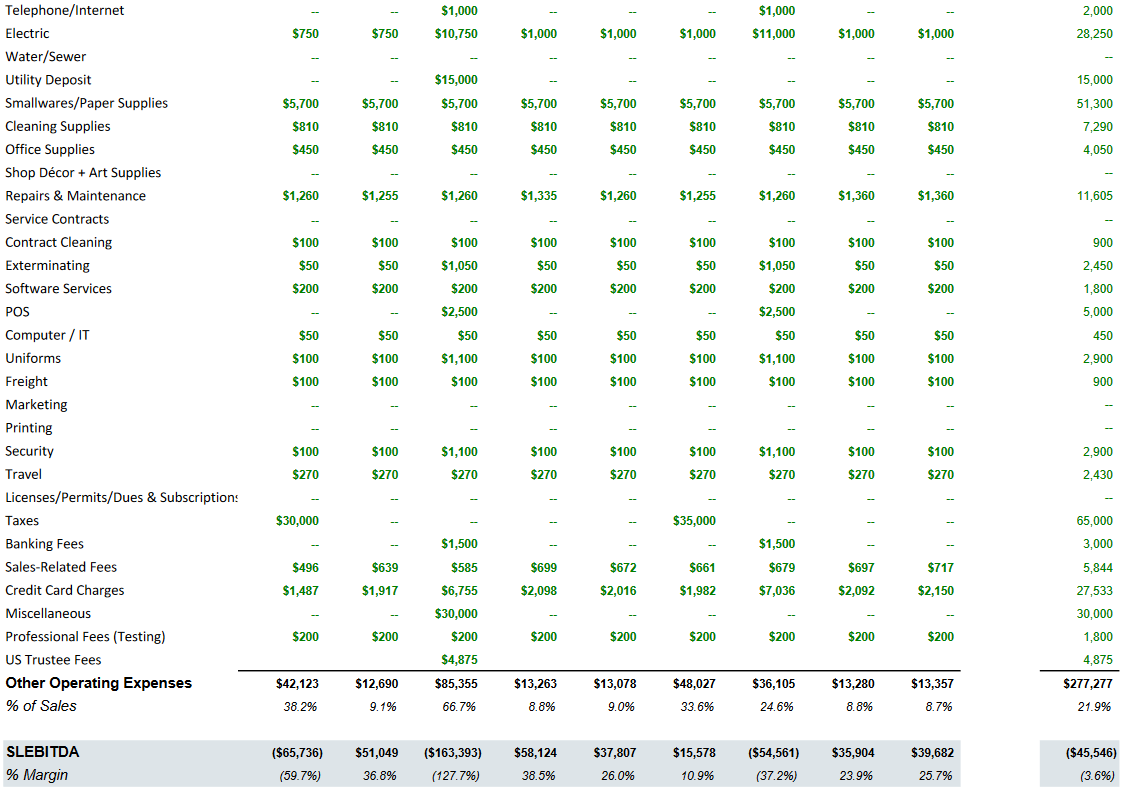

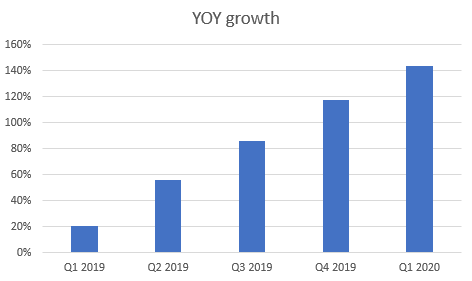

But here’s why this seems like a no-brainer to me. First, this is the year-over-year growth the last 5 quarters:

Second, at the price I have been buying it at, which is a little above the recent private placement price of $6.50, Intellicheck trades at ~11x EV/Sales.

In a world where 30-ish% SaaS growers trade at 25x sales or more, this seems mis-priced. Here we have a company with way higher (and accelerating!) growth, a large runway, a great land-and-expand customer acquisition model and they are free-cash-flow positive (before working capital changes).

I mean quite honestly, the stars are well aligned here.

The only pitfall is that this is a retail driven business. And retail is not in a good place. To make matters worse, Intellicheck gets paid on a per-use basis. So even though it is SaaS, this is not a COVID friendly business model. Intellicheck will gain from e-commerce, but will likely be hurt more by bricks and mortar.

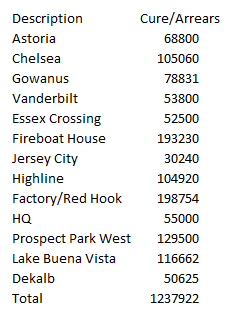

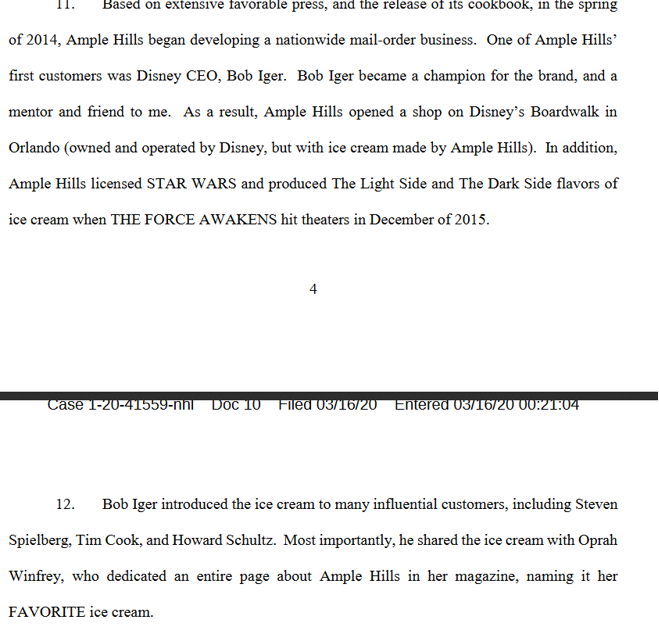

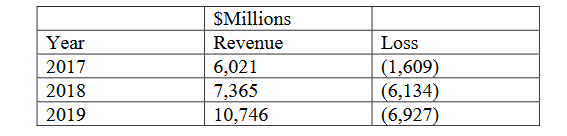

But that’s okay. It’s a bit like Schmitt and the ice cream business. A tough go for a while but this too will pass. I think Intellicheck will be extremely well positioned once we get through this pandemic.

OneSpan is another platform provider to banks.

I don’t know what it is about banks, but I am exceedingly comfortable owning banking related businesses. I like owning community banks, I like owning providers to banks – it just gives me a warm fuzzy feeling to know that the business is tied to banking. I have no explanation.

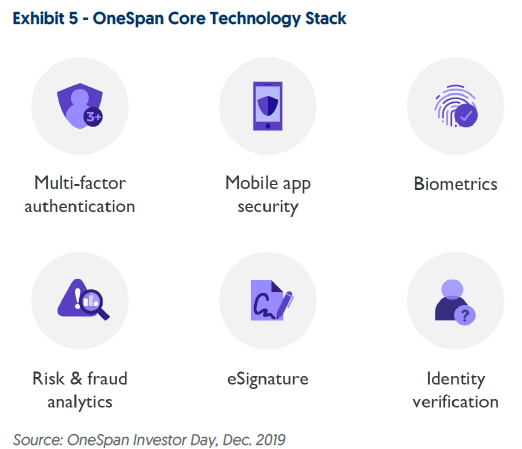

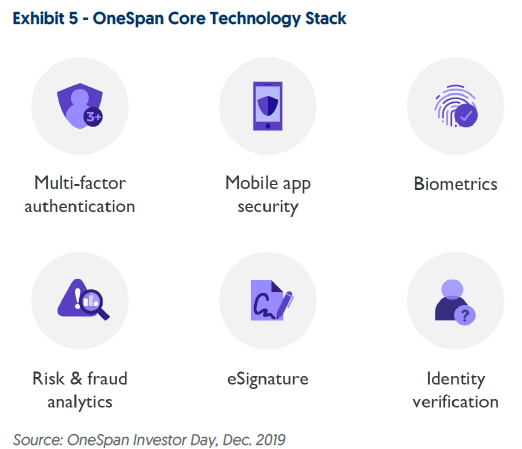

OneSpan is not a pure SaaS play. They are one of these hardware providers turned SaaS providers through acquisitions. Like Intellicheck, they are in the identity-based security business.

On the hardware side OneSpan sells authenticators, which seems like the sort of thing that will go the way of the dodo (and appears to be doing so).

But on the software side they sell a Trusted Identity platform – consisting of a web-authentication product (basically the verify who you are when you log into your bank and such), an e-signature product and an agreement automation product.

The key here is that these are products designed specifically for banks. So they aren’t really competing against Docusign for e-signature or Okta for security.

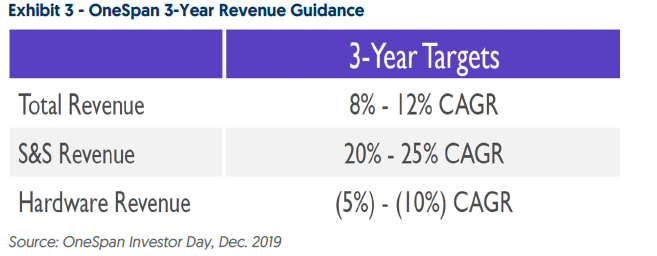

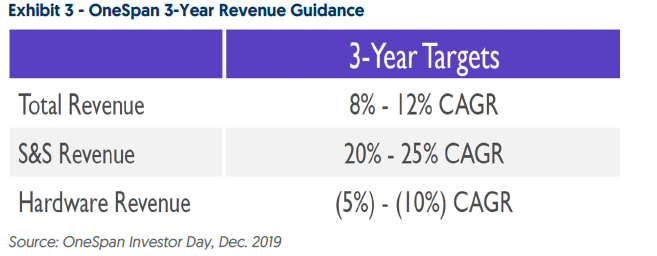

The software/SaaS business is breakeven right now, while the declining hardware business is a cash cow. The SaaS business is expected to grow 20%+ for the next few years while hardware declines:

When I was buying the stock, at $22 or so, it was trading at ~3x sales. Now it is a little under 4x. I’m not sure how much longer I will hold it if it keeps going up. At some point here I might be inclined to sell.

OneSpan reminds me a bit of Vonage. They are taking a declining hardware business and trying to lever it into a software platform by acquisition. The one (important) difference here is that OneSpan is probably more like a leader in the space while Vonage is always playing catch up to Twilio, RingCentral and the like.

But I do suspect that banks, which are probably some of the slowest adopters of the online movement, are going to be playing a lot of catch-up here. And I think OneSpan could put up some very good numbers as they do.

Gold Stocks

My list of gold stocks is long. There are four familiar names: Roxgold, Wesdome, Gran Colombia and Fiore Gold. To that I added two new names relatively recently: Teranga Gold and Superior Gold.

I mentioned Teranga in my last update. They have mines in Burkina Faso and Senegal. When I bought them they were trading at ~7x cash flow.

Teranga has plenty of room to grow through its Massawa mine (in Senegal), which they acquired from Barrick earlier this year. This was one of those acquisitions that is truly strategic – Teranga already owned a mine next door (called Sabodala) and by combining the two they can realize economies of scale including much higher throughput.

Teranga said that Massawa will add around 100koz to their production next year – which is about 30% growth. Even at $12 I’m inclined to hold on, especially given the gold market we are in.

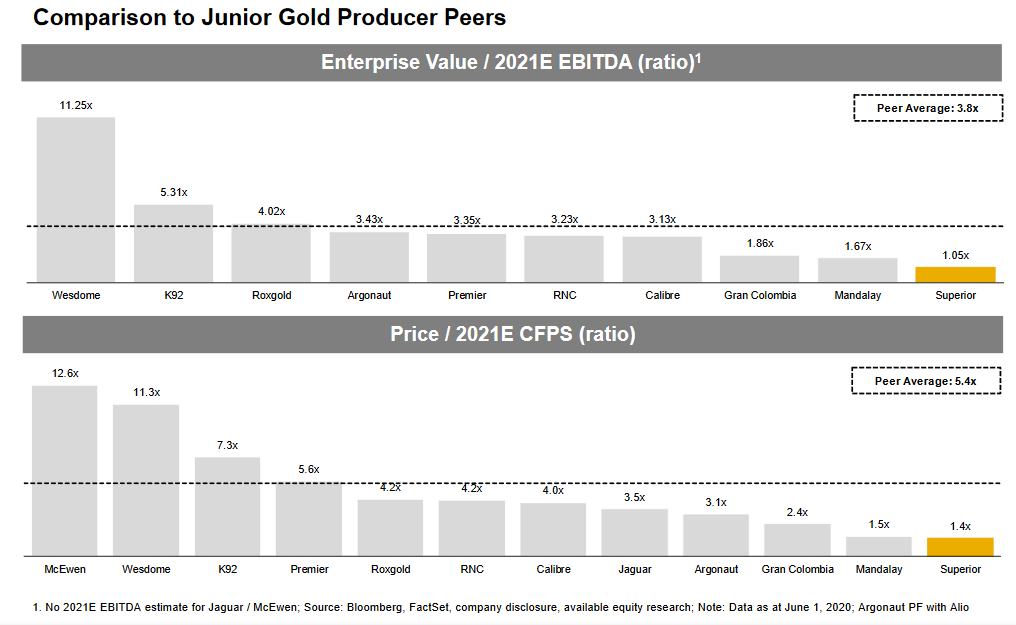

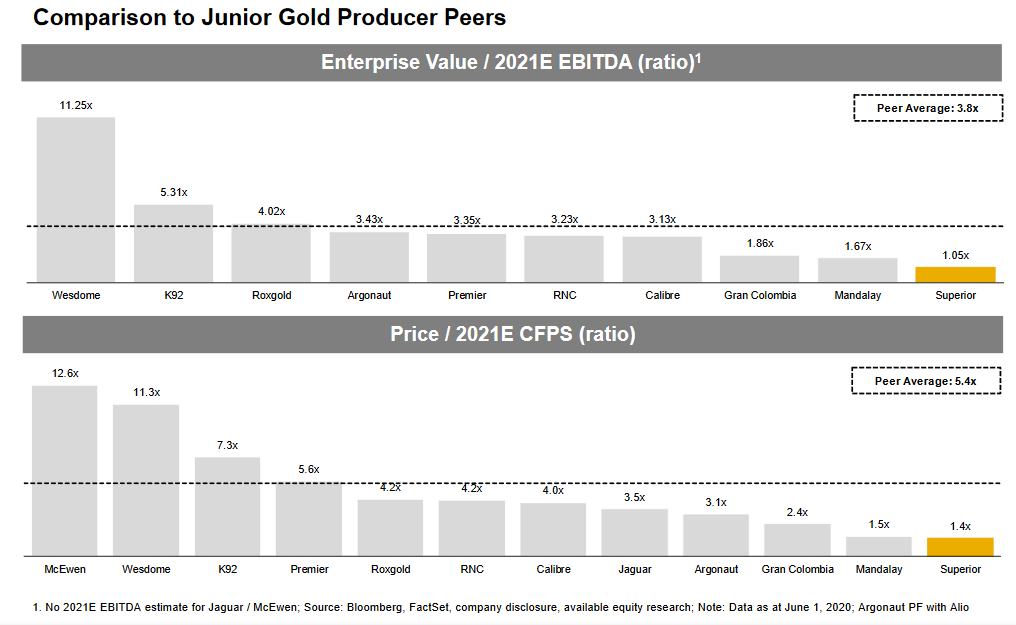

Superior Gold is a name I have talked about in the past and that was brought to my attention again by @BrownMarubozu. Unlike Teranga, which is a clean, growth story, Superior is more of a “dumpster dive” situation that I seem to tend towards (and often learn to hate).

The first thing Superior has going for it is that it is cheap:

Superior’s single mine asset is the Plutonic mine in Australia. This is an underground mine that has been around for a long time.

It is not too often that you can sum up the reason why a stock is cheap in a single chart but in this case you kinda can. While the chart below is a bit old (because Superior stopped including it in their slides, probably realizing that after a while, it is just embarrassing), it illustrates the issue perfectly:

The story is simple – fill the mill with higher grade ore.

Its actually even worse than the chart suggests as Superior is mixing in even lower grade ore from its open-pit sister deposit, Hermes, right now.

If they can find the ore, Superior could be a real winner. They actually have a second mill nearby, currently on care-and-maintenance, that could add more production – if they could fill it.

What has me interested in the story again is that Superior is finding more ore. Recent drill results (here and here) are in addition to extensions at other parts of the mine (Indian Northwest and Baltic).

The aggressive drilling and its success means there is the chance they hit on a really nice find – and if that happens, given the unused capacity, the stock will fly.

On the developer side, I continue to go with a basket approach: owning Gold Standard Ventures, Corvus Gold, and recently adding Gold X Mining, with which I replaced Probe Mining.

I bought Gold X on kind of an ill-fated idea that seems to have lucked out for different reasons. It was ill-fated, because I bought it when Gran Colombia announced their proposed acquisition of both Gold X and Guyana Goldfields.

That acquisition made sense to me – I mean Guyana has a mill that they have never been able to fill with ore while Gold X is a nearby gold deposit.

At the time, Gold X was trading at a discount to Gran Colombia, so why buy Gran Colombia when you could buy equivalent shares of Gold X on the cheap?

Well, that turned out to be a dumb idea. The acquisition failed, Guyana went to some Chinese bidder for way higher than Gran Colombia was willing to pay, and I was stuck with the Gold X shares.

I didn’t sell those shares because, even though the bid from Gran Colombia failed, the combination of Gold X and Guyana still makes sense. This Chinese bidder that was so willing to pay top dollar for Guyana – which is basically a disaster of a mine – well you’d think they’d be able to step up and buy Gold X at what would be a cheap price (the stock comps well to other projects) and put the two mines together. I guess we’ll see.

Stocks with no Theme

I could call these special situations but really, they are just stocks that do not fit into a particular theme. There are a few new ones that I have found: Protech Home Medical, Intermap Technologies, Globalscape, and Lantheus.

This is in addition to the list of existing ones that I have owned for a while: Identiv, Innovative Solutions, Overstock, Rada Electronics, Schmitt, Tel-Instrument Electronics, Tornado Hydrovacs and Velan.

Of these new names, the most ridiculous, most speculative, and therefore most interesting (to write about) is Intermap.

I preface this discussion by saying that the stocks I write about are not always the ones that I have the most conviction in, or the biggest positions in. It is often quite the opposite – the stocks that are most fun to write about are the one’s that are completely speculative flyers.

Intermap fits that bill. Here is the crazy deal. On the third of June Intermap announced that they had agreed to settle all of their outstanding Vertex notes (which are now owned by an entity called Pender Funds) for $1 million.

What is crazy about that transaction is this:

Under the terms of the Settlement, all of the outstanding Notes totalling US$33.9 million shall be settled for US$1 million in cash. Upon the delivery of a US$1m cash payment, Vertex/Pender shall release liens, extinguish the Notes, and the parties shall provide for a general release from all claims associated with the Vertex financings.

Wait, what?

In all honesty, it does not make any sense. Its like going into bankruptcy and having the debt holders wiped out while the equity remains fully intact.

I’ve been intending to call the company but things keep coming up. I’ll try to find the time next week. Because I need some sort of explanation.

As far as I can tell, Pender doesn’t even own any shares anymore (they sold what they had last year). So its not like they are wiping out their debt because the see that they have more to gain from the equity position. There is no logic to this that makes any sense.

Unless Pender is a benevolent fund, there just has to be more to it.

At the same time as the debt announcement, Intermap announced that they signed a new deal with the NOAA with a potential $40 million of revenue over 5 years and they signed a SaaS agreement for NEXTMap One terrain data with the State of California.

So why would Pender just walk away? Its bizarre.

I took a very, very small position on the off chance that this is actually a real deal, and I am at peace with the likely probability that my position goes right back to 10c. Because it is hard to believe that the deal is real. But it certainly makes for an interesting story to write about.

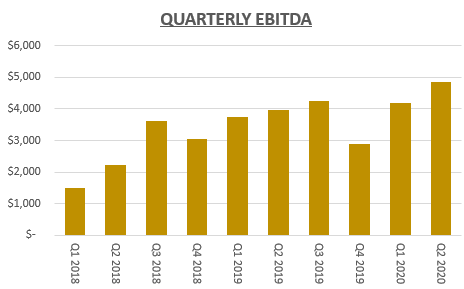

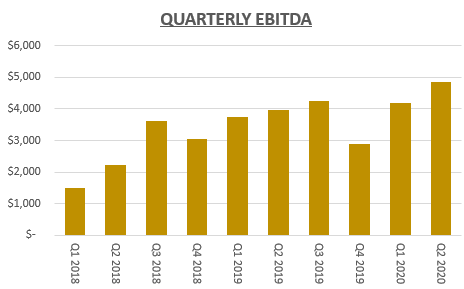

Protech Medical and Lantheus are pretty straightforward stories. Protech is quite cheap, even though it has moved up from where I bought it at ~$1. It trades at under 9x trailing free-cash-flow. It is growing EBITDA. And the pandemic is actually a tailwind to the business, which supplies oxygen supplies and ventilator equipment, among other things.

Lantheus I’m less sure about. Again, this is a business trading at a nice FCF multiple – I calculate about 9x based on last years numbers. There is some debt here and growth is pretty “meh” apart from acquisitions. The biggest problem is that the business centers around diagnostic medical imaging agents, which means it is tied to hospital admittance, which puts it at odds with a second wave of the pandemic. I already sold CRH Medical because I was uncomfortable with their exposure to a second wave, and so I’m pretty waffley on Lantheus for the same reason.

GlobalScape is a new name that I just bought. I was going through the list of additions to the Russell and I found it. I’ll write about it more later.

Why I Remain Cautious

As I said at the beginning of the post, I remain skeptical as to how much further stocks can go primarily on two accounts. These two considerations keep me cautious, while one other consideration: the Fed and global Central Banks, keeps me from going short.

First, I have a hard time believing that this time is different. That Robinhood retail investors represent a new class of long-term successful investors. Or to say this another way: I don’t believe that stocks only go up.

Every time we have had large retail investor enthusiasm it has ended poorly. Being a retail investor myself, I’d love to believe it is different this time. But I have to ask quite honestly – is there a historical precedent for retail investors leading a new bull market?

Portnoy is observant with his catch phrase, but it is really quite ironic. Because the concept that stocks only go up is truly the premise of all these episodes of enthusiasm.

At some point there will be a bear market and that premise will fail.

Are we there yet? Eh, who knows. But man, when I listen to a PlanetMoney podcasts interviewing a government employee that has made 7x her money in 2 weeks day trading bankrupt Hertz stock in her Robinhood account… well, that sort of stuff makes me uncomfortable.

But all this has already been said by others and I have no axe to grind. After all, I’m retail, and these are my folks. My only somewhat original thought is what I debated on twitter on Friday. This is somewhat off-topic so feel free to skip ahead.

The argument I took contention with went something like this: The Robinhood movement is an attack on the fee-based performance industry. This industry perpetually under-performs but still takes exorbitant fees – it is ripe for disruption and this is that disruption.

I don’t disagree with much of that statement. But my response is this: While I’d love to believe a disruption is upon us, I think there is an important nuance, and that is this: managing your own money through the cycle takes a large mental toll, particularly when the cycle turns south. And I am skeptical that any more than a small fraction of people have the mental makeup (and maybe the stubbornness) to manage their own money in the face of that.

With that in mind I hypothesize that the fees you pay are not only for performance. They are also paid in return for the service of not being directly tied to the outcome on a daily basis and for having someone to blame (other then yourself) when things inevitably go south.

The success of the Robinhood movement depends not on the performance (or lack there of) of the fee-based industry, but on the ability of individual investors to deal with the stress of making decisions for themselves throughout the cycle.

IMO that’s the deciding factor of whether the movement succeeds or fails. And why I am skeptical that the movement lives through the next bear market.

So while I will try to opportunistically “catch the wave” of Robinhood stocks where I can (though I can’t bring myself to buy Hertz), I think the movement is doomed in the long run.

My second point. As I wrote about a few weeks ago, is that I don’t believe that this pandemic is over.

I still feel like it is a false narrative that the government proactively shut us down. It seems to me that the truth is more like the government moved re-actively (like it always does) to do what everyone was already about to do anyway.

That differentiation in narrative is relevant now because we may be on the verge of a second wave of hospital overruns. In a few weeks there could be some cities without enough hospital beds.

In February, when investors did not have this virus on their radar, when they were still running the stock market up to new highs and I was shaking my head in disbelief, I said a shutdown seemed like the inevitable consequence of the dilemma we were in. Dilemma being the operative word.

Dilemma is a choice between bad options. While in retrospect we may frame the road not taken as a “good” option, that is only because we didn’t take it. There was no good option.

Without a shutdown I believe hospital beds would have filled up in a number of cities and then, as a consequence (and not because the government told them to) people would have stopped doing things anyway.

If you know there are literally no hospitals beds available, you think twice before getting in your car for a long drive (the off-chance of a car accident), or going for a hike (what if you fall and break a leg). And of course, the big one being – if you go out to a restaurant, bar, the beach, even to get groceries and get the virus, there may be no bed for you.

We take for granted how important having the medical system as a backstop is. Our whole system depends on the knowledge that if something happens to you, the medical system can help you deal with it. Without that backstop everyone becomes more cautious and some become much more cautious. So the economy tanks.

The virus skeptics I read are saying the following – what we are seeing right now is partly just increased testing, it is partly just young people, and the beds that are filling up will be vacated quickly. In the mean time the virus is simply “burning itself out”. So in their interpretation, there is really nothing to worry about.

Maybe they are right? But that seems like a big gambit to me, at least to put a significant bet on with the S&P at 3,000+.

Again, this isn’t about deaths rising or what the actual death rate is or any of the other stuff that I see. Its about one thing – hospitals filling up and what happens when they do. And it won’t matter if its filled with young people or middle-aged people or old people. A filled hospital bed is a filled hospital bed.

I don’t know how this plays out. But it certainly seems like it may be replay of what happened in February. This is a virus. It follows a pretty knowable trajectory once that trajectory starts. The skeptics are basically saying – yes there is a trajectory, but this time it is different. I hope it is, but I’m not willing to make an actual bet on that.

But as far as the market goes, that is just part of the story. The call is way more complex now than it was in February, and I’m way less sure of what that call is. I am simply not sure about how far the market can fall.

Consider that A. the Fed is backstopping everything but equities and B. the odds are that the Fed will backstop equities if equities fall too far.

To put it another way – even though I am skeptical, I do recognize that Portnoy is onto something. This time is different in one important respect – when you have the kind of liquidity we have, and there is no where in the real economy for that money to go – then stocks really should just go up.

On top of the printing related reasons I add one more. C. The market does have companies that will go up even if the skeptics are wrong.

There are a whole bunch of companies that are going to do well if the pandemic strings itself along with another wave. I talked about this in my bifurcated economy post – small businesses die and many big public companies flourish. Not good for most people, but good for many stocks.

Bottom line – it is best to be careful. I said last post I could see 2,000 or 4,000 on the S&P. I am perhaps exaggerating with the numbers, but in terms of symbolizing the chaos, I still feel that way.