Week 95: Setting the table (hopefully)

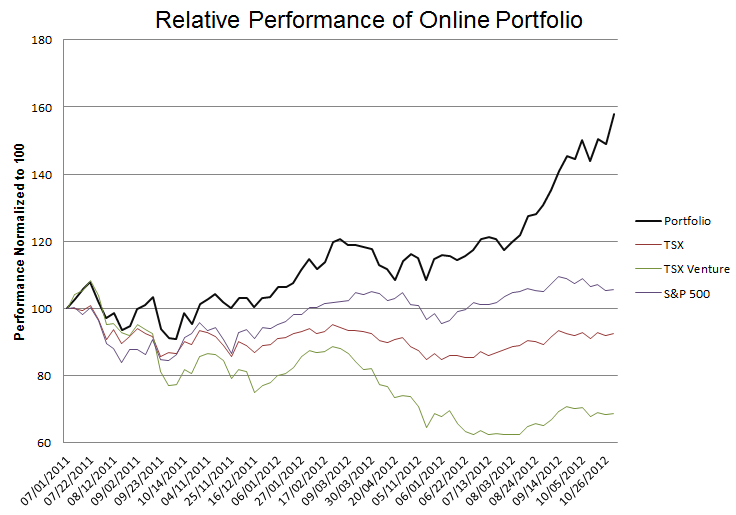

Portfolio Performance

See the end of the post for a full portfolio breakdown.

Update

Since my last update I exited Radian Group, Arkansas Best and MBIA. The sales reflect a desire to redeploy cash in other opportunities as well as some lingering concerns about each company.

With Arkansas Best, its my uncertainty about the outcome of union negotiations. The negotiations were extended this week for a second time. An escalation to a strike does not seem out of the question. If a strike occurs the stock price may or may not get hit; while a positive resolution could be quite good for the stock in the long-run (see my original post about how Arkansas Best would benefit from a contract structured in a similar manner to the one that YRC Worldwide operates with) the uncertainty may drive panic selling. I’ve decided to wait this one out for a few weeks and see how it plays out. Read more